Mortgage rate head fake

Well, that rally in mortgage rates didn’t last long! After last Friday’s startling jobs report which led to this article Mortgage rates are rising – and that’s good news and caused a jump in mortgage rates of about 1/8/1/4% on the day, this week saw a very different set of economic numbers and tone to markets.

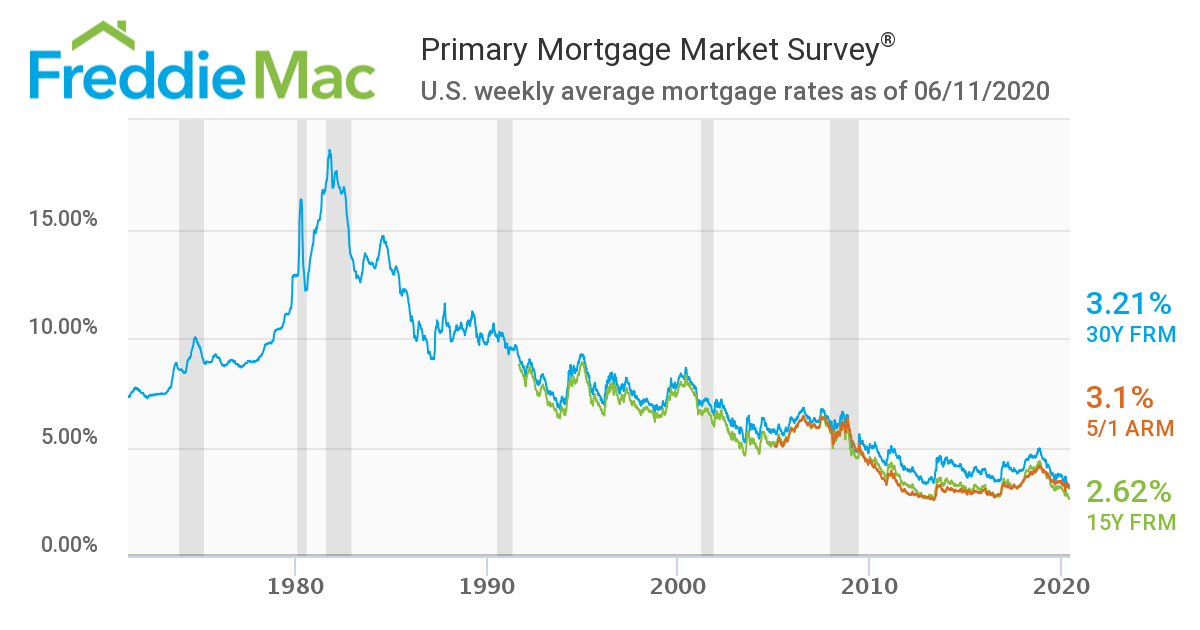

Consequently, while the Freddie Mac national weekly average, announced on Thursday and based on rates on Monday-Wednesday,saw a small increase from 3.15% to 3.18%, by the end of the week the 30-year Fixed Rate Mortgage (FRM) was hovering closer to 3% again – and on Thursday some lucky buyers were able to get mortgages under 3%.

I don’t want to get bogged down in nitty-gritty when the result is a minor fluctuation. I have written many times in recent weeks that I plan to ignore all economic statistics and forecasts because (a) the numbers, especially in April but for the whole second quarter, are going to be awful, but we are not surprised since the economy, domestically and internationally, was largely shut down, and (b) because all forecasts for the future have so many qualifiers (assuming this, assuming that, etc).

What happened this week?

Unless you took a SpaceX trip to another planet, it has been almost impossible to miss all the drama. On the issue of racism in this country, all I want to say in this forum is that I am very, very optimistic that the movement towards equality has a momentum that I hope and pray is unstoppable. Both the NFL and NASCAR have made dramatic moves, while corporation after corporation has been detailing the plans they have in place to put a rocket to their commitment to speed equality. Now it is up to all of us to keep the pressure on.

Economically….the weekly unemployment figures in Thursday seemed in contrast to the jobs number last week. Tempting though it is to revert to my “ignore them all” philosophy, it may be time as the economy starts to reopen to pay more attention. Two numbers stood out in Thursday’s report: continuing unemployment numbers of almost 21 million and nearly 30 million including those filing for Pandemic Unemployment Assistance benefits.

Nobody knows how many furloughed jobs will be lost as – and if – businesses reopen, or how many small business have only kept going because of funding from the Payroll Protection Program.

So I guess I am back to “we don’t know”. And it is important to differentiate between a stock market on a sugar high from all the liquidity being pumped into the economy by the Federal Reserve and the hardship already being suffered by many now and likely in the future.

And did somebody say rising COVID-19 cases? From CNBC: The rise in coronavirus cases seen in about half a dozen states across the U.S. isn’t the feared “second wave” — it’s still the first, scientists and infectious disease specialists say.

Back to mortgage rates. This is the only chart that matters, showing how cheap mortgage rates are by historic standards:

Andrew Oliver

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReports.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated