Mortgage rates after the collapse of bond yields

Somewhat to the surprise of markets, the Federal Reserve (Fed) lowered its Fed Funds Rate (FF) this week by 0.5% to 1.25%, in response to the rapidly developing, coronavirus-induced fear of an economic slump.

What does this mean for mortgage rates? First, I will explain the link – or lack of link – between FF and FRM- and what actually drives mortgage rates. This is easier than predicting what will happen going forward, but for what it is worth I offer some thoughts at the end of this piece.

Five charts explain the factors driving mortgage rates. In all cases the numbers are at the dates that the Fed has changed its FF over the last 4 years: 10 increases, followed by four decreases.

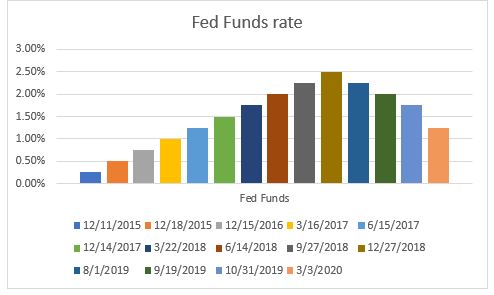

Fed Funds rate (FF)

The Fed Fund rate is the rate at which banks lend to each other overnight.

After increasing from 0% to 2.5% since late 2015, cuts in 2019 and 2020 have lowered the rate to 1.25%.

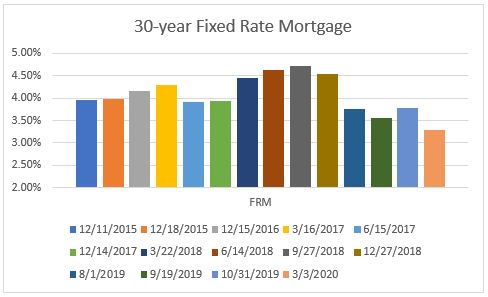

30-year Fixed Rate Mortgage (FRM)

The FRM reached nearly 5% in late 2018 and dropped to an all-time low this week of 3.29%.

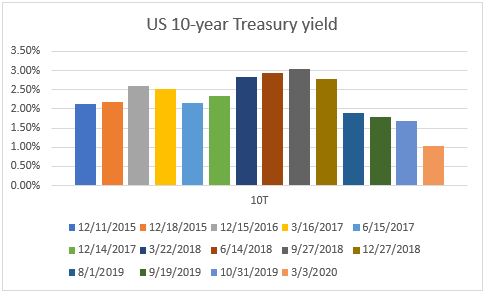

10-year Treasury yield (10T)

The yield on the 10T is influenced by two major factors: the outlook for the economy (expanding businesses invest creating demand for money) and geopolitical events – the US dollar and US Treasuries are seen as a safe haven during times of uncertainty.

The yield reached 3.2% in November, 2018 (which was the time of the peak in the FRM), but in the last two weeks the yield has plummeted from around 1.5% to 0.74% on Friday.

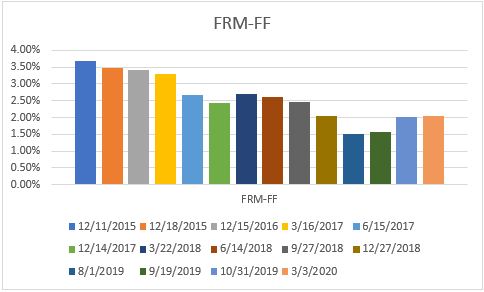

The spread, or difference, between FRM and FF

If there were a link between FF and FRM it would show up in this chart. In fact, the spread dropped from 3.7% in 2015 in 2019 before increasing to 2.0% recently, demonstrating that there is no direct link between FF and FRM

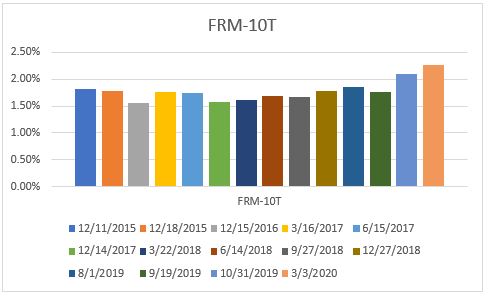

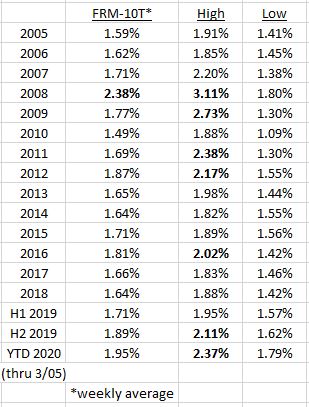

The spread, or difference, between FRM and 10T

We see more consistency between FRM and 10T, where the spread has, until recently, been in a much tighter range of 1.5% to 1.8%.

Indeed, over the last several years the spread has been very stable averaging around 1.7%. But I would point out two things in this table: first, the spread widened significantly in the great recession in 2008; and, secondly, while the median spread for the year has been in a narrow range, within the years there have been quite wide variations – in particular look at 2008/2009.

Comment

The FF rate affects the lending rate for credit cards, auto loans, adjustable rate mortgages, all of which are impacted by banks’ Prime Rate, which moves with the FF rate. Fixed Rate Mortgages – the typical 30-year mortgage – have a longer life and their benchmark is the closest Treasury security, which is the 10T. Conventional mortgages are bundled and sold to investors, who require a risk premium – higher yield – over that offered by 10T.

As can be seen, that premium – spread – has been remarkable constant over recent years. It does fluctuate from time to time – as the yield on 10T tends to move quickly at times, although never before as quickly as in the last two weeks – but in recent years has always comes back to around that 1.7% level.

Here are a few thoughts about the current situation:

1. Nobody knows how severe the coronavirus will prove to be, but there seems to be a good chance that many sectors of the world economy will see an abrupt slump, rather than a gradual slowdown.

2. The hope is that the crisis stage of COVID-19 will pass quite quickly and that this will be followed by a rapid recovery in economic activity.

3. But nobody knows.

4. In times of crisis countries need strong political leadership, reassuring the public that, while serious, all possible action is being taken to confront the situation. The response has varied country to country, but we must hope that there will be a more coordinated effort in the very near future.

Mortgage rates

As the last table showed, whereas over time the spread between FRM and 10T has been consistent in the 1.7% range, there have been wide variations in the short-term. We saw that in 2008 and 2009, a time of great economic duress when widespread buying of US Treasuries as a safe haven drove yields down and spreads widened. Those spreads returned to the norm as economic conditions improved.

The current economic situation is very different from the Great Recession. Indeed, but for COVID-19 the extremely strong employment numbers announced yesterday would lead to expectations that the Fed would be increasing rates; instead, the market is expecting another cut.

But as many commentators have pointed out, lower interest rates will not overcome health concerns. For example, lower rates will not make people travel.Money is cheap and plentiful – what is lacking right now is demand. It is a time for fiscal measures not monetary ones.

Another factor is the demand for mortgage-backed securities, the bundles of mortgages sold to investors. In the Great Recession, investors were wary about the value of the underlying security – residential mortgages – and so demanded a larger premium. That should not be a concern now with housing markets remaining very strong.

So will mortgage rates get to 3%, a number raised in my Are mortgage rates headed to 3%? article last June.

My best guess – and at this stage it is a guess – is that in time, when we know the extent of the economic slump and the pace of recovery, interest rates will raise again.Could the FRM reach 3%? Yes. Will it? Ask me again in a couple of weeks.

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReports.com

www.TeamHarborside.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated