Essex County property tax rates for 2016

Essex County property tax rates for 2016 have been announced. Here is a map (so that you can compare tax rates in neighboring towns) and the changes over the last two years, followed by my comments:

How property tax rates are calculated

I wrote How your property taxes are calculated earlier this year.

There are two main points to understand:

The dollar amount raised by property taxes is based on a simple formula: the dollar levy for the previous year plus 2 1/2% (Prop 2 1/2), plus any new growth (e.g. new construction), plus any voter-approved overrides or debt exclusions.

The tax rate is then calculated by dividing the dollar amount by the Assessed Value of all property. For FY2016 (July 2015-June 2016) Assessed Values are based upon sales during 2014.

Thus, the dollar amount will always increase from year to year, but the tax rate depends upon what happens to Assessed Values (AV). Here are examples. All assume a 4% increase in the dollar amount to be raised from taxes.The variable is the change in the AV. In the years when AVs were declining, tax rates rose. As AVs are now increasing we should expect to see tax rates flat to down.

Tax rate changes in 2016

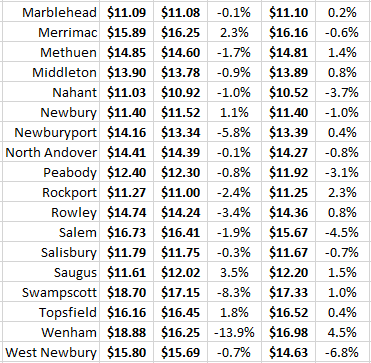

Of the 34 cities and towns in Essex County, 14 have announced decreases in their tax rate while 20 have had increases approved.The median change was an increase of just 0.2%.

Of the decreases 7 were 1% or less, while the largest decrease was the 6.8% in West Newbury.

While there were more increases, 9 were 1% or less. The largest increase by far was the 9.9% in Ipswich.

Outlook for 2017

With one week left in the year it seems the median price of a Single Family Home in Essex County will increase about 3.5% in 2015, and it is 2015 sales which will be used in calculating FY2017 tax rates. Since the dollar amount to be raised from property taxes will naturally continue to increase, at this stage it seems reasonable to expect little overall change in tax rates for FY2017, but there will, as always, be fluctuations from town to town.

I am publishing below a downloadable spreadsheet showing tax rates by city and town for the last 5 years.

Essex County Residential tax rates_2012_16_

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, feel free to contact me on 617.834.8205 or Andrew.Oliver@SothebysRealty.com.

Read Which broker will find the buyer for my house?

Andrew Oliver is a Realtor with Harborside Sotheby’s International Realty. Each Office Is Independently Owned and Operated

You can REGISTER to receive email alerts of new posts on the right hand side of the home page at www.OliverReports.com.

@OliverReports