Do you know why the Chinese like doing business with you?

That was the question put to me by a Chinese businessman in Malaysia many years ago.

“No,” I said, “I haven’t got a clue.”

“Because you are smart enough to know that you will never understand us. So many people come out here from London, we take them out and entertain then, and they leave thinking they have made a friendship – when we are just being polite.”

The same businessman taught me about the importance of “face” to the Chinese. There is no simple definition of face, but the concept is to avoid anything which causes another person to lose face.

One source suggests avoiding: “openly criticizing, challenging, or disagreeing with someone, being openly and publicly angry at someone.”

I am reminded of the concept of face when President Trump tweets: “Who is our bigger enemy, Fed Chairman Powell or Chinese President Xi?”

According to a recent CNBC report: “President Donald Trump and economic advisor Peter Navarro are alone in the White House feeling that interest rate hikes are causing the economy to slow, according to senior administration officials who spoke to CNBC. Most West Wing officials think Trump’s trade war is the root of the economic issues.”

Federal Reserve Chairman Powell, in remarks at this week’s symposium at Jackson Hole, commented: “The global growth outlook has been deteriorating since the middle of last year. Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States.

“While monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rulebook for international trade. Setting trade policy is the business of Congress and the Administration, not that of the Fed.”

Wharton Finance Professor Jeremy Siegel commented recently: “where we really see a slowdown and what people fear might get worse — if there’s more tariff escalation — is business spending” weakening, Siegel said. “A lot of businesses are saying, ‘I don’t know which way these tariffs are going to go, I’m putting off my decision [to expand]. Economists are more worried that capital spending is going to be the initiator of the next recession, if we have one.” But if consumer sentiment dives too, there’s very little the U.S. can do to “save ourselves from a recession.”

While there is a lot of truth about the allegations of Chinese behavior over the years, the way to correct that behavior is to form alliances with our global allies and work to find a solution. Alienating allies and insulting China – whose President does not have an election in 2020, or any other time – is counter-productive.

At some point it seems probable that President Trump will be forced to seek some agreement with China, but at this stage it would appear that the advantage lies with China in any negotiations.

The Wall Street Journal refers to President Trump as “Tariff Man”; if he continues his public battle with China, he may be fighting the 2020 election during a recession.

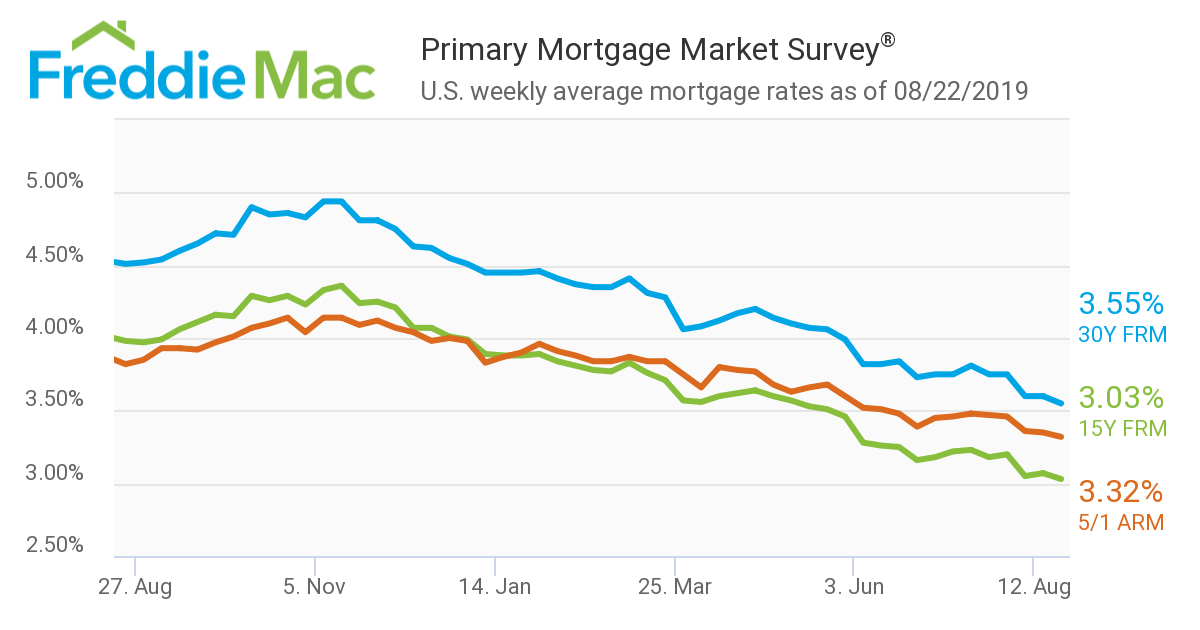

Yesterday’s article Mortgage rates drop again included this chart:

The rate on the 30 year FRM is market driven and in general follows the yield on the 10-year Treasury (10T). In broad terms, the yield on 10T reflects two main factors: the outlook for the US economy, and the demand by investors both for a “safe haven” in a time of uncertainty and increasingly for yield when Government debt in many countries offers negative yields.

This is what I wrote in early June:

I have written several times in recent months that the outlook for the US is a slowing, but still growing economy, and for a stable housing market. It is clear that the world economy is slowing and also that increased tariffs are contributing to that slowing – and to growing uncertainty.

This blog tries to stick to real estate and economic commentary so I will just quote from an Editorial in yesterday’s Wall Street Journal headed Tariff Man Unchained: “The biggest economic risk of a Donald Trump Presidency has always been that his trade obsessions would swamp the benefits of tax reform and deregulation. For two years he has kept his worst protectionist impulses mostly in check, but as he seeks a second term we are now seeing Tariff Man unchained. Where he stops nobody knows, which is bad for the economy and perhaps his own re-election.”

The best outcome for both the US and the rest of the world would be an end to the tariff war, which would lead to renewed confidence, increased capital spending and continued economic growth. This, in turn, would increase the demand for money and lead to higher interest rates and higher mortgage rates. Higher rates would, in fact, be a positive sign for both the economy and the housing market.

Andrew Oliver

Realtor, Sagan Harborside

Sotheby’s International Realty

www.andrewJoliver.com

www.OliverReports.com

Tel: 617.834.8205

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated