Swampscott market surges to new high in 2017

(Click here to download a pdf of this report.)

The median price of the Single Family Homes (SFH) sold in Swampscott in 2017 jumped $42,000, or 8.6%, to a new high of $530,000, finally surpassing the prior 2005 peak of $517,300. Sales, however, reflecting the low inventory all year, dropped to 135 from 157 in 2016 and 183 in 2015.

Median price

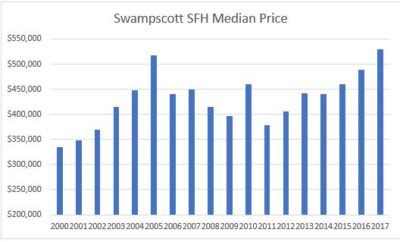

The first chart shows median prices since 2000. I find it helpful to look at longer term trends and this chart shows how prices – which had already risen for some years prior to 2000 – jumped sharply in the early years of the millennium, with a spike in 2005, and dropped during the Great Recession. Prices have been moving upwards for the last three years.

Source:Oliver Reports

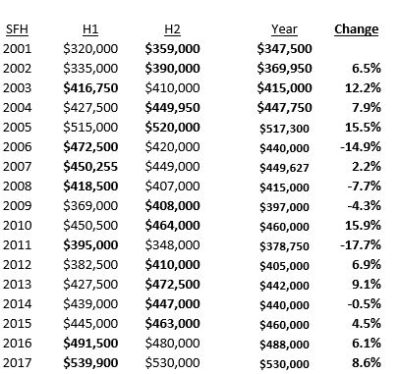

Next is a table of prices since 2000 with the annual change in median price. This table suggests that 2005 and 2011 were outliers, one up one down.

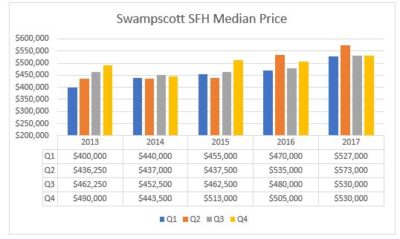

And here is the chart of quarterly numbers for the last 5 years.

Sales

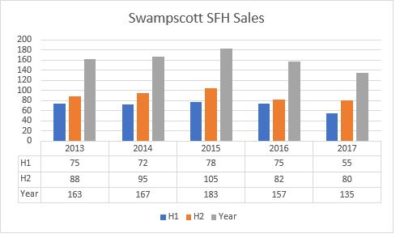

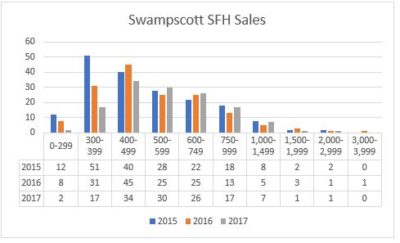

After reaching a record in 2015 the number of sales has dropped sharply, reflecting the low levels of inventory.

The number of sales under $400,000 plummeted from 63 in 2015 to just 19 in 2017. The top end continues to struggle, with just 2 sales over $1.5 million in 2017.

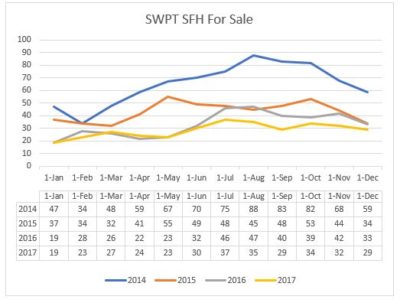

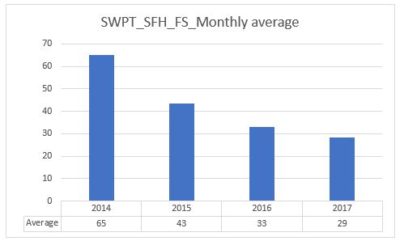

SFH For Sale

A surprising feature of the market in recent years has been the disappearance of the spring bump in the number of houses for sale. There has been some pick-up but it has been very modest compared with what we saw in 2014. The second chart shows that on average the number of houses on the market each month has more than halved since 2014.

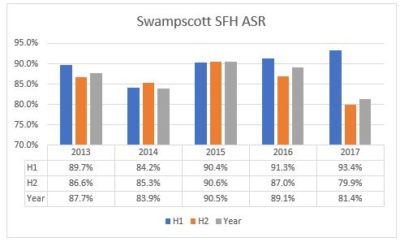

Assessed Value to Sales Ratio (ASR)

One way I measure prices is by the ratio (ASR) of Assessed Value (AV) to Sales Price (SP). The ASR is the AV divided by the SP: if the SP is rising (prices going up), the ASR will fall. In a period of rising prices the ASR is likely, as a lagging indicator, to be below 100%.

As we hope out properties are worth more than the AV an ASR below 100% is a positive sign. Remember that AVs are a lagging indicator: the tax bills that have just been sent out for FY2018 are based on actual sales in 2016. Thus the 2017 sales data, reported in this review, will be the basis for FY2019 assessments. And my data compares 2017 sales with AVs based upon 2016 prices.

Let’s look at the ASR in recent years:

In 2018, the ASR of 81.4% means that the median house sold for 23% above its Assessed Value, a sure sign of rising prices.

Property tax rate

Swampscott’s high tax rate has been a bone of contention for many years and thus it was encouraging to see the rate for FY 2018 drop from $17.54 to $16,00, while the commercial rate also dropped. For more information about Swampscott’s tax rate read How is Swampscott’s 2018 tax rate calculated?.

Outlook for 2018

Immediately after the 2016 Election I published What does the Election mean for real estate markets? in which I made the bullish case: “The removal of a lot of strangling regulations and the end of gridlock in Congress will produce stronger economic growth. Major infrastructure spending will boost jobs and wages at the lower end, while lower corporate tax rates and lower personal tax rates will produce increased personal wealth. Interest rates will rise, reflecting the stronger economy, and the demand for housing will increase. Greater wealth and confidence will provide a boost to the higher end of the market.” I concluded:”I have no doubt that 2017 will provide many surprises along the way, but with a stronger economy and low supply of houses for sale, there seems little reason for home prices in Swampscott not to continue their steady, but modest, upward movement.”

Um, well we got many surprises…..and some of the economic progress, and prices increased perhaps more than modestly. As for 2018? There are a lot of variables, particularly as people in States like Massachusetts try to figure out how they come out with the tax changes. The economy may well grow at a faster rate than in recent years, which would place upward pressure on interest rates and mortgage rates, while it is hard to see at this stage what will increase the supply of houses for sale, something the market sorely needs.

Andrew Oliver

www.OliverReports.com