Essex County 2021 Property Tax Rates: Town by Town guide

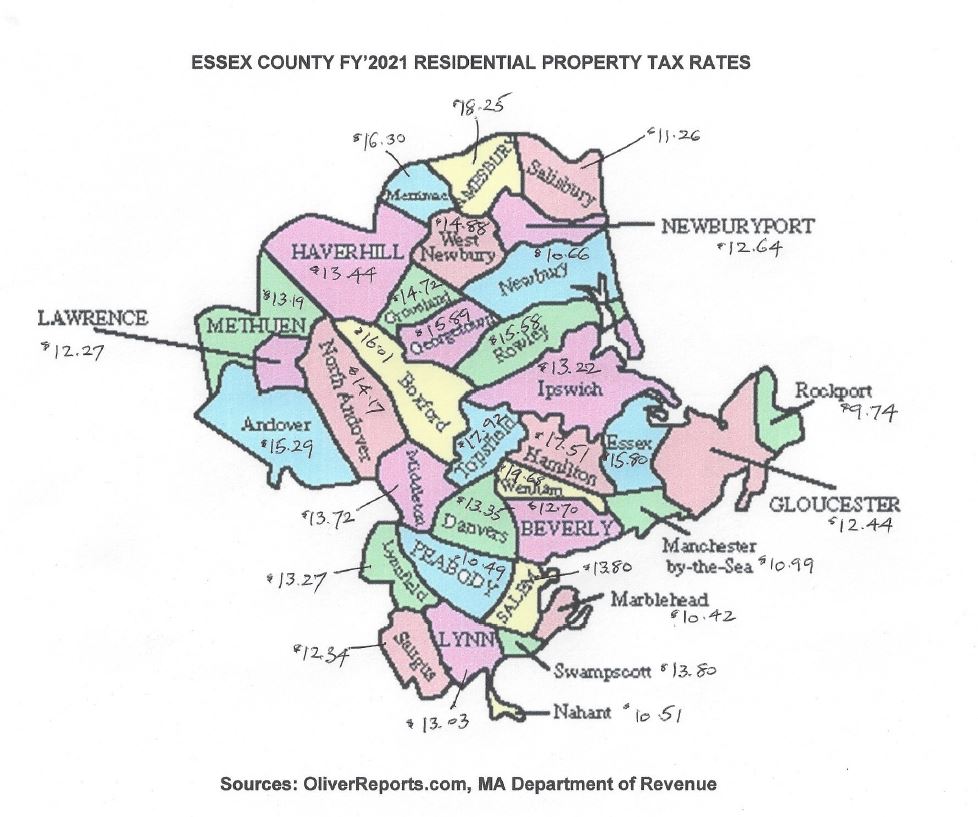

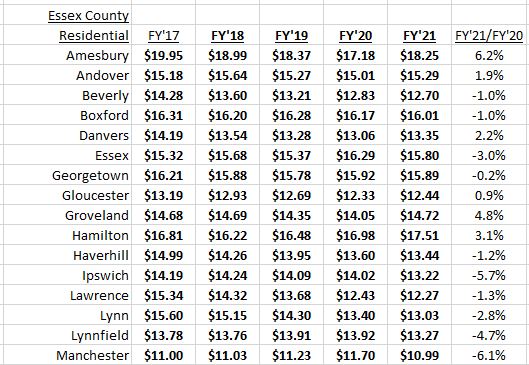

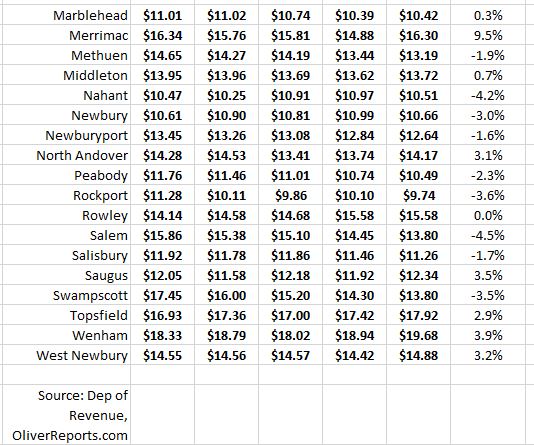

Property tax rates for FY 2021 for all 34 cities and towns in Essex County have been certified. Below is a map, so that you can compare tax rates in neighboring towns, followed by the tax rates for each town the last 5 years. The first table shows the tax rates in alphabetical order, while the second lists them from low to high.

Tax rates for each town

Alphabetically (download a copy of this table by clicking here.

From lowest to highest based on 2021 rates (download a copy of this table by clicking here)

Median and Average Tax Rates

The median tax rate for FY2021 is $13.40, down from $13.68 in FY2020, while the average tax rate is unchanged at $13.80. The highest taxed town, Wenham, has a rate 47% higher than the County median, while the lowest, Rockport, is 27% below the median. Or put another way, the highest tax rate in Essex County is double that of the lowest.

How property tax rates are calculated

There are two main points to understand:

The dollar amount raised by property taxes is based on a simple formula: the dollar levy for the previous year plus 2 1/2% (Prop 2 1/2), plus any new growth (e.g. new construction), plus debt service.

The tax rate is then calculated by dividing the dollar amount to be raised by the Assessed Value of all property. For FY 2021 (July 2020-June 2021) Assessed Values are based upon sales during 2019. Sales in 2020 will be used for calculating the FY 2022 tax rates.

20 of Essex County’s cities and towns choose a single tax rate, whereby residential and commercial properties are taxed at the same rate. The other 14 cities and towns choose a split tax rate whereby commercial properties are taxed at a higher rate – in some cases a much higher rate.

A separate report on commercial tax rates will be published in the near future.

For a walk through the tax calculation of a single rate tax town read How Marblehead’s 2021 Tax Rate is calculated

Tax rate changes in 2021

Of the 34 cities and towns in Essex County, 19 have announced decreases in their FY2021 residential tax rate while 14 have had increases approved and one is unchanged.. Decreases of 5% or more were seen in Manchester and Ipswich, while 5% or larger increases were recorded in Merrimac and Amesbury. Bear in mind that a major determinant of the change in tax rates is the movement in Assessed Values. Thus, in a time of rising home prices, a general expectation is that tax rates should be flat to down.

Tax Rates of Neighboring Towns

Where taxes become interesting is when one can compare tax rates in neighboring towns. Many people, especially those moving to the area, whether from Boston or elsewhere, are willing to consider more than one town.There are many factors in the decision about where to live, but tax rates can be a significant influence on the decision, and have become more so with the limitation on the deduction of property taxes from Federal taxation. Some argue that lower property values offset higher taxes. Frequently, however, residents of highly taxed towns cite property taxes as a reason for wanting to move.

Commercial Property Tax Rates:a Town by Town guide

Mortgage Markets Return to Normal

Conforming Mortgage Loan Limits raised for 2021

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

Licensed Sales Agent in Florida

www.OliverReports.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”