Lies, damned lies and statistics*: mortgage rates

Sometime I scratch my read when I read pronouncements from “experts”. Take this comment from Sean Becketti, chief economist at Freddie Mac:

“In a short week following Presidents Day, the 10-year Treasury yield fell about 8 basis points. However, the 30-year mortgage rate rose 1 basis point to 4.16 percent. This week’s survey once again displays the disconnect between mortgage rates and Treasury yields, a result of continued uncertainty.”

The Freddie Mac weekly survey data is collected from Monday through Wednesday and the results are released on Thursdays at 10 a.m. ET. This week, of course, markets were closed on Monday so there was very little data on which to base the week’s calculations.

More importantly, the yield on the 30 year Fixed rate Mortgage (FRM) does track the yield on the 10 year Treasury note (10T) closely. It does not move directly in line because US Treasuries have been regarded as the “safe haven” for investors in times of uncertainty. Last summer, for example, the UK vote to leave the EU triggered buying of US Treasuries, causing their yields to drop. Mortgage rates did not fall as far, because the fall in Treasury yields was unrelated to the demand for mortgages.

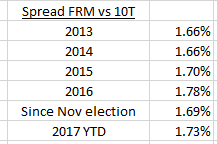

Anyway, let’s get back to Mr. Becketti’s assertion that there is a “disconnect between mortgage rates and Treasury yields”. Look at this table, which shows the spread – the extra yield investors in mortgage backed securities demand over the yield on 10T. The first four numbers are the average for the entire year:

I’d say there is a pretty clear connect between mortgage rates and Treasury yields. The spread was a little wider in 2016 because of events like Brexit, but even with the spike in Treasury yields since the election the spread has remained in a narrow band.

What will drive Treasury yields this year ?

For the last several years the only economic policy, in the absence of any fiscal policy from Congress, has been monetary policy – i.e. keeping interest rates low to try to stimulate the economy. Yields on US Treasuries have spiked since the election for two main reasons: the expectation that a Republican Congress and Administration will pass legislation to foster faster economic growth, which in turn will lead to higher inflation. As a result interest rates will rise.

The yield on 10T increased from 1.75% before the election to as high as 2.6%, before dropping back to 2.3%. A disconnect seems to be emerging between Administration Twitter pronouncements and action and policy by Congress and Department leaders. And it does seem that actions on the economy are going to take second fiddle to action on the Affordable Care Act. While the Treasury Secretary this week said he wanted to try to pass tax reform by August he admitted that that timetable was aggressive and there would not be an impact until 2018.

If you are thinking of buying or selling a home this year and want to avoid surprises when it comes to your mortgage rate, the one number to focus on is the yield on the 10 year Treasury. Mortgage rates will vary from lender to lender, while the rate can be reduced by paying more upfront in terms of points. But I keep a mental picture of base mortgage rates by looking at the yield on 10T and adding 1.7%.

*”There are three kinds of lies: lies, damned lies, and statistics.” The actual origin of this expression is disputed but it was attributed by Mark Twain to the British Prime Minister Benjamin Disraeli. This article is one of an occasional series I write about what I deem to be false statistical claims.

Not sure which broker to use to sell your home? Read Which broker should I choose to sell my house?

Please contact me on 617.834.8205 or Andrew.Oliver@SothebysRealty.com for a free market analysis and explanation of the outstanding marketing program I offer.