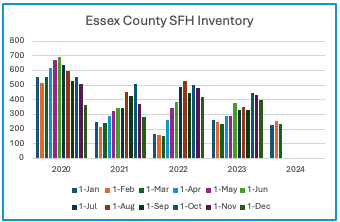

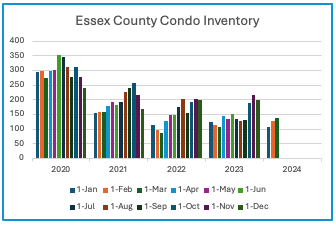

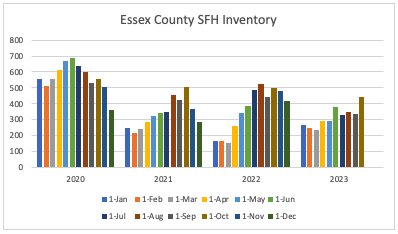

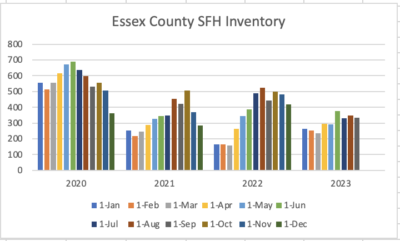

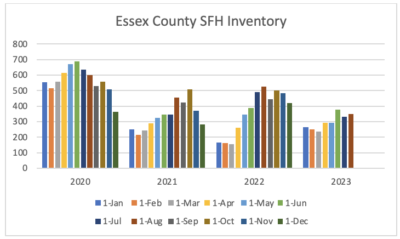

March Inventory shows no Improvement

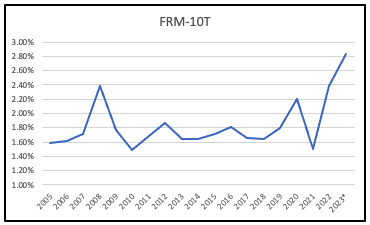

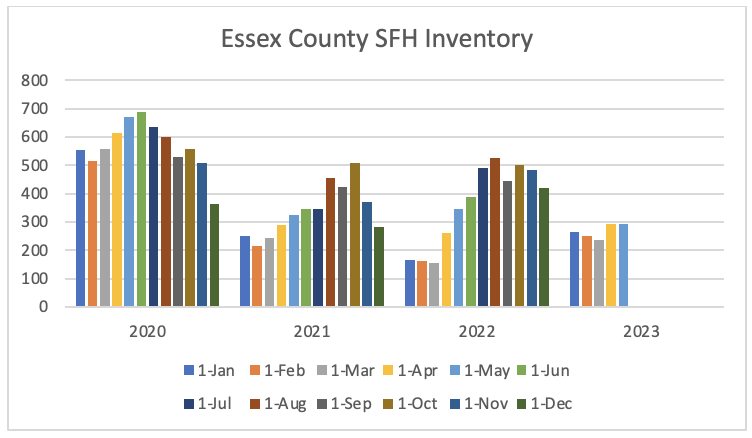

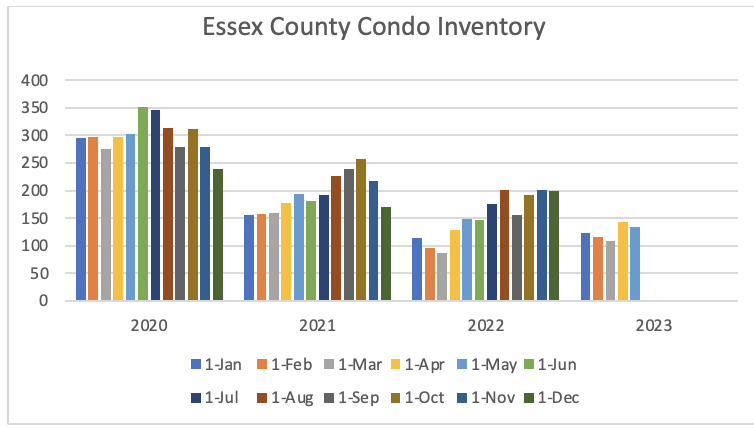

Overall in Essex County, while Inventory has been reasonably consistent in the last 3 years, it is running at less than half the 2020 levels for both Single Family Homes and Condos.

Single Family Homes (SFH)

Condos

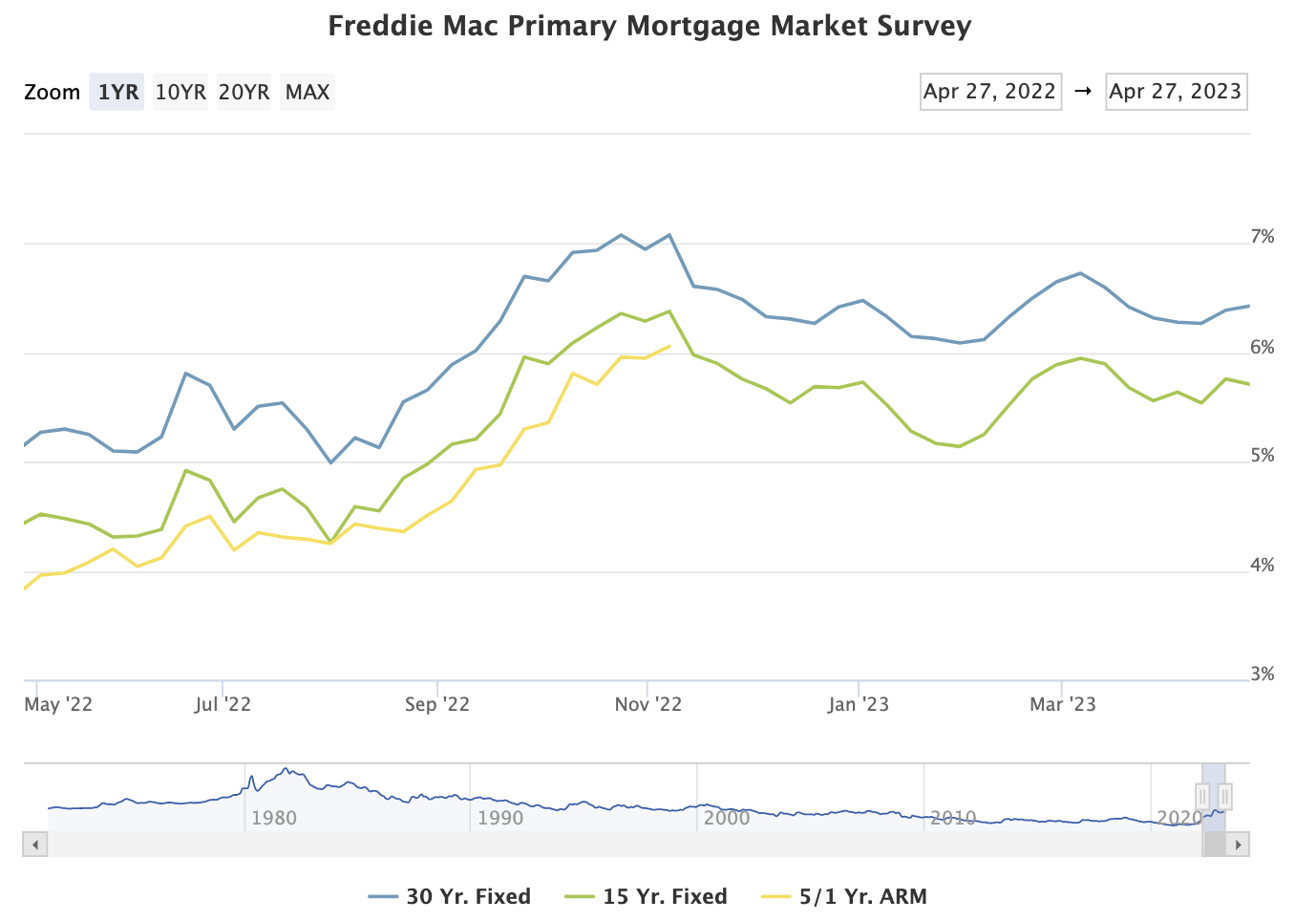

Mortgage rates (more…)

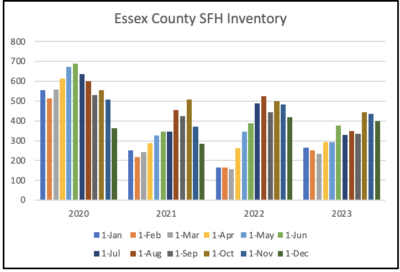

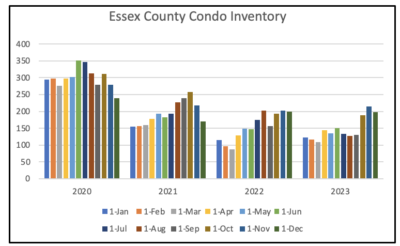

December Inventory shows little change, while mortgage rates fall

Overall in Essex County, while Inventory has been reasonably consistent in the last 3 years, it is running at around half 2019 levels for both Single Family Homes and Condos.

Single Family Homes (SFH)

In the early months of 2023 SFH was up 50% or more from the extremely low levels in 2022. By the summer, YOY inventory was down by around 1/3. October showed an increase of 1/3 from September 1. In December inventory was above 2021 levels- but that was in the early staages of the COVID-buying surge.

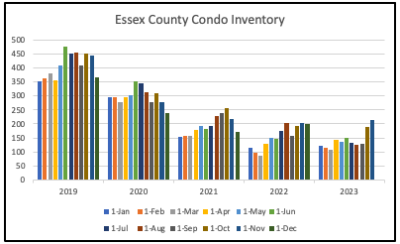

Condos

Condo inventory has increased sharply since the estremely low levels of August.

Mortgage rates

As inflation has slowed significantly this year (read Core Inflation Prices Barely Budged in August), the Federal Reserve finally stopped hiking rates. Meanwhile, the yield on the 10-year Treasury (10T) – which influences mortgage rates – soared in recent months, in part as the market has realised that there will be record sales of Treasuries at a time when the Federal Reserve has tuned seller, and foreign countries are not increasing their holdings and purchases of Treasuries. (more…)

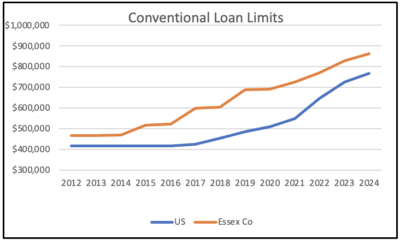

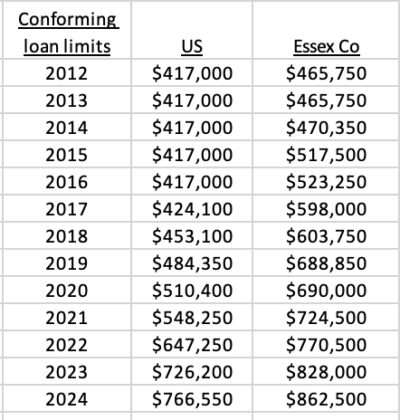

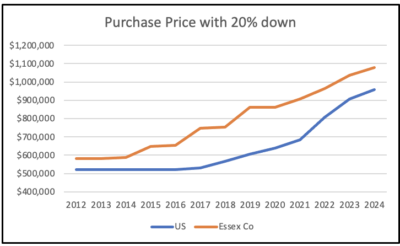

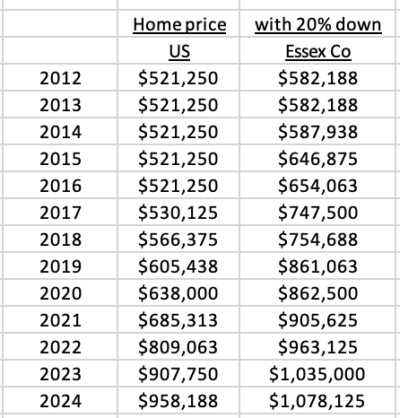

Conventional Mortgage Loan Limits increased for 2024

Fannie Mae and Freddie Mac are restricted by law to purchasing single-family mortgages with origination balances below a specific amount, known as the “conforming loan limit” (CLL) value. Loans above this amount are known as jumbo loans.

Essex County is considered a high-cost area, and limits are higher than the base level set by the FHFA. For 2024, the CLL is $766,550 and for Essex County the limit is $862,500,

Which means that, with a 20% down payment, a property in a standard area costing just over $950,000 can be purchased with a conventional mortgage, and in Essex County that rises to well over $1 million.

And these recent articles:

Why Mortgage Rates will fall in 2024

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023 SALEM Q3 MARKET REPORT 2019-2023

ESSEX COUNTY Q3 2023 MARKET REPORT

(more…)

INFLATION and RECESSION UPDATE

This time last year, stocks were still in the gutter, inflation was in the stratosphere and Fed interest rates were going up, up, up. Today the S&P 500 has risen 17% since Jan. 1, the much-anticipated recession has yet to arrive, unemployment remains below 4% and consumers are still spending–Walmart, Target, and Gap all beat expectations this week.

Inflation has dropped to around 3%, not too far off the Fed’s 2% target. Walmart CEO Doug McMillon was talking about deflation in the coming months. Oil prices are below $75 a barrel, Airfares are significantly cheaper this year than they were for the holidays last year. Bond yields are dropping, too, as traders start to price in Fed rate cuts next year. The 10-year yield has dropped back to around 4.4% from as high as 5% in October. (Barrons)

On Thursday, Walmart CEO Doug McMillon said deflation could be coming as general merchandise and key grocery items, such as eggs, chicken and seafood get cheaper.

He said the retailer expects some of the stickier higher prices, such as the ones for pantry staples, to “start to deflate in the coming weeks and months,” too.

“In the U.S., we may be managing through a period of deflation in the months to come,” he said on the company’s Thursday earnings call. “And while that would put more unit pressure on us, we welcome it, because it’s better for our customers.”

“I think the most important observation we’ve made is that the worst of the inflationary environment is behind us,” Hone Depot, Chief Financial Officer Richard McPhail

The question now is whether the Federal Reserve, having been extremely slow to start raising rates and reversing Quantative Easing, will be similarly late in easing. The Fed claims to be data dependent, but data tells us what happened in the past – and the Fed’s actions impact the future.

“The Fed must lower rates to cause money suply to grow by 5% per year, consistent with the 2% inflation target.If the Fed waits until core inflation is 2% we could have a recession.”(Jeremy Siegel, Wharton) (more…)

Why Mortgage Rates will fall in 2024

This article addresses two things: what drives mortgage rates, and why they will fall in 2024.

What drives mortgage rates?

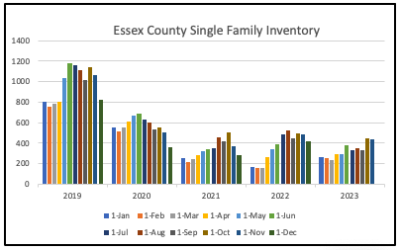

The Federal Reserve (Fed) meets regularly and announces, with great fanfare, its “Federal Funds Rate(FFR).” But what is this interest rate and what does it influence?

The FFR is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. It is this rate which impacts the interest rate on many consumer loans, such as credit cards and automobile loans, but NOT 30-year Fixed-Rate Mortgages (FRM).

In general, FRM are sold to Fannie Mae and Freddie Mac and are bundled into portfolios which are sold to investors as Mortgage-Backed Securities (MBS). The yield investors demand for MBS is based upon the yield on the US Treasury 10-year (10T) yield, and the extra yield investors want to buy MBS rather than just risk-free Treasuries.

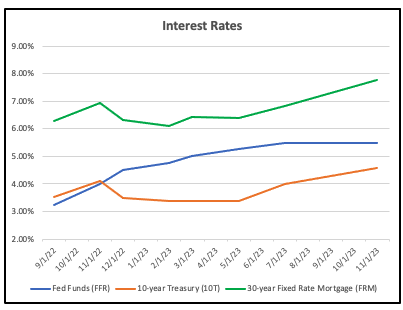

Look at this chart showing the three rates (FRM, FFR and 10T) over the last year. Note that the Green (FRM) and Red (10T) lines move in tandem, while the blue line (FFR) does not move with either of the other two. Thus, the FRM is determined by the yield on 10T, which is set by the market, and not by the Federal Reserve.

The Spread

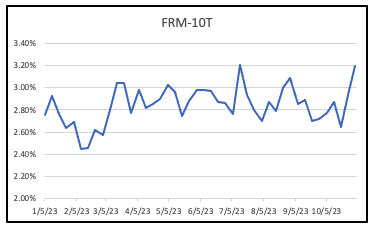

The spread – reflecting the extra yield investors want to buy MBS – between FRM and 10T this year has between 2.5% and 3.2%. That is unusually high, as we shall see.

Why Mortgage rates will Fall

And now to the forecast. The spread between FRM and 10T is much higher than it is in “normal” times. Look at this chart going back to 2005:

For most of the last 18 years the spread has been in the 1.6 – 1.8% range and has averaged around 1.75%. The exceptions have been:

2008 – the Great Recession and the height of the foreclosure crisis making mortgages unattractive to investors, who demanded higher yields

2020 – at the outset of the pandemic, amidst widespread uncertainty, spreads widened before the Fed started its huge program of pouring money into the economy, buying both Treasuries and MBS and igniting an asset boom

2022-23 – when the Fed finally, belatedly, stopped injecting liquidity into the system, the market reacted to two main factors: the Treasury would need to sell a lot more Securities to fund the spending, and the growing Budget deficit; and the fact that the biggest buyer of Treasuries – the Fed itself – was switching from being a buyer to a seller.

This resulted in the most basic economic equation – more sellers than buyers, so the price of Treasuries went down and the yield (which moves inversely to the price) went up.

How far will mortgage rates fall?

Few if any forecasts have been accurate over the last few years, so it would be foolish for me to suggest a timeframe.

What is less foolish is to suggest that the era of cheap money over the last 15 years has ended. It is only in that period that the yield on 10T has been below 4%, and a sustained return to a 4% yield on 10T is likely.

That in turn would suggest a sub 6% FRM.

Not 3%, but better than 7.7%.

And these recent articles:

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023

SALEM Q3 MARKET REPORT 2019-2023 (more…)

November Inventory down 60% from 2019

Overall in Essex County, while Inventory has been reasonably consistent in the last 3 years, it is running 60% below 2019 levels for Single Family Homes and 50% below for Condos.

Single Family Homes (SFH)

In the early months of 2023 SFH was up 50% or more from the extremely low levels in 2022. By the summer, YOY inventory was down by around 1/3. October showed an increase of 1/3 from September 1. By November inventory was above 2021 levels- but that was in the early staages of the COVID-buying surge.

Condos

Condo inventory has increased 70% since August,taking it back to 2021 levels.|

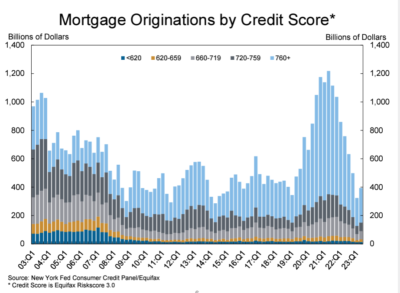

Two More Ways the Mortgage Market differs from 2007/2008

The chart below shows how loans with a credit score under 660 – the bottom colours of yellow and dark blue – which were about 20% of the total in the 2004-2007 period, have virtually ceased, with loans over 720 now making up the vast majority of new mortgages.

Two other changes:

Adjustable-rate mortgages can lead to higher default rates when interest rates rise, but they now represent less than 5% of total purchase and refinance loans, compared with over 35% at the peak of the pre-GFC (Global Financial Crisis) housing cycle. (FORTUNE)

The ratio of Americans’ mortgage debt to their real estate assets—also called loan-to-value—was just 27% in the second quarter, compared to over 40% in 2008 and roughly 50% in 2010. (Bank of America)

And these recent articles:

Core Inflation Prices Barely Budged in August

Two More Ways the Mortgage Market differs from 2007/2008

October Inventory shows Sharp Jump from September

Credit Score Change Could Help Millions of Buyers (more…)

October Inventory shows Sharp Jump from September

Overall Inventory in Essex County has been on a roller-coaster this year in terms of comparison with a year ago.

Single Family Homes (SFH)

In the early months SFH was up 50% or more from the extremely low levels in 2022. By the summer, YOY inventory was down by around 1/3. October showed an increase of 1/3 from September 1, bringing the YOY deficit to just 11%.

Condos

Condo inventory showed a similar, if less exaggerated, pattern. The 45% increase from September to October brought inventory levels in line with 2022’s, but still well below those in 2020 and 2021.

(more…)

Core Inflation Prices Barely Budged in August

While inflation rose 3.5% year-to-year in Aug. – still above the Fed’s 2% goal – it was only up 0.1% month-to-month after backing out higher gas prices.

Core inflation slows

But excluding the volatile food and gas categories, “core” inflation rose by the smallest amount in almost two years in August, evidence that it’s continuing to cool. Fed officials pay particular attention to core prices, which are considered a better gauge of where inflation might be headed.

Core prices rose just 0.1% from July to August, down from July’s 0.2%. It was the smallest monthly increase since November 2021.

Compared with a year ago, core prices were up 3.9%, below July’s reading of 4.2%. That, too, was the slowest such increase in two years. (more…)

Credit Score Change Could Help Millions of Buyers

The nation’s consumer bureau took a first step to erase medical debt from credit reports and lending decisions because that type of debt “has little predictive value.”

The Consumer Financial Protection Bureau (CFPB) outlined proposals under consideration – moves that it says would help families recover from medical crises, stop debt collectors from coercing people into paying bills they may not owe, and ensure that creditors don’t rely on data that is often plagued with inaccuracies and mistakes.

“Research shows that medical bills have little predictive value in credit decisions, yet tens of millions of American households are dealing with medical debt on their credit reports,” says CFPB Director Rohit Chopra. “When someone gets sick, they should be able to focus on getting better rather than fighting debt collectors trying to extort them into paying bills they may not even owe.”

“Access to health care should be a right and not a privilege,” Vice President Kamala Harris told reporters as she helped CFPB make the announcement. “These measures will improve the credit scores of millions of Americans so that they will better be able to invest in their future.” (more…)

No signs of improvement in Housing Inventory

Single Family Homes (SFH)

SFH inventory did not have the usual early summer bump this year and is now running 25% below last year’s level:

Condos

Condo inventory is even more depressed and is now 45% lower thn it was in 2021:

(more…)

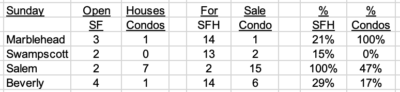

Open Houses Sunday August 6

Here are today’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

And these recent articles:

Bidding Wars return to North Shore

Housing Inventory Drops; Mortgage Rates Rise

Two signs Inflation is Slowing (more…)

Housing Inventory Drops; Mortgage Rates Rise

Single Family Homes (SFH)

SFH inventory did not have the usual early summer bump this year and is now running 25% below last year’s level:

Condos

Condo inventory is een more depressed and is now 1/3 lower thn it was in 2022:

(more…)

Two signs inflation is slowing

During the supply problems of recent years, two products that seemed to be particularly affected – and whose prices rose sharply – were kitchen appliances and cars.

Here are two indications from my mailbox this week that the situation has changed (the first is from a car dealer, the second from Home Depot):

And read these articles:

Economic and mortgage commentary

Federal Reserve increase rates; Mortgage Rates drop

What drives Mortgage rates in one chart

How Marblehead’s 2023 Property Tax Rate is Calculated (more…)

May Inventory shows no improvement

No spring boost for Inventory so far.

Single Family Homes

Condos

Mortgage rates

The 30-year Fixed Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a policy reversal late in 2021 sparked a jump in the crucial 10-year Treasury (10T) yield and hence in mortgage rates. With inflation continuing to soar well beyond the Fed’s preferred 2%, interest rates climbed in 2022, driving mortgage rates to a multi-year high.

As inflation appeared to slow, so the yield on 10T dropped, leading to a drop in the FRM of 1% in early 2023. Inflation, however, remains stubbornly high – and the labour market stubbornly strong- causing interest rates and the FRM to move up again, before the crises at a number of banks drove Treasury yields – and hence the FRM – lower again.

In recent weeks the FRM has been mainly in the 6.25-6.5% range.

And these recent articles:

Economic and mortgage commentary

Federal Reserve increase rates; Mortgage Rates drop (more…)

Recent Comments