Essex County Q3 2023 Market Report

The median price of the Single Family homes sold in Essex County increased 35% from $475,000 in 2019 to $640,0000 in 2022, and to $680,000 through Q3 2023. Sales were quite steady from 2019 to 2021, but dropped sharply in 2022, and again YTD in 2023.

The median price of the Condos sold increased by 34% from $320,000 in 2019 to $429,900 in 2022, and to $450,000 YTD Q3 2023. with sales following a similar pattern to that for SFs.

Go HERE to read a copy of the full report

And these recent articles:

Why Mortgage Rates will fall in 2024

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023

ESSEX COUNTY Q3 2023 MARKET REPORT (more…)

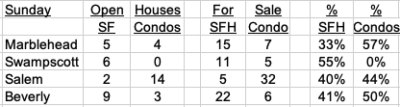

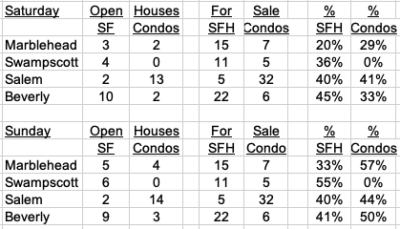

Open Houses Sunday November 5

Here are today’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

And these recent articles:

Why Mortgage Rates will fall in 2024

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023

ESSEX COUNTY Q3 2023 MARKET REPORT (more…)

Why Mortgage Rates will fall in 2024

This article addresses two things: what drives mortgage rates, and why they will fall in 2024.

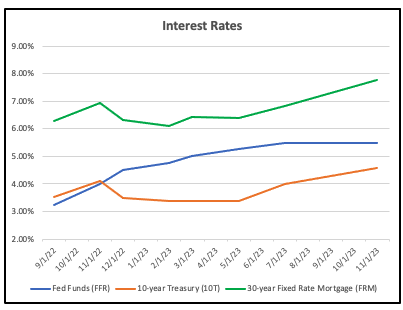

What drives mortgage rates?

The Federal Reserve (Fed) meets regularly and announces, with great fanfare, its “Federal Funds Rate(FFR).” But what is this interest rate and what does it influence?

The FFR is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. It is this rate which impacts the interest rate on many consumer loans, such as credit cards and automobile loans, but NOT 30-year Fixed-Rate Mortgages (FRM).

In general, FRM are sold to Fannie Mae and Freddie Mac and are bundled into portfolios which are sold to investors as Mortgage-Backed Securities (MBS). The yield investors demand for MBS is based upon the yield on the US Treasury 10-year (10T) yield, and the extra yield investors want to buy MBS rather than just risk-free Treasuries.

Look at this chart showing the three rates (FRM, FFR and 10T) over the last year. Note that the Green (FRM) and Red (10T) lines move in tandem, while the blue line (FFR) does not move with either of the other two. Thus, the FRM is determined by the yield on 10T, which is set by the market, and not by the Federal Reserve.

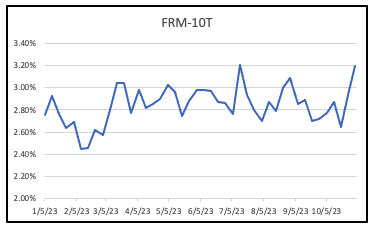

The Spread

The spread – reflecting the extra yield investors want to buy MBS – between FRM and 10T this year has between 2.5% and 3.2%. That is unusually high, as we shall see.

Why Mortgage rates will Fall

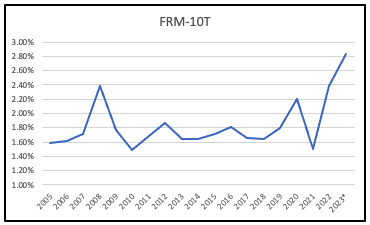

And now to the forecast. The spread between FRM and 10T is much higher than it is in “normal” times. Look at this chart going back to 2005:

For most of the last 18 years the spread has been in the 1.6 – 1.8% range and has averaged around 1.75%. The exceptions have been:

2008 – the Great Recession and the height of the foreclosure crisis making mortgages unattractive to investors, who demanded higher yields

2020 – at the outset of the pandemic, amidst widespread uncertainty, spreads widened before the Fed started its huge program of pouring money into the economy, buying both Treasuries and MBS and igniting an asset boom

2022-23 – when the Fed finally, belatedly, stopped injecting liquidity into the system, the market reacted to two main factors: the Treasury would need to sell a lot more Securities to fund the spending, and the growing Budget deficit; and the fact that the biggest buyer of Treasuries – the Fed itself – was switching from being a buyer to a seller.

This resulted in the most basic economic equation – more sellers than buyers, so the price of Treasuries went down and the yield (which moves inversely to the price) went up.

How far will mortgage rates fall?

Few if any forecasts have been accurate over the last few years, so it would be foolish for me to suggest a timeframe.

What is less foolish is to suggest that the era of cheap money over the last 15 years has ended. It is only in that period that the yield on 10T has been below 4%, and a sustained return to a 4% yield on 10T is likely.

That in turn would suggest a sub 6% FRM.

Not 3%, but better than 7.7%.

And these recent articles:

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023 (more…)

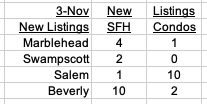

New Listings, Inventory, week ending November 3

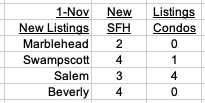

Here are the latest New Listings:

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

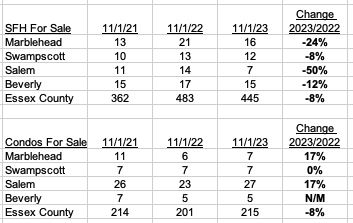

And here are the latest inventory numbers:

And these recent articles:

Why Mortgage Rates will fall in 2024 </a.

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023 (more…)

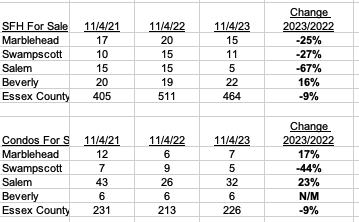

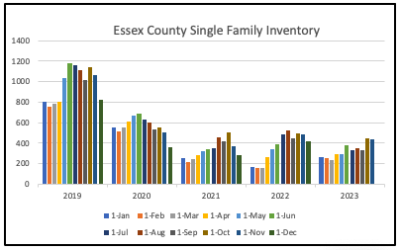

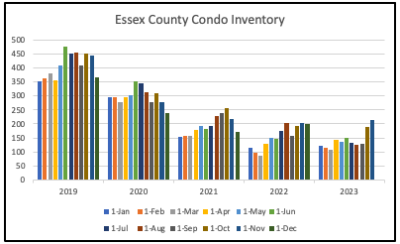

November Inventory down 60% from 2019

Overall in Essex County, while Inventory has been reasonably consistent in the last 3 years, it is running 60% below 2019 levels for Single Family Homes and 50% below for Condos.

Single Family Homes (SFH)

In the early months of 2023 SFH was up 50% or more from the extremely low levels in 2022. By the summer, YOY inventory was down by around 1/3. October showed an increase of 1/3 from September 1. By November inventory was above 2021 levels- but that was in the early staages of the COVID-buying surge.

Condos

Condo inventory has increased 70% since August,taking it back to 2021 levels.|

Open Houses weekend November 4/5

Here are this weekend’s Open Houses (an updated list for Sunday will be posted tomorrow at 8 a.m.*):

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

*due to the timing of the MLS feed many of Sunday’s OHs do not show up in today’s links until later today and will be in tomorrow’s post

And these recent articles:

Why Mortgage Rates will fall in 2024

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023 (more…)

New Listings, Inventory after Halloween

Here are the latest New Listings:

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

And here are the latest inventory numbers:

And these recent articles:

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023 (more…)

Recent Comments