Essex County 2023 Property Tax Rates: Town by Town guide

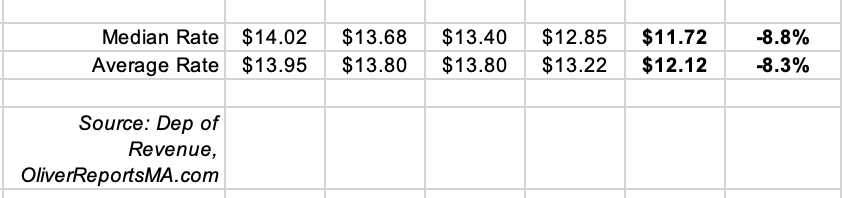

Property tax rates for FY 2022 for all 34 cities and towns in Essex County have been certified. The first table shows the tax rates in alphabetical order, while the second lists them from low to high.

Tax rates for each town

Alphabetically (download a copy of this table by clicking here)

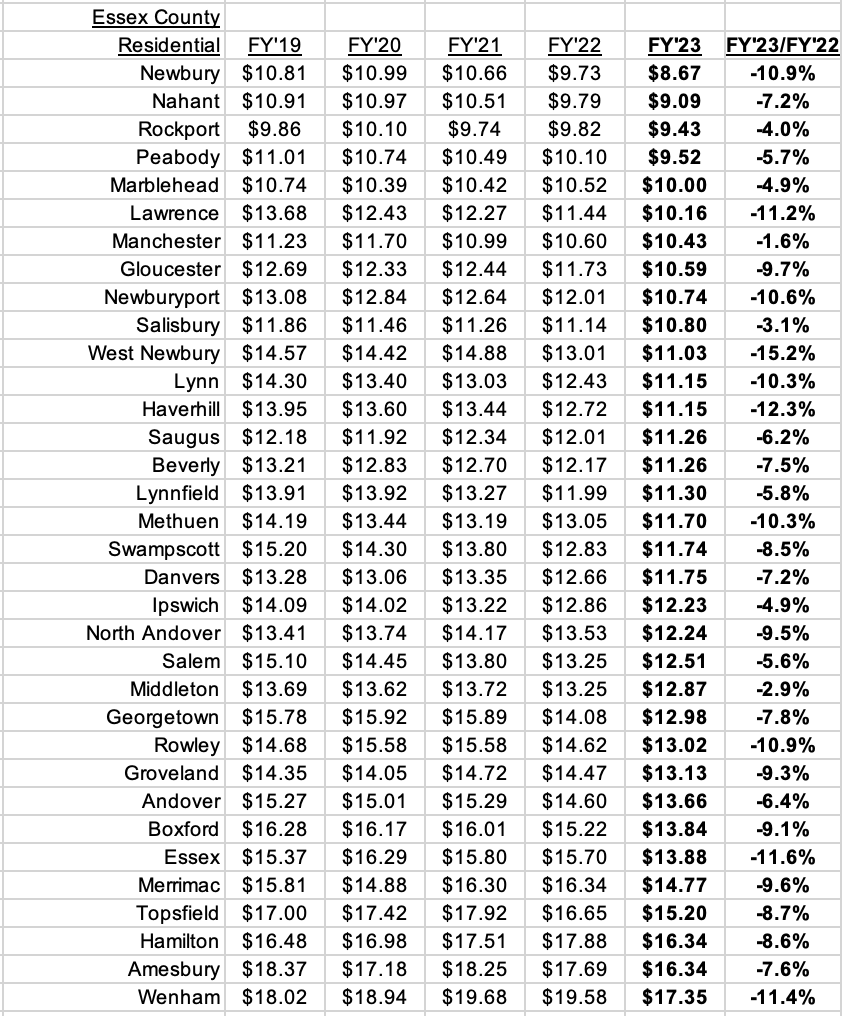

From lowest to highest based on 2022 rates (download a copy of this table by clicking here)

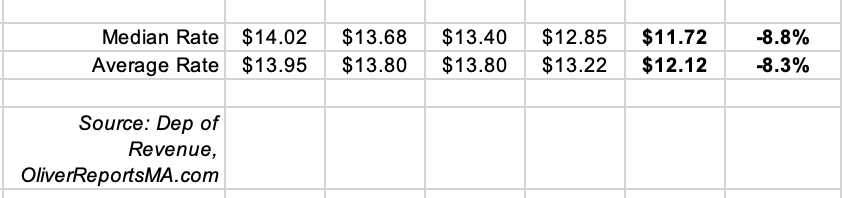

Median and Average Tax Rates

The median tax rate for FY2022 is $11.72, down from $12.85 in FY2021, while the average tax rate is $12.12 down from $13.22. The highest taxed town, Wenham, has a rate 48% higher than the County median, while the lowest, Newbury, is 26% below the median. Or put another way, the highest tax rate in Essex County is double that of the lowest.

How property tax rates are calculated

There are two main points to understand:

The dollar amount raised by property taxes is based, in general, on a simple formula: the dollar levy for the previous year plus 2 1/2% (Prop 2 1/2), plus any new growth (e.g. new construction), plus debt service.

The tax rate is then calculated by dividing the dollar amount to be raised by the Assessed Value of all property. For FY 2023 (July 2022-June 2023) Assessed Values are based upon sales during 2021. Sales in 2022 will be used for calculating the FY 2024 tax rates. In a time of rising home prices, the nominal tax rate may well decline, but the dollar amount of taxes paid will still increase.

20 of Essex County’s cities and towns choose a single tax rate, whereby residential and commercial properties are taxed at the same rate. The other 14 cities and towns choose a split tax rate whereby commercial properties are taxed at a higher rate – in some cases a much higher rate.

Tax rate changes in 2021

All 34 cities and towns in Essex County have announced decreases in their FY2023 residential tax rate. Bear in mind that a major determinant of the change in tax rates is the movement in Assessed Values. Thus, in a time of rising home prices, a general expectation is that tax rates should be flat to down.

Tax Rates of Neighboring Towns

Where taxes become interesting is when one can compare tax rates in neighboring towns. Many people, especially those moving to the area, whether from Boston or elsewhere, are willing to consider more than one town. There are many factors in the decision about where to live, but tax rates can be a significant influence on the decision, and have become more so with the limitation on the deduction of property taxes from Federal taxation. Some argue that lower property values offset higher taxes. Frequently, however, residents of highly taxed towns cite property taxes as a reason for wanting to move.

Read these recent reports:

How Marblehead’s 2023 Property Tax Rate is Calculate

Economic and mortgage commentary

Marblehead 2023 Property Tax Rate

Why Mortgage Rates Will Fall

Recession? Yes, no, maybe….

Has Inflation Peaked?

Are we already in a Recession?

Essex County 2023 Property Tax Rates: Town by Town guide

Market Reports

HOW AND WHEN WILL HOUSING REBOUND?

December sales in Marblehead and Swampscott still mostly above List Price

Marblehead Q3 2022 Report: Median Price tops $1 million

Swampscott Q3 2022 Report: Median Price hits $800,000

Salem Q3 2022 Report: Median Single Family price breaks through $600,000

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

[email protected]

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205