How is Marblehead’s 2019 Property Tax Rate calculated?

This article, which explains how the tax rate is calculated, is a follow up to Marblehead 2019 tax rate drops to $10.74.

The formula is actually very simple: take the $ amount of the previous year’s tax levy, add 2.5% for Proposition 2 1/2, and also add any new growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt.

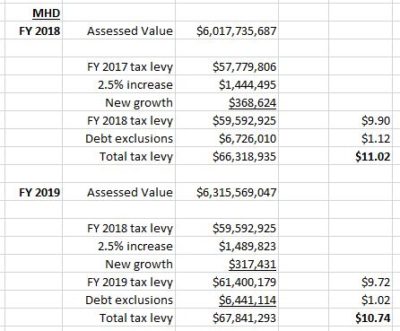

Here are the numbers for Fiscal Year 2018 and 2019, remembering that the FY runs from July to June.

The Tax Levy calculation

The dollar amount raised by the property tax will increase year by year. That is because of the formula: last year’s number plus 2.5% plus new growth. In the table above you can see how the FY 2018 tax levy of $59,592,925 becomes the base for FY 2019. Add $1,489,823 for Prop 2.5% and $317,431 for new growth and the new figure is $61,400,179. To this number is added the debt service – Principal and Interest on the town’s debt, much as homeowners pay P&I on their mortgage – to give a total amount to be raised of $67,841,293.

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, commercial and personal. The tax rate is calculated by dividing the total dollar amount to be raised by the total Assessed Value of all property. Thus, while the $ amount raised by the tax (and therefore the average tax bill) will increase each year, the headline tax rate will fluctuate depending upon the direction of Assessed Values.

In simplistic terms, the $ amount raised before debt service will increase by a little more than 2 1/2% each year, so if the median Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will rise. One other variable is the cost of debt service, which is currently projected to be stable for the next few years.

In FY 2018 the tax rate was $11.02, achieved by dividing the almost $66.3 million to be raised by the $6.0 billion of Assessed value. And in FY 2019 the calculation is $67.8 million divided by $6.3 billion, which produces a rate of $10.74. While the tax rate will decline in 2019, the median tax bill, based on the higher Assessed Values, will increase by $121, or 1.7%, to $6,766.

Note that the calculation of the tax rate is made simpler by the fact that Marblehead’s Board of Selectmen votes each year to have a single tax rate for both residential and commercial tax. In towns which elect to have a differential rate – i.e. by taxing commercial property at a higher rate than residential – there are generally two different tax rates, achieved by diving the amount to be raised from residential and commercial taxpayers by their respective aggregate Assessed Values.

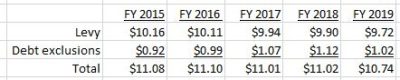

How does debt service affect the tax rate?

The announced property tax rate announced each year includes the cost of debt service, which Marblehead tries to keep to 10% or less of the total tax bill. The first major reduction in debt service is not currently due until FY 2026.

What is the outlook for FY 2020?

The residential real estate market in Marblehead has been strong again in 2018 (and 2018 prices will be the basis for the FY 2020 tax rate). At this stage it looks as though the SFH median price will be around $690,000, an increase of about 4% from 2017’s $665,000. But bear in mind this is the median price of the roughly 210 SFHs that will sell this year out of the more than 6,200 SFHs in Marblehead. This does not imply that the Town’s Assessed Value will increase by 4%, including as it does all types of property.

Nevertheless, with debt service forecast to be similar to the FY 2019 level, it seems reasonable to expect that the tax rate in FY 2020 will be similar to that for FY 2019 or slightly lower.

www.OliverReports.com