New Listings week ending May 5

A few more New Listings this week:

Click on these links for details: (more…)

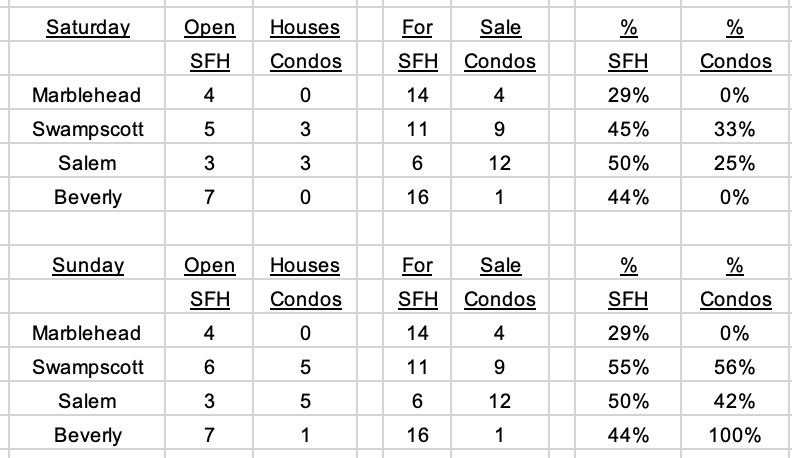

Open Houses weekend May 6/7

Here are this weekend’s Open Houses (an updated list for Sunday will be posted tomorrow at 8 a.m.*):

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

*due to an error in the MLS feed not all the Sunday OHs show up in today’s links but they will in tomorrow’s pst

And these recent articles: (more…)

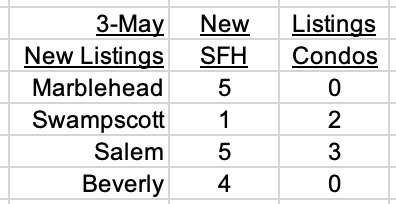

New Listings mid-week May 3

No spring boost yet for New Listings:

Click on these links for details: (more…)

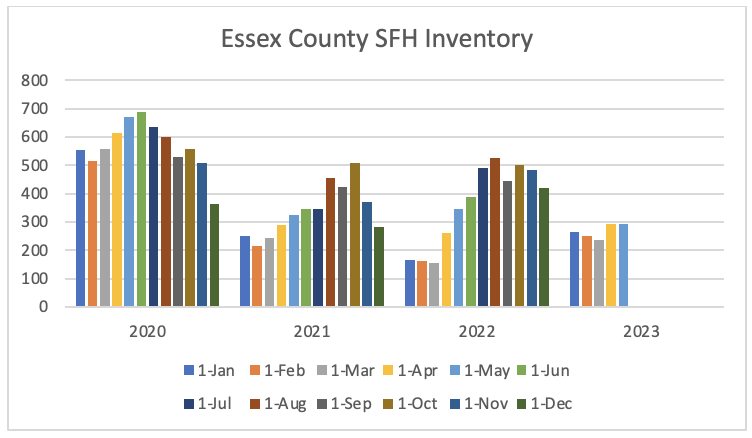

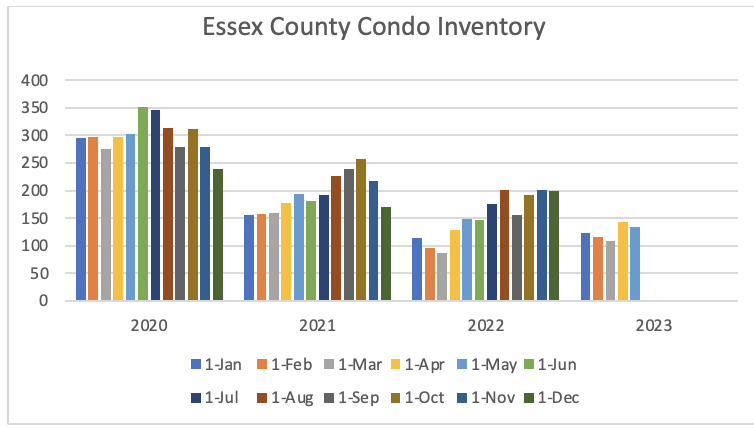

May Inventory shows no improvement

No spring boost for Inventory so far.

Single Family Homes

Condos

Mortgage rates

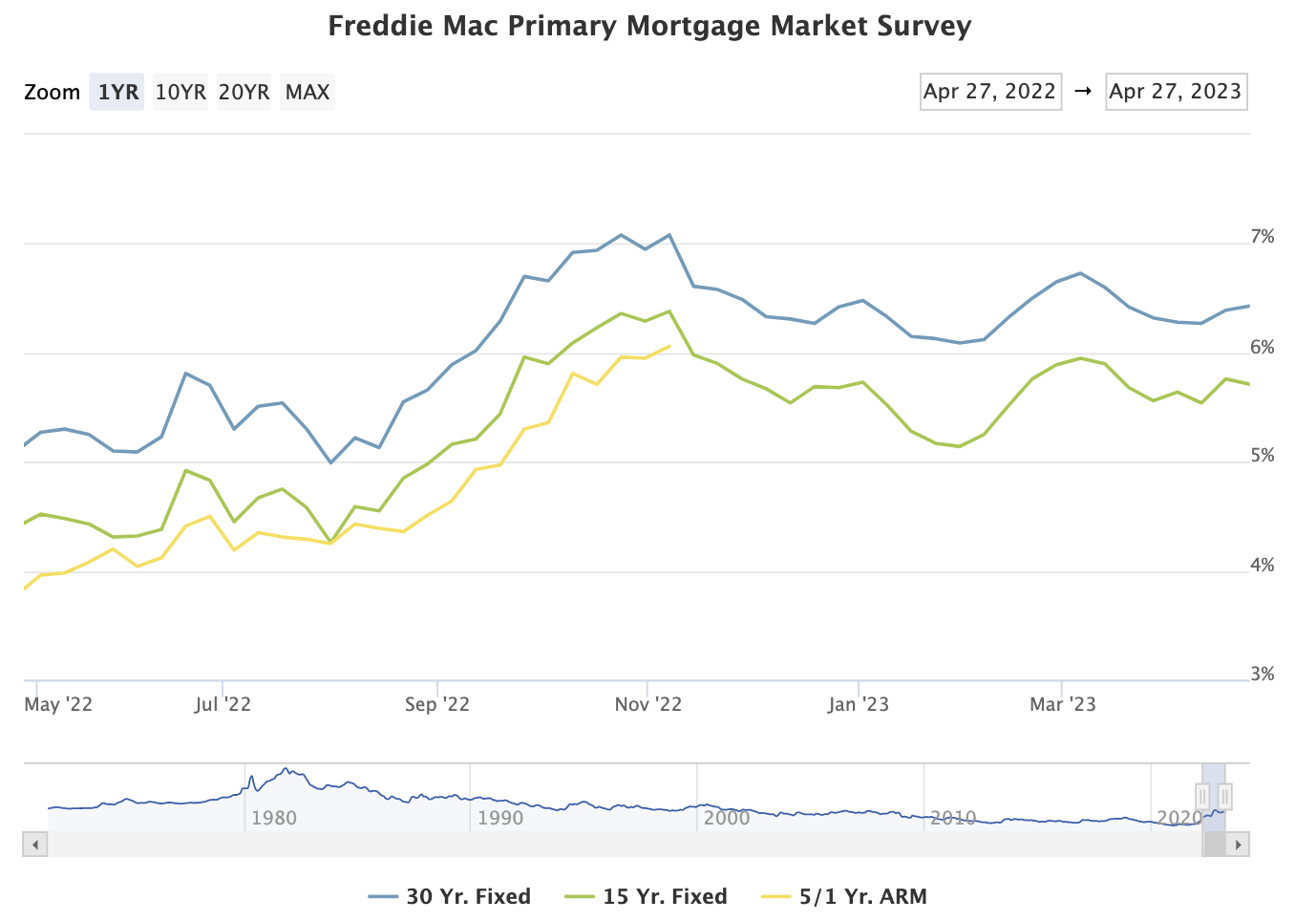

The 30-year Fixed Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a policy reversal late in 2021 sparked a jump in the crucial 10-year Treasury (10T) yield and hence in mortgage rates. With inflation continuing to soar well beyond the Fed’s preferred 2%, interest rates climbed in 2022, driving mortgage rates to a multi-year high.

As inflation appeared to slow, so the yield on 10T dropped, leading to a drop in the FRM of 1% in early 2023. Inflation, however, remains stubbornly high – and the labour market stubbornly strong- causing interest rates and the FRM to move up again, before the crises at a number of banks drove Treasury yields – and hence the FRM – lower again.

In recent weeks the FRM has been mainly in the 6.25-6.5% range.

And these recent articles:

Economic and mortgage commentary

Federal Reserve increase rates; Mortgage Rates drop (more…)

Recent Comments