Mortgage rates head for 5%

The yield on the US 10 year Treasury Note (10T) jumped sharply in the later part of the past week, a move which will cause the 30 year Fixed Rate Mortgage to move up again in the coming week, approaching 5%.

What drives mortgage rates?

The Federal Reserve (Fed) raised the Fed Funds (FF) rate again recently, the 8th increase since December, 2015

While changes in the FF rate (the rate at which banks lend overnight money to each other) claim the headlines, the 30 year Fixed Rate Mortgage (FRM) rate is set by the market and is a based on the yield investors in mortgage- backed securities demand over what they can earn from the US 10 year Treasury Note (10T).

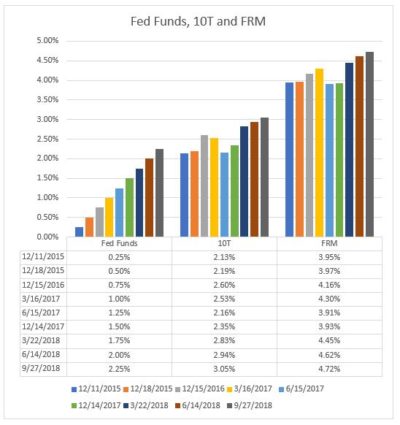

Let’s look at some numbers. In the chart below, the first column shows the FF rate on the date of the increases. The second and third columns show the yield at that time on the 10T and FRM.

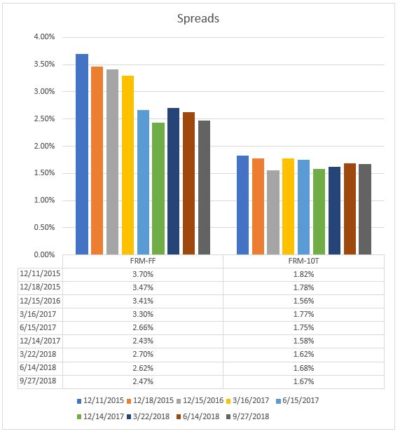

The second chart shows the spread (difference in yield) between FRM and FF on the left, and between FRM and 10T on the right. The consistency of the second column illustrates the link between the 30 year mortgage rate and the yield on the US 10 year Treasury Note.

What rates are influenced by the FF rate?

Banks respond to increases in the FF rate by raising their Prime Rates. This in turn influences the rates on such things as credit cards and auto loans, as well as home equity lines of credit. Adjustable rate mortgages (ARM) also move up with increases in short-term rates, especially the 1 year Treasury bill.

Where are rates heading?

Part of the reason for the increase in bond yields last week was the statement from the Chairman of the Federal Reserve that the current FF rate was “a long way from neutral”, a statement interpreted by the bond market as confirming that the FF rate may increase by another 1% over the next year. With the economy currently growing strongly and very low levels of unemployment, the bond market fears that inflation will pick up. With higher inflation levels, investors will demand higher yields from Treasuries. And this comes at a time when the Budget Deficit is jumping, a deficit that needs to be funded by selling more Treasuries.

Background Reading

Here are two articles I have written. The first is from October 2018:

Why mortgage rates may be headed upwards – finally

And this one from February 2018:

What will happen to Home Prices in the Experimental Economy?

Sagan Harborside Sotheby’s International Realty

www.SaganHarborside.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated