How is Swampscott’s 2020 Property Tax rate calculated?

Swampscott’ residential tax rate will drop from $15.20 in Fiscal Year 2019 to $14.30 in FY 2020 (and down from a high of $18.84 in FY 2013). The FY 2020 rate will be the lowest since 2008.

Commercial and industrial property is surcharged at 170%, as in FY 2019, resulting in a tax rate of $27.45, down from $28.83 in FY 2018 (and a high of $35.02 in FY 2013).

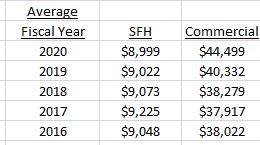

The average SFH tax bill has been flat in recent years, while the average commercial tax bill has increased:

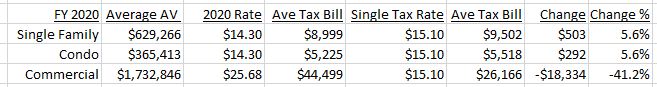

Were a single tax rate to be enacted – meaning that residential and commercial property were taxed at the same rate – that rate would be $15.10 for FY 2020. The average SFH and condo tax bills would increase by 5.6% while the average commercial bill would drop 41.2%.

How is the rate calculated?

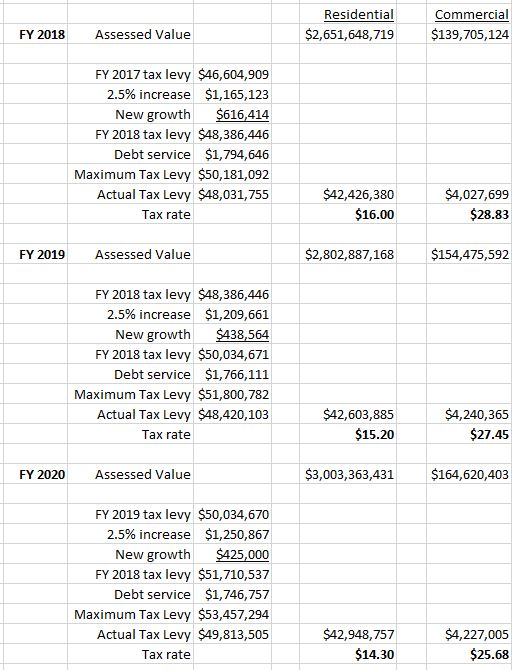

The method of calculating the tax rate is quite simple: take the $ amount of the previous year’s tax levy, add 2.5% for Proposition 2 1/2, and also add any new growth (such as new construction or a condo conversion). This figure is the new maximum tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt.

Note that in recent years, Swampscott has not assessed the maximum allowed under this formula, a decision that has reduced the tax bill for residents. The average tax bill will decline by $23 in FY 2020, a third consecutive year of decline.

Here are the numbers for FY 2018, 2018 and 2020, remembering that the FY runs from July to June.

The Tax Levy calculation

The maximum $ amount that can be raised by the property tax will increase year by year. That is because of the formula: last year’s number plus 2.5% (Prop 2 1/2) plus new growth. In the table above you can see how the FY 2019 maximum tax levy of $50,034,670 becomes the base for FY 2020. Add $1,250,867 for Prop 2 1/2 and new growth of $425,000 to get the new figure of $51,710,537.

To this number is added the debt service – Principal and Interest on the town’s debt, much as homeowners pay P&I on their mortgage. Note that the actual tax levy was less than the maximum allowed by just over $2 million in FY 2018, by $3.4 million in FY 2019 and by $4.4 million in FY 2020. In other words, the amount to be raised through taxes was reduced by these amounts each year.

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, and commercial, industrial and personal (CIP). The tax rate is calculated by dividing the total dollar amount to be raised from each class by the Assessed Value of each class. Thus, the headline tax rate will also fluctuate depending upon the direction of Assessed Values.

In simplistic terms, if we assume that the $ amount to be raised increases by a little more than 2 1/2% each year, then if the average Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. In recent years Assessed Values have been increasing significantly more than 2 1/2% allowing for the tax rate to decline sharply.

Looking at the Swampscott residential tax rate, in FY 2019 it was $15.20, achieved by dividing $42.6 million raised from residential homeowners by the residential AV of $2.8 billion. In FY 2020 the amount to be raised from residential taxpayers is set to increase slightly to $42.9 million, but because the total residential AV increased by 7.2% to $3.0 billion, the headline tax rate has dropped sharply to just $14.30, the lowest figure since 2009.

Comment

The residential real estate market in Swampscott was stable in 2019 (and 2019 prices will be the basis for the FY 20201 tax rate), with the median price of Single Family Homes sold rising less than 1%, while the median price of the condos sold declined 2.5%. Sales in any year represent only a small percentage of the total stock so it does not follow that assessed values calculated by the town will mirror these movements.

As to the tax rate for FY 2021, that depends on a number of factors: the amount of debt service, how much of the maximum tax levy is assessed, and the shift to the CIP class being three of them. Absent some change in methodology, however, it does not seem likely that the residential tax rate will see a further decline in FY 2021.

From a residential real estate perspective, the substantial decline in the tax rate in recent years and the stability in tax bills are both very welcome news and are clearly encouraging more people to decide both to live and work in Swampscott.

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReports.com

www.TeamHarborside.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated