“Party on, dude” says the Federal Reserve

Former Federal Reserve Chair William McChesney Martin, Jr famously said: “The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

This week, current Fed Chair Jerome Powell in effect said “party on, dude.” As the New York Times commented: “The official view of the central bank’s leaders now is that it has been an overly stingy host, taking away the punch bowl so quickly that parties were dreary, disappointing affairs.

The job now is to persuade the world that it really will leave the punch bowl out long enough, and spiked adequately — that it will be a party worth attending. They insist punch bowl removal will be based on actual realized inebriation of the guests, not on forecasts of potential future problematic levels of drunkenness.”

Chairman Powell’s comments

“We will continue to provide the economy the support that it needs for as long as it takes.”

“We’re not going to act pre-emptively based on forecasts for the most part, and we’re going to wait to see actual data. And I think it will take people time to adjust to that, and the only way we can really build the credibility of that is by doing it.”

“People start businesses, they reopen restaurants, the airlines will be flying again — all of those things will happen, and it will turn out to be a one-time bulge in prices, but it won’t change inflation going forward.”

Interest rates and inflation

The big questions overhanging financial markets are what will happen to inflation and to interest rates.

As the Wall Street Journal commented: “The sheer magnitude of the deficits to be financed is a rare experiment in U.S. fiscal history. Even before the $1.9 trillion spending bill passed, the Congressional Budget Office estimated the deficit as a share of GDP would be 10.3% in fiscal 2021. With the Pelosi-Schumer-Biden blowout, the deficit this fiscal year will now be in the neighborhood of 18% of GDP. That’s the highest by far since the four wartime years of 1942-1945.

The fortunate news is that the economy is about to zoom ahead as the pandemic and social distancing ease. This year could see the fastest GDP growth since 7.2% in 1984, and the economy is poised to make up all of the ground it lost during the pandemic as soon as this quarter.

But eventually there is a price for everything in economics, notwithstanding the assurances of modern-monetary theory. The test for the Fed will come in future months as the economy recovers. The market may demand higher interest rates, even as the Fed will want to keep them low to finance continuing federal deficits. The political pressure from the Biden Treasury and Congress will be enormous to keep rates low as far as the eye can see.

This won’t matter in the short-term as the economy booms, but the rub will come if inflation or interest rates rise beyond the Fed’s comfort zone. Then the Fed will face conflicting pressure from markets on the one hand and Treasury on the other.”

Budget Deficit

After Congress passed the Tax Cuts and Jobs Act (TCJA) in December 2017 I published What will happen to Home Prices in the Experimental Economy?.

“What is an Experimental Economy?

Let’s try to compare the economy in a recession to a car pulling a trailer, with a full load of passengers, while going uphill. What does the driver do? To offset the gradient and the weight being pulled, she pushes on the accelerator pedal, the extra effort allowing her to maintain speed. And when she gets to the top of the hill? She eases off the pedal so that she can avoid speeding and the risk of losing control.

Now, let’s look at the economy. As we emerged from The Great Recession, the Federal Reserve (Fed), understanding that the economy was facing a sharp incline, had its foot hard down on the accelerator (cheap and plentiful money), dragging the car (economy) with its trailer (unemployment) up the incline.

After an initial period, the car slowly regained its speed and as it neared the top of the hill the driver started to ease off on the accelerator (raising interest rates and buying fewer Government securities – Treasuries).

And then, the car reached the top of the hill (historically low levels of unemployment, an economy growing steadily). So, what does the driver do now? Well, based upon historical evidence, the driver (Fed) raises interest rates, while the Government tries to run a budget surplus to squirrel away funds for the next recession.

The Fed has done its part, but the Government, as in Congress, has decided that it is time for an Experimental Economy. Instead of taking the foot off the accelerator, Congress has passed a series of tax cuts and spending increases which will more than double the Budget Deficit. Rather than easing up on the accelerator, Congress has decided to push its foot down even harder.

I call what we are entering now the Experimental Economy, the experiment being that we are betting that the tax cuts and spending increases will lead to faster economic growth, which in turn will reduce the budget deficit.”

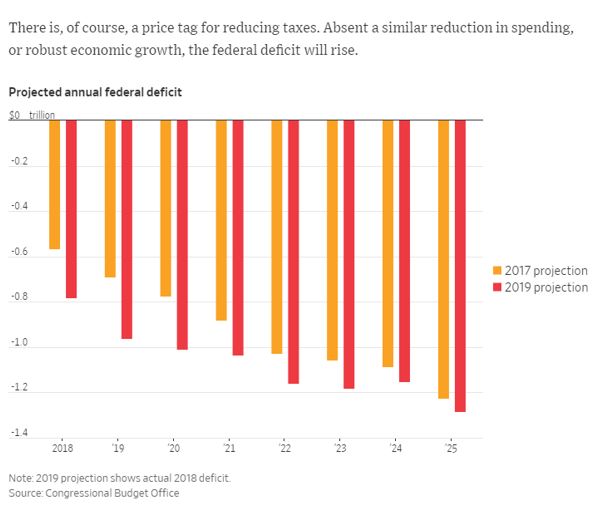

Well, we now know that while growth may have been a little higher than it would otherwise have been the budget deficit actually increased, as these figures from the CBO show:

These numbers were published before the pandemic so the numbers for 2020 and beyond are much higher than the CBO was forecasting in 2019, but the deficits for 2018 and 2019 were substantially higher – not lower – as a result of TCJA.

And budget deficits need to be financed by issuing Treasury securities. Just as I have been writing for several years that the law of supply and demand in housing, where demand outstrips supply, must lead to rising prices, so in terms of Treasuries, where supply is seemingly infinite and demand less so, prices should fall – which means rising yields (yields move in the opposite direction to prices).

Chairman Powell may say that the increase in inflation is only a short-term phenomenon, but if markets collectively believe otherwise, yields will continue to be driven upwards. And whereas in what I may now call the Experimental Economy Mark 1, the Fed was raising rates as Congress pressed hard down on the accelerator pedal, in the Experimental Economy Mark 2 both Congress and the Fed are acting like James Holzhauer on the Daily Double in Jeopardy and saying “all in.”

In the 2018 article, which was published during the Winter Olympics, I published this photo and commented: “Stepping on the gas at the top of the economic hill might be compared to jumping in a bobsleigh and hurtling down the track. In this photo of a 4 man team, the man at the back – the brakeman – appears to have his head down, as if in prayer. I am wondering if he is the Federal Reserve Chairman who has just been told that Congress has passed another spending bill.”

In 2021, I wonder if Powell has dropped the brakeman for a more aggressive rider.

Mortgage rates

The 30-year FRM is priced based largely on the extra yield – spread – that investors demand above that available on the nearest Treasury security in terms of duration – the 10-year Note.

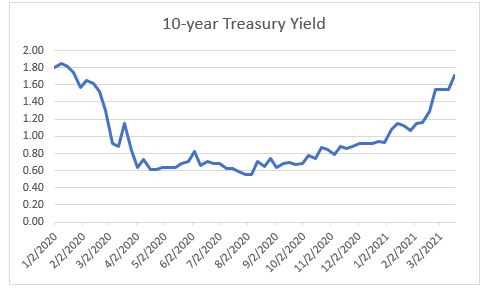

This is what has happened to 10T since the beginning of 2020:

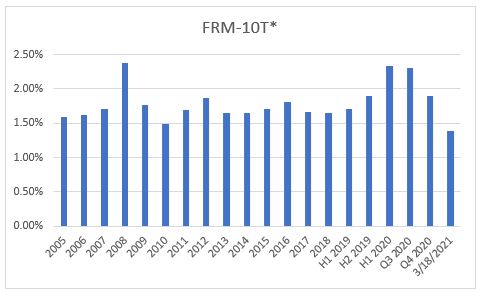

And now the FRM:

Notice that while the yield on 10T is almost back to its pre-pandemic level, the FRM is still somewhat lower than it was then, in large part because the Fed has been buying mortgage-backed securities (bundles of mortgage sold to investors).

The spread between FRM and 10T has mostly been the the 1.6-1.8% range over the last 15 years or so. The exceptions have occurred during periods of financial stress – the Great Recession and the pandemic. The current spread of 1.38% indicates that mortgage rates are below the levels one would expect on an historical basis.

Even if – when? – mortgage rates return to their “normal” levels – which with a 1.7% yield on 10T would imply 3.3-3.5%, and even if, as many forecast, the yield on 10T increases to 2% this year, indicating a normalized FRM of 3.6-3.8% , mortgage rates will still be at historically low levels.

And as I pointed out in yesterday’s Buyers are overpaying, but are there signs of a bubble?, during the boom years 2000-2006 the FRM was mostly in the 6-8% range.

“The last year has deepened the divide between the “have’s” and the “have not’s. While the latter have suffered greatly, the former – and here I am talking only financially not from a health point of view – have seen their home prices soar along with the stock market. We are rapidly approaching mass vaccination levels which will allow some semblance of normal life – or at least the new normal – to return this summer. And there is a lot of cash waiting to be spent as savings have climbed over the last year.

And then there is the American Rescue Plan on top of that, pumping a vast amount into the economy, some immediately and some over a longer period. Forecasts of GDP growth this year seem to be increasing almost daily, with numbers of 7% or even 8% being whispered. What fascinates me as a mathematician is that I have yet to hear on a financial channel any commentator add: “but bear in mind GDP dropped 3.5% in 2020, so a 7% increase from the 2020 level would produce GDP only 3.2% higher than in 2019.” But it will still be a spectacular year and may well herald above trend growth for a few years to come..

Oh, and then there is the long overdue infrastructure bill that may be passed this year as well.

Mortgage rates are rising- read my Goodbye sub 3% mortgages – to levels last seen in – gulp, July last year. During the boom years of 2000-2006 the 30-year Fixed Rate Mortgage was mostly between 6% and 8%, so it is hard to imagine that 3.5% or 4% is going to stifle this market, especially with the much more stringent mortgage requirements post the Great Recession.

For the most part, the buyers in recent months have been people who want to live in their new homes. This is so unlike the HGTV-encouraged “buy 3 homes and flip them” go-go days of the early 2000s.

Finally, let me point out that Greenspan made his irrational exuberance comment in 1996 and the dot.com bubble did not burst until 2000.

Yes, the housing market is booming, but IMO it is not in a bubble.”

The US does seem to be positioned to achieve above trend growth in the next few years. As the UK’s Daily Telegraph pointed out: “While the US is spending $2.8 trillion (£2 trillion) or 13pc of GDP in fast fiscal relief – two thirds this year – the EU has nothing of the kind. The Recovery Fund is for rebuilding later. It is a medium-term investment plan. It doesn’t do much in the short term.

There is fiscal stimulus worth 2pc of GDP at a national level but the Atlantic gap is huge. Washington is “going big” even though the US output gap will be closed by June, so big that the OECD now thinks America will regain its pre-pandemic trajectory by next year – along with China in this elite club.

Yet Europe is “going small” even though the output gap in the eurozone is still a dire 8pc of GDP, reaching 10pc in Italy and Spain (IIF data). It is Atlantic decoupling like never before in modern times.

The story that has yet to gain media traction is cross-Channel decoupling. It is no longer implausible to imagine Britain leaving Europe far behind over the course of 2021, a remarkable thought given the counter-story in the British lay press that post-Brexit trade has been a calamity.”

“Going big” has its risks. If Chairman Powell’s optimism proves correct, the outlook in the US is for growth that will attract inward investment – and he hopes buyers for all the Treasuries that will be flooding the market.

In this environment, asset-price inflation – meaning amongst other things rising home prices – remains likely.

How Marblehead’s 2021 Property Tax Rate is Calculated

Essex County 2021 Residential Property Tax Rates: Town by Town guide

It’s 80 degrees in Florida…

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

Andrew Oliver

Sales Associate | Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its indication of a […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its policy reversal […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its policy reversal […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its policy reversal […]

[…] will quote from my blog posts. In March 2021 in “Party on, dude” says the Federal Reserve I wrote: Former Federal Reserve Chair William McChesney Martin, Jr famously said: “The Federal […]

[…] in March 2021, I published “Party on, dude” says the Federal Reserve which included: Former Federal Reserve Chair William McChesney Martin, Jr famously said: “The […]

[…] in March 2021, I published “Party on, dude” says the Federal Reserve which […]

[…] Rate Mortgage fluctuated around 3% for most of 2021. The Fed appeared to many commentators (read my “Party on, dude” says the Federal Reserve posted in March 2021) to be taking an overly optimistic view about inflation; its policy reversal […]