Marblehead FY 2024 Property Tax Explained

Marblehead’s property tax rate for FY 2024 (July 1, 2023- June 30, 2024) has been set at $8.96, down from $10.00 in FY 2023 following a dramatic 16% increase in Assessed Values.

The formula for calculating the property tax is: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt – to produce the total Tax Levy.

The tax rate is then calculated by dividing the Tax Levy by the Assessed Value of property – and, crucially, that calculation is based upon prices as of January 1, 2023, using date from sales in calendar year 2022. What that means is that 2023 sales are used for the calculation of the tax rate in FY2025 – not FY2024.

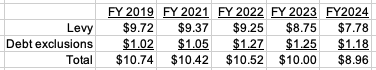

Here are the numbers for Fiscal Years 2023 and 2024, remembering that FY 2024 runs from July 2023 to June 2024.

The Tax Levy calculationThe dollar amount raised by the property tax will increase year by year. That is because of the formula: last year’s number plus 2.5% plus new growth. In the table above you can see how the FY 2023 tax levy of $69,217,826 becomes the base for FY 2024. Add $1,730,446 for Prop 2.5% and $468,709 for new growth and the new figure is $71,416,980 . To this number is added the debt service of $10,813,091 – to give a total amount to be raised of $82,230,071..

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, commercial and personal. The tax rate is calculated by dividing the total dollar amount to be raised by the total Assessed Value of all property. Thus, while the $ amount raised by the tax (and therefore the median tax bill) will increase each year, the headline tax rate will fluctuate depending upon the direction of Assessed Values.

In simplistic terms, the $ amount raised before debt service will increase by a little more than 2 1/2% each year, so if the median Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. One additional factor is the cost of debt service.

In FY 2023 the tax rate was $10.00, achieved by dividing the $79.1 million to be raised by the $7.9 billion of Assessed Value. And in FY 2024 the calculation is $82.2 million divided by $9.2 billion, which produces a rate of $8.96. The median tax bill, based on the higher Assessed Values, will increase by $244 or 3%, to $8,318.

Note that the calculation of the tax rate is made simpler by the fact that Marblehead’s Select Board votes each year to have a single tax rate for both residential and commercial property. In towns which elect to have a differential rate – i.e. by taxing commercial property at a higher rate than residential – there are generally two different tax rates, achieved by dividing the amount to be raised from residential and commercial taxpayers by their respective aggregate Assessed Values.

How does debt service affect the tax rate?

The announced property tax rate announced each year also includes the cost of debt service:

What is the outlook for FY 2025?

In 2023, the year that is the basis for the FY 2025 property tax calculation, the median MLS SFH sale price through December 16 was $987,000, an increase of 4% from 2023’s $938,000. This suggests that the actual tax rate should be flat or show perhaps a slight decline for FY2025, but we will get a clearer idea after the town publishes its budget next February .

Read these recent reports: Why Mortgage Rates will fall in 2024

How a tax break of up to $3,200 can help heat your home more efficiently this winter

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023 SALEM Q3 MARKET REPORT 2019-2023

ESSEX COUNTY Q3 2023 MARKET REPORT

Two More Ways the Mortgage Market differs from 2007/2008

November Inventory down 60% from 2019

Credit Score Change Could Help Millions of Buyers

2 of Every 25 U.S. Homes Worth at Least $1M

Economic and mortgage commentary

Two signs Inflation is Slowing

What drives Mortgage rates in one chart

How Marblehead’s 2023 Property Tax Rate is Calculated

Essex County 2023 Property Tax Rates: Town by Town guide

Why Mortgage Rates Will Fall

Two More Ways the Mortgage Market differs from 2007/2008

Market Reports

Essex County 2022 Housing Market Review

Essex County Town by Town Guide: 2022 Median Prices and Sales; 2023 Tax Rates

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205