“Home prices drop for the 12th consecutive month.” Really?

The above headline is from a recent article written by a mortgage broker. (Not the “really?” That came from me.)

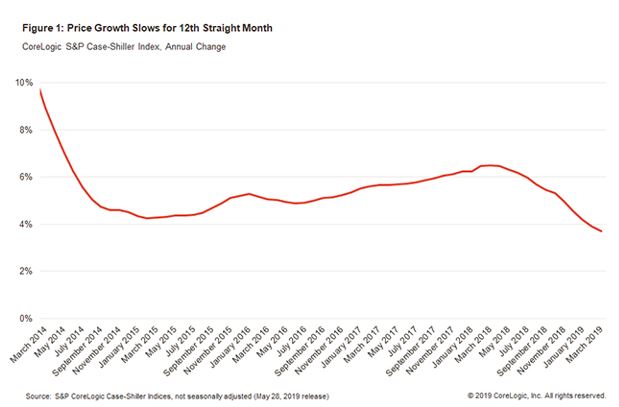

The next headline in the article was: Appreciation slowdown hits the one-year mark.

And then it read: According to new data from CoreLogic, March marked one full year of slowing growth for U.S. home prices. They rose just 3.7 percent between March 2018 and March 2019 (my italics).

Ah, so now we are getting to the truth. The rate of increase has been slowing for the last year, but prices are still 3.7% higher than they were a year ago.

Let’s look at two charts. The first, the point in the headline (however incorrectly worded) shows the rate of growth:

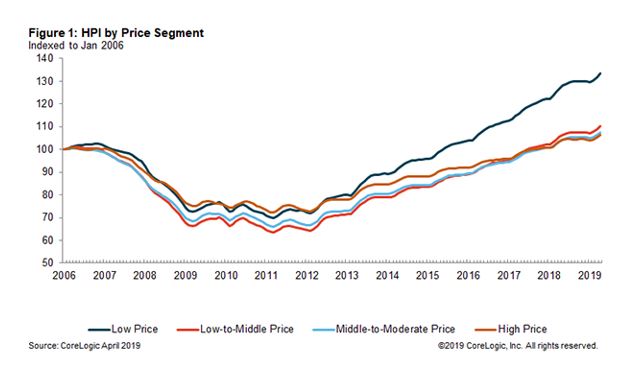

The second shows actual home prices:

Now, when I buy a product, let’s say a pineapple , I ask “what’s the price?” I don’t ask: “how much has the cost of this pineapple gone up in the last year?” Unfortunately, I cannot buy the pineapple at last year’s prices – I have to pay today’s price. Same with houses.

The annual compound rate of growth in national house prices from 2000-2018 was 3.6%. None of us buys a “national average” house nor pays a “national average” price. As buyers and sellers know only too well, many factors – many of them emotional – go into the decision to buy or sell a house. And for the vast majority of people buying a house is buying a home, a place to bring up a family.

I have been saying consistently since late last year that my outlook for 2019 was for a slowing, but still growing economy and, locally, for a stable housing market.

In last week’s article Why are mortgage rates plummeting? I quoted the Wall Street Journal’s Editorial Board: “The biggest economic risk of a Donald Trump Presidency has always been that his trade obsessions would swamp the benefits of tax reform and deregulation. For two years he has kept his worst protectionist impulses mostly in check, but as he seeks a second term we are now seeing Tariff Man unchained. Where he stops nobody knows, which is bad for the economy and perhaps his own re-election.”

And here is another quote this week from the same source: “The stock market on Friday rallied as investors bet that the Federal Reserve will cut interest rates to counter trade uncertainty. But as we learned in the Obama years, monetary policy alone can’t overcome bad fiscal, trade or regulatory policy. The May jobs report is a flashing yellow light that Mr. Trump needs to settle his trade wars and get back to promoting growth.”

The reason that interest rates and mortgage rates are dropping (the Freddie Mac 30 year FRM was 3.82% this week) is the slowing economy and increasing uncertainty caused by the President’s tariff obsession. Should the economic numbers continue to herald a significant slowdown the Federal Reserve is indeed likely to cut rates to try to stimulate the economy. Last year the Fed increased interest rates in order to prevent the huge tax cuts over-stimulating the economy and causing inflation. I think the Fed did a good job last year and I would expect it again to act to add stimulus to try to counteract the negative impact of tariffs and tariff threats.

I shall end by repeating the last sentence of last week’s article: “The natural tendency and hope is that all these issues will blow over quickly and not have a damaging effect on the economy. But the bond market is sending out warning signals.”

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReports.com

www.TeamHarborside.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated