Politics, Financial Markets, and the Magnificent Seven

At the end of The Magnificent Seven (1960) Yul Brynner says: “…only the farmers won. We lost. We always lose.” (The “we” refers to the gunslingers hired to protect a Mexican village from bandits.)

I am reminded of this quote whenever politicians try to take on financial markets – the markets are the farmers, and the politicians are the gunslingers.

Let us look at two recent examples – I asked my best buddy ChatGPT for non-political commentaries.

UK 2022

When Prime Minister Liz Truss announced large, unfunded tax cuts in September 2022, it triggered a sharp loss of confidence in the UK’s financial markets. Here’s a non-political explanation of what happened and how it was resolved, focusing purely on economic and financial mechanisms:

What Happened:

1. The Announcement:

In late September 2022, the UK government (under PM Liz Truss and Chancellor Kwasi Kwarteng) announced a “mini-budget” featuring around £45 billion in tax cuts — the largest since 1972 — without detailing how these would be funded.

2. Market Reaction:

Financial markets reacted negatively for several reasons:

• No funding plan: Investors feared that the government would borrow heavily to pay for the tax cuts, increasing the UK’s debt burden.

• Inflation risks: At a time when inflation was already high, the stimulus risked adding more upward pressure on prices.

• Loss of confidence: The lack of an independent forecast from the Office for Budget Responsibility (OBR) added to uncertainty.

3. Immediate Consequences:

• Gilt yields surged: Yields on UK government bonds (gilts) rose sharply, meaning the cost of borrowing for the government spiked.

• Pound plummeted: The British pound fell to its lowest level ever against the US dollar (around $1.03), reflecting investor concern over the UK’s fiscal credibility.

• Pension fund crisis: Rapidly rising gilt yields triggered a liquidity crunch for pension funds that used derivatives to hedge liabilities — these funds faced margin calls and were forced to sell assets, further pushing yields up.

How It Was Resolved:

1. Bank of England Intervention:

On September 28, 2022, the Bank of England (BoE) stepped in with emergency action:

• It temporarily bought long-dated UK government bonds to stabilize the market.

• This helped calm gilt yields and prevent a broader financial crisis involving pension funds.

2. Reversal of Policy:

Over the following weeks:

• Most of the tax cuts were reversed.

• A new Chancellor, Jeremy Hunt, was appointed, who emphasized fiscal discipline and postponed further economic decisions until a full budget review.

3. Leadership Change and Stabilization:

• Liz Truss resigned in October 2022.

• Rishi Sunak, perceived by markets as more fiscally cautious, became Prime Minister.

• Financial markets stabilized as confidence returned, aided by clear communication and fiscal restraint.

Summary:

The UK government’s announcement of large, unfunded tax cuts in an already inflationary environment led to a market panic due to concerns over fiscal responsibility. Bond yields spiked, the pound dropped, and pension funds faced stress. The crisis was resolved through central bank intervention, policy reversals, and leadership changes that restored market confidence.

US 2025

In early 2025, U.S. financial markets experienced significant turbulence following President Donald Trump’s announcement of sweeping tariffs and public threats to dismiss Federal Reserve Chair Jerome Powell. Here’s a non-political breakdown of the events and their economic implications:

What Happened in Financial Markets (Early 2025)

1. Trump’s Tariff Announcements

• In early 2025, President Trump proposed sweeping universal import tariffs, starting with a 10% tariff on all goods entering the U.S., with up to 60% tariffs on imports from China.

• Markets viewed this as a significant inflationary threat and a major disruption to global supply chains.

2. Threat to Fire the Federal Reserve Chair

• Around the same time, Trump publicly criticized Fed Chair Jerome Powell for keeping interest rates high and suggested removing him — something no president has ever done in modern history.

• This undermined confidence in the Fed’s independence, raising concerns that monetary policy might become politicized.

Market Impact

Stock Market:

• The S&P 500 fell over 15% between late February and early April 2025.

• The Nasdaq dropped more than 18%, with tech and multinational firms hit hardest due to their exposure to global trade.

Bond Market:

• Yields on longer-term U.S. Treasuries initially spiked due to inflation fears from tariffs.

• However, as recession risks grew, investors moved into bonds, eventually pulling yields back down.

Currency:

• The U.S. dollar weakened against major currencies as investor sentiment shifted and fears of slower growth mounted.

How It Was Resolved

1. Clarification on Fed Leadership:

Trump later walked back his comments, saying he had “no current plans” to remove Powell. This reassured markets temporarily.

2. Tariff Adjustments:

The administration entered talks with trading partners, and by May 2025, partial tariff rollbacks were announced with China and some G7 nations.

3. Stabilization:

The Federal Reserve reaffirmed its independence in public statements.

Markets began to recover in late spring as investors priced in a more moderate trade stance and a resilient U.S. economy.

Resolution and Ongoing Challenges

1. Partial Tariff Reductions:

• In May 2025, the U.S. and China agreed to reduce some tariffs, with U.S. tariffs on Chinese goods decreasing from 145% to 30%, and China’s tariffs on U.S. goods dropping from 125% to 10

2. Market Recovery:

• Following these developments, the S&P 500 rebounded, rising 18.1% from its April 8 low, and moving into positive territory for the year.

3. Persistent Uncertainty:

• Despite the recovery, many companies, including General Motors and Ford, adjusted their earnings forecasts due to ongoing tariff-related uncertainties.

In summary, President Trump’s tariff policies and comments regarding the Federal Reserve in 2025 led to significant market volatility and economic uncertainty. While some measures were later adjusted, and markets partially recovered, the events underscored the sensitivity of financial markets to trade policies and the importance of central bank independence.

Summary

Markets react not to party labels, but to perceived threats to economic stability.

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

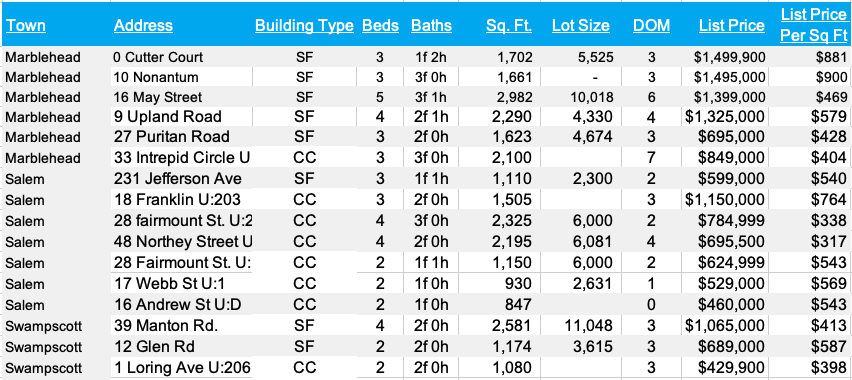

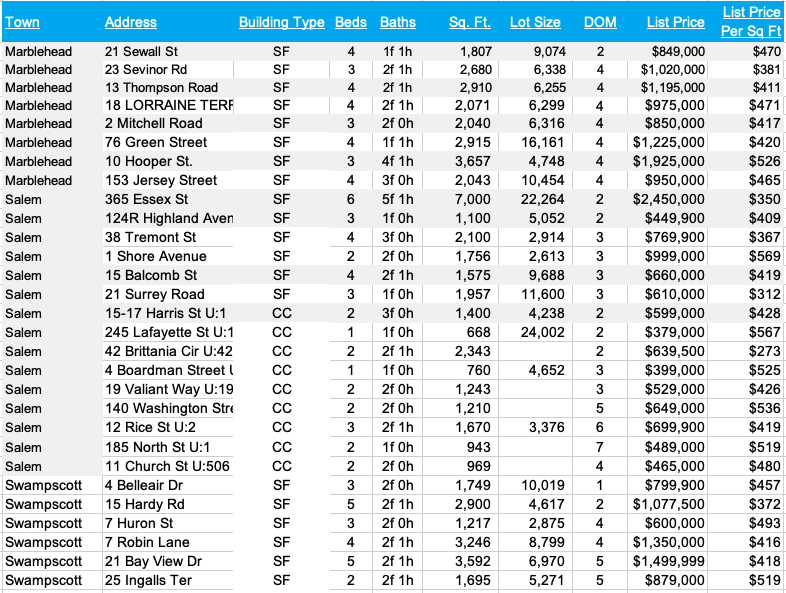

New Listings and Inventory before Memorial Day

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

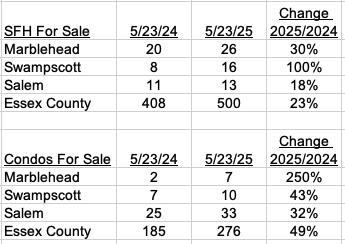

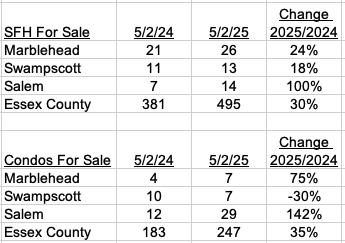

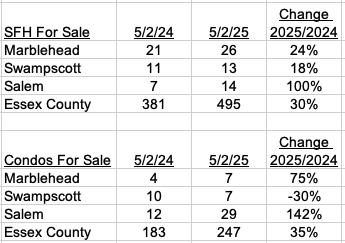

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

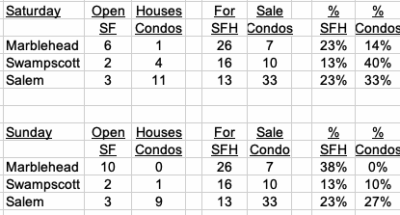

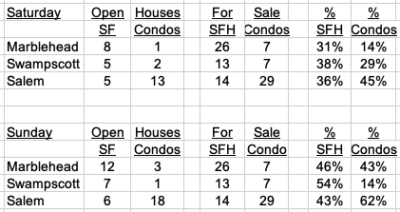

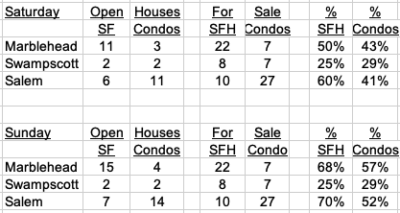

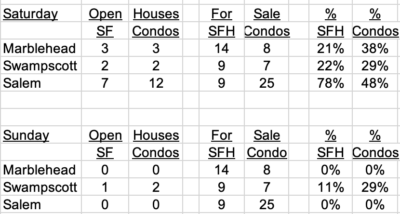

Open Houses Memorial Day weekend

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

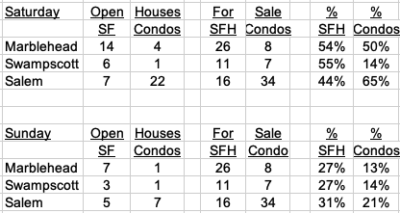

Open Houses weekend May 17/18

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

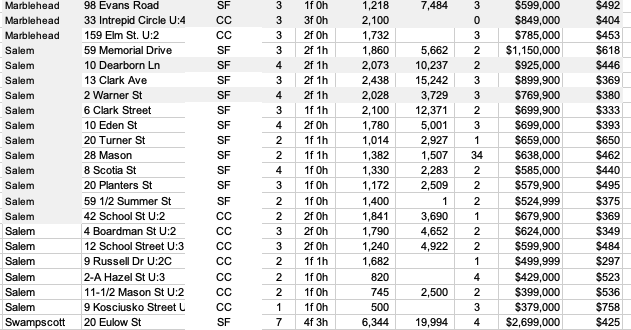

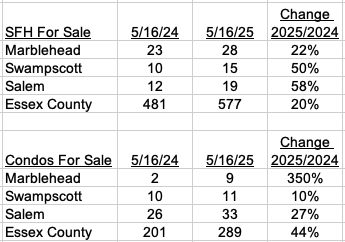

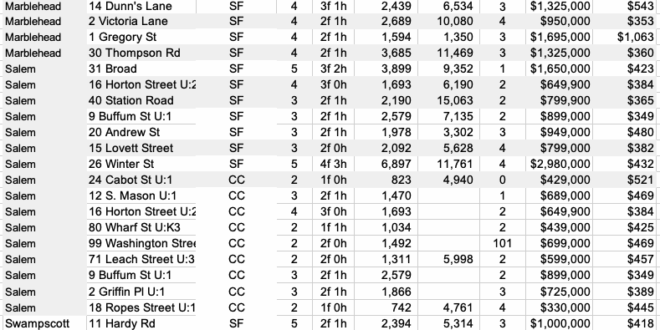

New Listings and Inventory week ending May 16

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

Open Houses weekend May 10/11

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

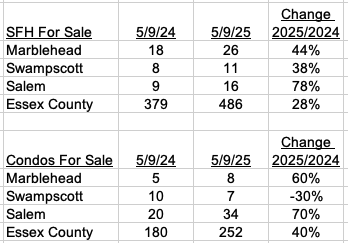

New Listings and Inventory week ending May 9

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

May Housing Inventory shows sharp Jump

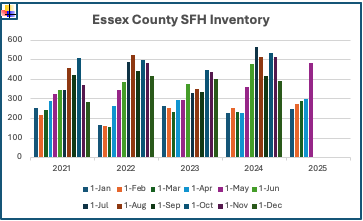

Inventory always starts the year at a low level, before picking up in the spring and early summer. There has, however, been a very sharp jump in inventory in the last month.

Single Family Homes (SFH)

May 2024 was the first month t0 show a year-over-year increase for some time. That trend has continued and was supercharged as of May 1. It will be interesting to see how inventory builds over the next 2-3 months; there has not been a reduction in sales YTD.

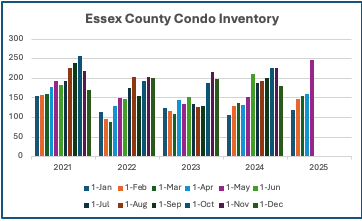

Condos

Condo inventory has increased sharply in the last month, reaching withing striking distance of the highest level in the last 5 years.

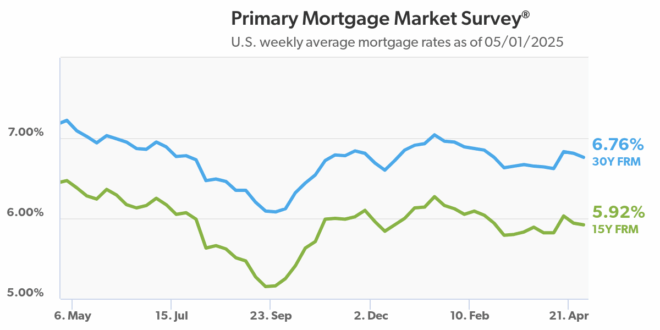

Mortgage rates

Mortgage rates have stayed withing a narrow range for most of 2025:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

Open Houses weekend May 3/4

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

New Listings and Inventory week ending May 2

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

The formatting has changed and gives you more options to search.

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

Open Houses weekend April 26/27

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

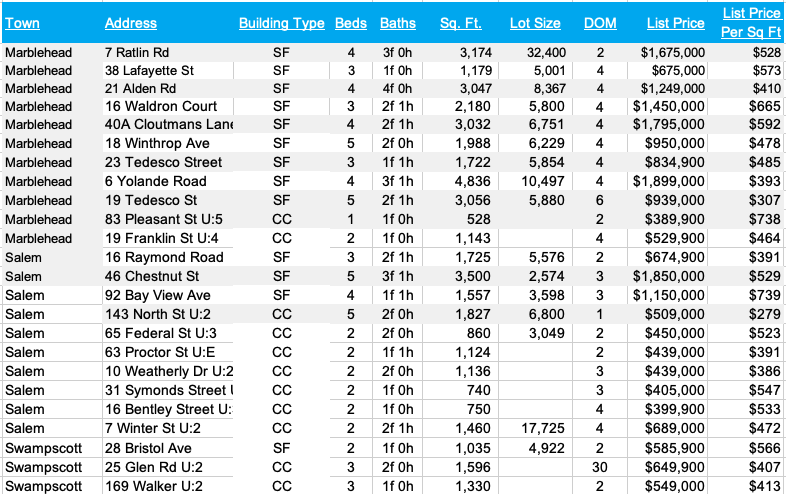

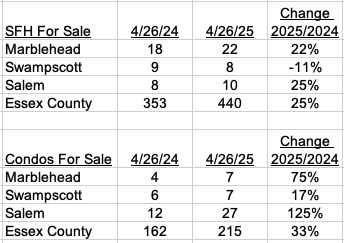

New Listings and Inventory week ending April 25

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

The formatting has changed and gives you more options to search.

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

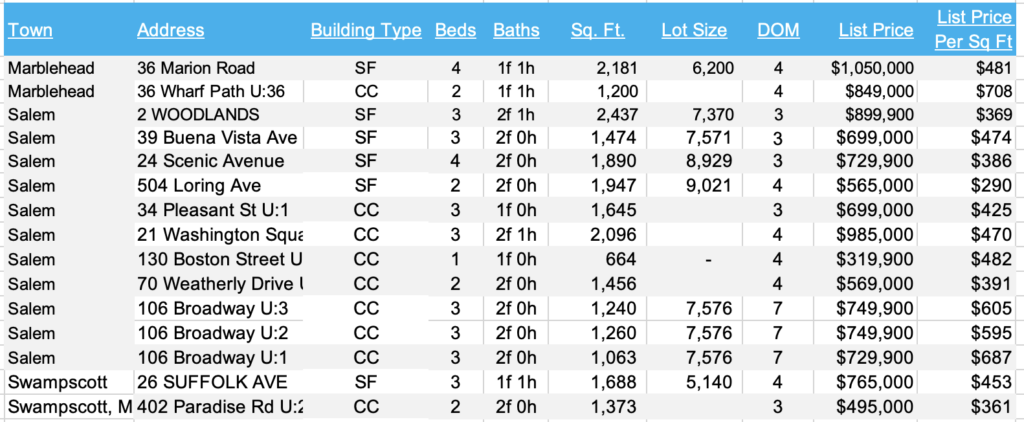

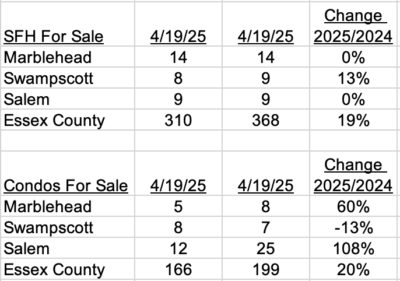

New Listings and Inventory week ending April 18

Here are the latest New Listings and Inventory.

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

The formatting has changed and gives you more options to search.

Here are the latest Inventory numbers:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

““If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

“Thank you for the wonderful, wonderful job you do for the community (explanation of property tax process and calculation) – it is so helpful and so clearly explained.”

Licensed in Massachusetts with Stuart St.James

Licensed in Florida with Compass

www.OliverReportsFL.com

Open Houses Easter weekend

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

Open Houses weekend April 12/13

Here are this weekend’s Open Houses:

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

(more…)

Recent Comments