December Inventory shows little change, while mortgage rates fall

Overall in Essex County, while Inventory has been reasonably consistent in the last 3 years, it is running at around half 2019 levels for both Single Family Homes and Condos.

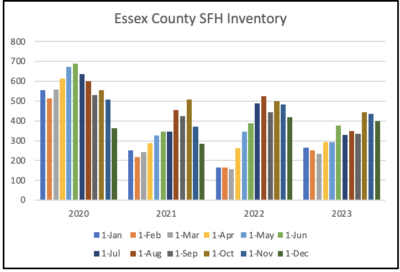

Single Family Homes (SFH)

In the early months of 2023 SFH was up 50% or more from the extremely low levels in 2022. By the summer, YOY inventory was down by around 1/3. October showed an increase of 1/3 from September 1. In December inventory was above 2021 levels- but that was in the early staages of the COVID-buying surge.

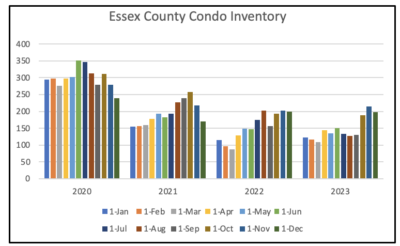

Condos

Condo inventory has increased sharply since the estremely low levels of August.

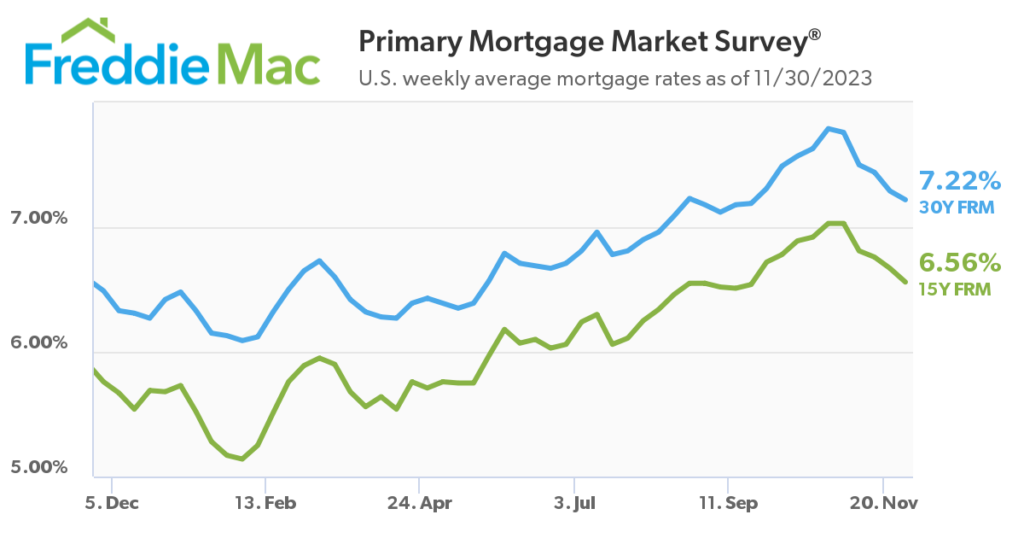

Mortgage rates

As inflation has slowed significantly this year (read Core Inflation Prices Barely Budged in August), the Federal Reserve finally stopped hiking rates. Meanwhile, the yield on the 10-year Treasury (10T) – which influences mortgage rates – soared in recent months, in part as the market has realised that there will be record sales of Treasuries at a time when the Federal Reserve has tuned seller, and foreign countries are not increasing their holdings and purchases of Treasuries.

As the market understood that the Fed was done hiking rates, and with evidence that the economy is slowing, the yield on 10T, after reaching almost 5% in October, has sincew fallen to 4.2%, driving down the 30-year Fixed Rate Mortgage (FRM).

For my 2024 mortgage forecast read Why Mortgage Rates will fall in 2024.

And these recent articles:

Why Mortgage Rates will fall in 2024

2 of Every 25 U.S. Homes Worth at Least $1M