Summer 2022 Market Review

Click on Summer Market Review to read the market review for the first 6 months of 2022,

This reports covers all 34 cities and towns in Essex County, with more detailed reviews of Beverly, Gloucester, Manchester-by-the-Sea, Marblehead, Rockport, Salem and Swampscott

And these recent articles: (more…)

Open House 41 Spinale Road Swampscott TODAY

This property has HUGE potential. It offers a large (3,376 sq. ft.), home on over 1 acre of land located on top of a hill situated in the middle of tranquility and privacy. The home offers plenty of space and is ready for your updating and great ideas. Very convenient to the Swampscott train station, restaurants, shopping, the high school and less than a mile to the beach. Great opportunity to create your own dream home in a wonderful seaside community

Click here for details or call me on 617.834.8205 to arrange a private showing.

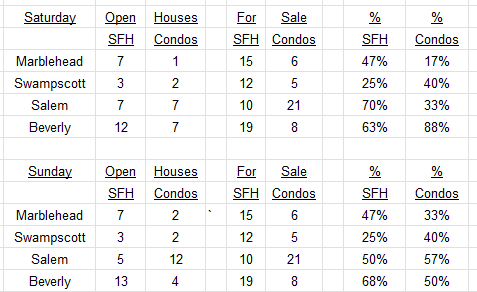

Open Houses weekend May 21/22

Here are this weekend’s Open Houses (an updated list will be published tomorrow at 8 a.m.):

Click on these links for details: (more…)

New Listings week ending May 20

There is a bounce in New Listings this week:

Click on these links for details: (more…)

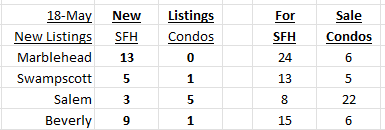

New Listings mid-week May 18

There is a spring again in New Listings this week:

Click on these links for details: (more…)

Swampscott House on over 1 acre with HUGE potential

This property has HUGE potential. It offers a large (3,376 sq. ft.), home on over 1 acre of land located on top of a hill situated in the middle of tranquility and privacy. The home offers plenty of space and is ready for your updating and great ideas. Very convenient to the Swampscott train station, restaurants, shopping, the high school and less than a mile to the beach. Great opportunity to create your own dream home in a wonderful seaside community.

Click 41 Spinale Road for more details and call me on 617.834.8205 to arrange a private showing.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

m.617.834.8205

www.OliverReportsMA.com

ajoliver47@gmail.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

Licensed in Florida

www.OliverReportsFL.com

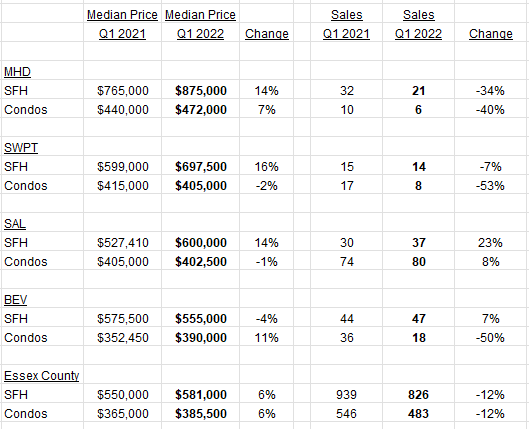

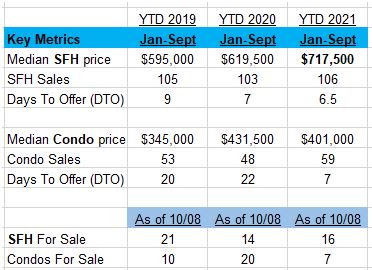

Flash First Quarter 2022 Numbers

The shortage of inventory is reflected in these Q1 numbers:

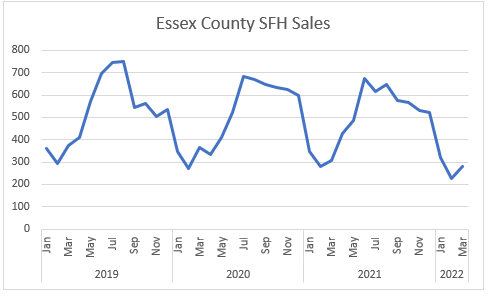

As always, small numbers need to be treated with caution. This chart shows the cyclicality of sales in New England:

Swampscott Votes OK $98 million Elementary School

Swampscott will build a $98 million elementary school on the Stanley Elementary School site at 10 Whitman Road, voters decided in a special election on Tuesday. According to Swampscott Town Clerk Susan Duplin’s unofficial results, the turnout was 35% of the town’s 11,875 registered voters and the affirmative captured 65% of the vote.

Tuesday’s majority vote essentially OK’d a $64 million Proposition 2 1/2 debt-exclusion override. The Massachusetts School Building Authority is making available a $34.3 million grant award toward the school building project, leaving Swampscott taxpayers to pick up the remaining $64 million. The $60 million would be borrowed right away, taking advantage of low-interest rates, and $4 million next year, and the borrowing would be paid back over 30 years, according to the Swampscott Finance Committee.

“The maximum estimated annual net impact on the median single-family household tax bill is approximately $300,” wrote the Finance Committee in a letter printed on last month’s Town Meeting warrant. Click here to read the Swampscott Reporter’s article on the election including details of the financing.

The new school once built will unify a trio of neighborhood elementary schools: Stanley Elementary School, Hadley Elementary School and Clarke Elementary School. It will serve 900 students enrolled in kindergarten – fourth grade. (more…)

Swampscott Election Tuesday October 19

Swampscott is holding an election this coming Tuesday, October 19, to approve funding for the new elementary school.

Here are the Election FAQs provided by the town and this is a sample ballot: (more…)

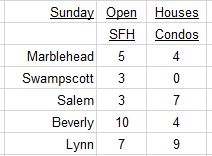

Open Houses Sunday October 10

Here is the updated list of today’s Open Houses (with links to Q3 market reports for Marblehead and Swampscott):

Click on these links for details: (more…)

Fall Market Report

Sagan Harborside has published my Fall Market Report this week. The report includes stats on every city and town in Essex County, with more detailed analysis of the markets in Marblehead, Swampscott, Salem, Beverly, Gloucester, Nahant, Manchester-by-the-Sea and Rockport.

Here are the highlights: (more…)

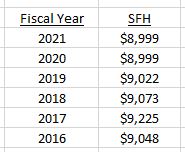

Swampscott FY 2021 Property Tax Rate Calculation

Swampscott’s residential tax rate will drop from $14.30 in Fiscal Year 2020 to $13.80 in FY 2021 (and down from a high of $18.84 in FY 2013). The FY 2021 rate will be the lowest since 2008.

Commercial and industrial property is surcharged at 170%, as in FY 2020, resulting in a tax rate of $24.90, down from $25.85 in FY 2020 (and a high of $35.02 in FY 2013).

The average SFH tax bill has been flat in recent years:

“Every year since 2017, Swampscott’s average, single-family home tax bill has dropped or stayed level – and that’s unique, exceptional,” said Fitzgerald in the fiscal 2021 tax classification hearing on Dec. 9. “You won’t be able to find another community in the commonwealth that has spent as much time really trying to find balance and stability. Many peer communities have increased their taxes every year over the past four years.”

How is the rate calculated?

The method of calculating the tax rate is quite simple: take the $ amount of the previous year’s tax levy, add 2.5% for Proposition 2 1/2, and also add any new growth (such as new construction or a condo conversion). This figure is the new maximum tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt.

Note that in recent years, Swampscott has not assessed the maximum allowed under this formula, a decision that has reduced the tax bill for residents.

Here are the numbers for FY 2020 and FY 2021, remembering that the FY 2021 runs from July 2020 to June 2021.

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, and commercial, industrial and personal (CIP). The tax rate is calculated by dividing the total dollar amount to be raised from each class by the Assessed Value of each class. Thus, the headline tax rate will also fluctuate depending upon the direction of Assessed Values.

In simplistic terms, if we assume that the $ amount to be raised increases by a little more than 2 1/2% each year, then if the average Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. In recent years Assessed Values have been increasing significantly more than 2 1/2% allowing for the tax rate to decline sharply.

Looking at the Swampscott residential tax rate, in FY 2020 it was $14.30, achieved by dividing $42.9 million raised from residential homeowners by the residential AV of $3.0 billion. In FY 2021 the amount to be raised from residential taxpayers is set to increase slightly to $43.7 million, but because the total residential AV increased by 5.4% to $3.17 billion, the headline tax rate has dropped sharply to just $13.80, the lowest figure since 2009.

Comment

The residential real estate market in Swampscott was stable in 2020 (and 2020 prices will be the basis for the FY 2022 tax rate), with the median price of Single Family Homes sold rising by 2.1%. Sales in any year represent only a small percentage of the total stock so it does not follow that assessed values calculated by the town will mirror these movements.

As to the tax rate for FY 2023, 2022 ( the basis for FY 2021) is a different story with the median Single Family price increasing 16% in the first half of the year. The actual rate will depend on a number of factors: the amount of debt service, how much of the maximum tax levy is assessed, and the shift to the CIP class being three of them. But unless there is a dramatic change in the market in the second half of 2021 the likelihood is that the actual tax rate will decline significantly in FY2023.

From a residential real estate perspective, the substantial decline in the tax rate in recent years and the stability in tax bills are both very welcome news and are clearly encouraging more people to decide both to live and work in Swampscott.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver

REALTOR® | Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

Swampscott Mid-Year Market Report

The median price of Single Family Homes (SFH) sold in the first half of 2021 (H1 2021) increased 16.5% from $592,500 to $690,000, while sales increased from 59 to 68, exactly in line with the 5-year pre-COVID average.

Following 2 SFH sales over $2 million in H2 2020, there were 3 such sales in H1 2021. 3 out of 4 SFH sales took place over list price, with 28% of all sales (compared with 11% in H1 2020) at 110% or more of list. (more…)

Swampscott Q1 2021 Housing Market Review

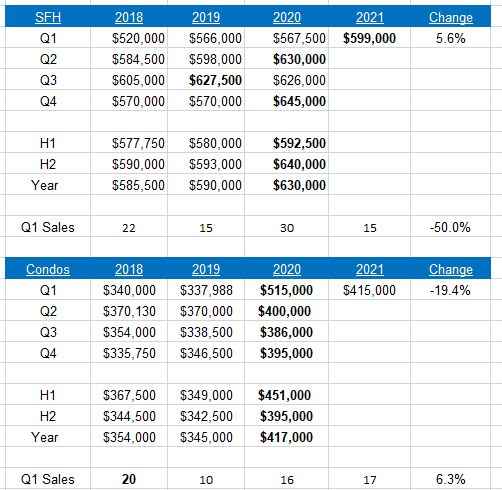

1. The median price of the SFHs sold in Q1 2021 increased 5.6% to $599,000, but this compared with $630,000 for the whole of 2020.

2. Without sales at Fisherman’s Watch – which occurred in Q1 2020 at prices between $724,900 and $1.25 million -the median price of the Condos sold dropped back to $415,000, more in line with the figure from Q2 to Q4 in 2020.

3. SFH sales have been volatile in the last 3 years: 14 in Q1 2019, 30 in 2020 and back to 15 in Q1 2021. Condo sales ticked up from 16 to 17, but with a very different mix.

For a more detailed report on the market in Q1 go to Team Harborside’s website and read: Swampscott Q1 Market Review (more…)

Recent Comments