Homebuilders’ confidence plummets – again

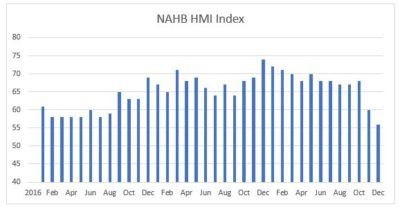

Builder confidence in the market for newly-built single-family homes fell four points to 56 in December (after falling 8 points in November) on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) as concerns over housing affordability persist. Although this is the lowest HMI reading since May 2015, builder sentiment remains in positive territory.

“We are hearing from builders that consumer demand exists, but that customers are hesitating to make a purchase because of rising home costs,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “However, recent declines in mortgage interest rates should help move the market forward in early 2019.”

The Housing Market Index (HMI) is a weighted average of responses to survey questions asking builders to rate three aspects of their local market conditions: current sales of single-family detached new homes, expected sales of single-family detached new homes over the next 6 months, and traffic of prospective buyers in new homes. Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

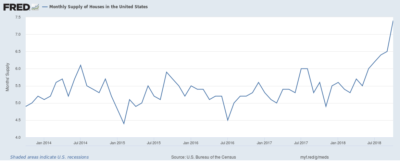

It is perhaps not surprising that builders’ confidence should have dropped recently as the supply of new homes jumped to 7.4 months in October (the November report will be published on December 27), after being in the 5-6 months range for the last 5 years).

New home sales also fell 8.9% in October to the lowest level since March 2016, while new home prices fell 3.1% from a year ago.

Comment

The figures quoted in this report are for the country as a whole. (The full report, with regional break downs, can be read by clicking New residential sales.) While new home sales account for only about 10% of total home sales, they do give another indication that the housing market is losing momentum, while we have yet to see what the impact of the recent sharp decline in the stock market and political and geopolitical developments may be.

www.OliverReports.com

Sagan Harborside Sotheby’s International Realty