Mortgage rates drop again – where to next?

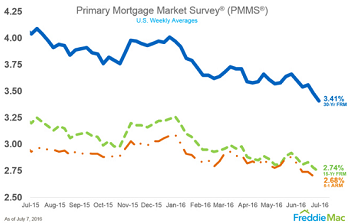

Immediately following Brexit I wrote What Brexit means for the housing market. The key point I made is that any near term increase in interest rates in the US was now off the table. This week we have seen the Freddie Mac 30 year Fixed Rate Mortgage (FRM) drop to 3.41%.

US unemployment rates and bond yields

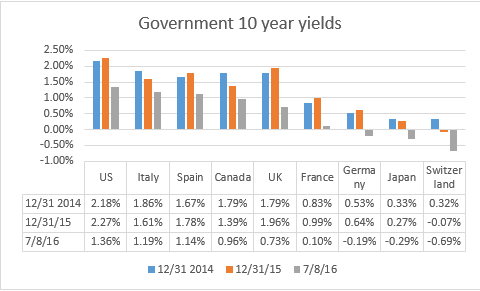

On Friday, the employment report showed a sharp recovery from May’s swoon, yet bond yields did not jump as might be expected. The main reason is that despite the sharp fall in the yield on US 10 year Treasury (10T), that yield remains above that of all other major counties, attracting foreign buying. The following table shows those yields for the last 2 1/2 years:

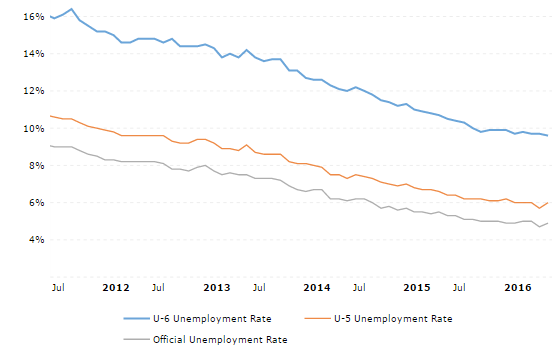

Additionally, despite the headline unemployment rate of under 5%, there are actually three measures of unemployment. U3 is the official unemployment rate. U5 includes discouraged workers and all other marginally attached workers. U6 adds on those workers who are part-time purely for economic reasons. While U6 has come down in recent years it is still close to 10%.

What drives mortgage rates?

As a reminder, the Federal Reserve can only directly impact short-term rates, such as those on credit cards, auto loans and home equity loans (HELOCs). The 30 year FRM is based upon market interest rates, most notably for the US 10 year Treasury (10T) – which is generally viewed as a better barometer of how the market views prospects for the US economy.

When the Fed finally – and too late – increased short-term rates last December ( and talked of 4 more rate increases) the yield on the 10T was 2.26%. That yield has now dropped to under 1.4%. Note that despite the US being seen as a safe haven, the yield on 10T has consistently been higher than that of other countries’ similar debt, one of the reasons the dollar has been so strong.

The FRN does not move in lock step with 10T because of the safe haven status of the dollar, meaning that in times of political upheaval investors buy US Treasuries as a “safe haven”. Over the last 3 1/2 years the average FRM has been about 1.7% higher than 10T. With 10T at 1.4%, that would imply a 3.1% FRM, but…. part of the reason for the low 10T yield is geopolitical, so I would not expect the FRM to drop that far, unless the 10T yield stabilizes at this level.

Another factor in keeping mortgage rates higher than might be expected is the fact that, at a time of pressure on profits, banks are keen to increase their margins on mortgages, especially when rates are low and the housing market strong.

Comment

I know this may be getting a bit complicated or a real estate blog. A quick and easy way to stay informed is to read the posts on my blog under the Mortgage Rates and Forecasts tab. Here is a link to it: Oliver Reports: Mortgage rate forecasts

Even just reading the summaries will give you a good feel for what has been happening.

If you are considering selling your home please contact me on 617.834.8205 or Andrew.Oliver@SothebysRealty.com for a free market analysis and explanation of the outstanding marketing program I offer.

Read Which broker should I choose to sell my house?

If you are looking to buy, I will contact you immediately when a house that meets your needs is available. In this market you need to have somebody looking after your interests.

Andrew Oliver is a Realtor with Harborside Sotheby’s International Realty. Each Office Is Independently Owned and Operated

@OliverReports