Mortgage rates near 4%: no need to panic

As anticipated in my Is this the end of ultra cheap mortgages? post last week, the rate on the 30 year Fixed Rate Mortgage (FRM) jumped to 3.94% this week, according to the latest Freddie Mac weekly survey. Before we all panic, let’s consider a few facts.

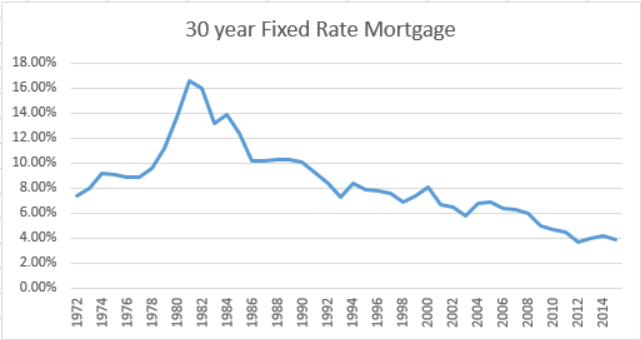

Mortgage rates are historically extremely low

Look at the chart below. Mortgage rates fell below 5% for the first time ever only in 2010. They averaged a little below 4% in 3 of the last 4 years, but even after the jump since the election rates are merely back to where they were a year ago and remain close to all-time lows. And during the boom years of 2004-2006 the average mortgage rates were 6.84%, 6.87% and 6.41%.

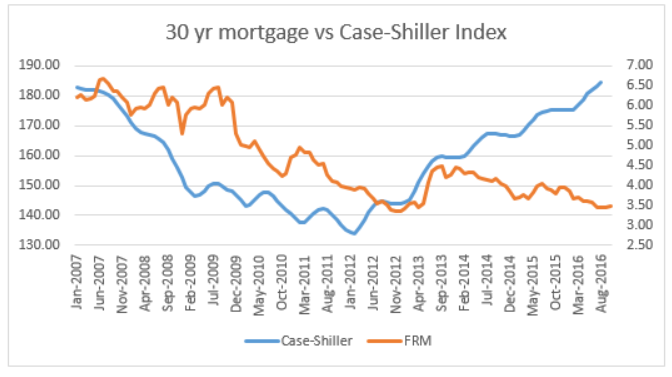

There is no clear correlation between mortgage rates and home prices

Data for the last 10 years for national home prices starts as the housing boom was already over, but the chart below shows how home prices tumbled from 2007 to 2012 at a time when mortgage rates were also falling. Once the market turned, the spike in mortgage rates in 2013 did not stop the increase in home prices.

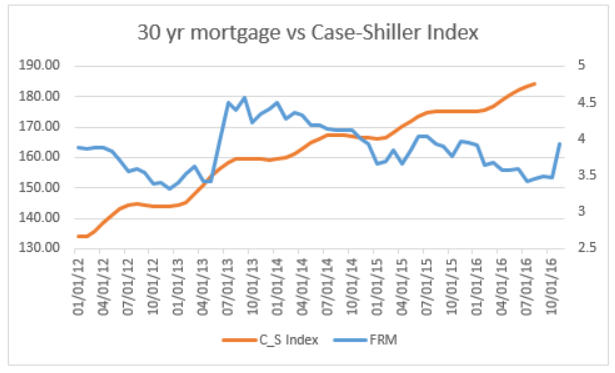

The next chart shows in a little more detail what has happened in the last 4 years. All I can say is that I see no direct correlation in the chart above or the one below between home prices and mortgage rates. That is not to say that mortgage rates do not have an impact on home prices, just that they are not the only factor.

Is inflation going to rise?

Since the Great Recession, central banks have been pumping cash into world economies in an attempt to stave off deflation – falling prices. Why are falling prices so bad? Because some consumers will defer purchases in the belief that prices will be lower in the future. Since by some estimates consumer expenditure accounts for 70% of the economy, any concerted move by consumers to defer purchases would have a major negative effect on the economy.

So is inflation going to rise now that the Republicans control Congress and the White House? Probably, and that is the bet markets are making, causing the yield on the 10 year Treasury Note (10T) to jump nearly 0.5% in less than two weeks. And mortgage rates follow closely the yield on 10T.

Is renewed Inflation bad news for the economy?

As the Wall Street Journal put it: “The world should welcome higher long-term bond yields insofar as they signal a brighter outlook for economic growth and a return to moderate inflation after years of fear about falling consumer prices. Central banks have been trying hard—especially in Europe and Japan, without much success—to drag inflation higher. The long run of low rates also has battered banks, pension funds and insurance companies.”

Higher economic growth, the ending of the fear of deflation, relief for financial institutions – there’s a lot to like in moderate inflation – the key, of course, being moderate.

How does inflation affect real estate markets?

One of the key aspects of borrowing money in an inflationary environment is that the asset purchased will appreciate, while the loan will be paid back in depreciated dollars. The incentive, therefore, is to buy now before prices rise – the opposite to the concern in a time of deflation.

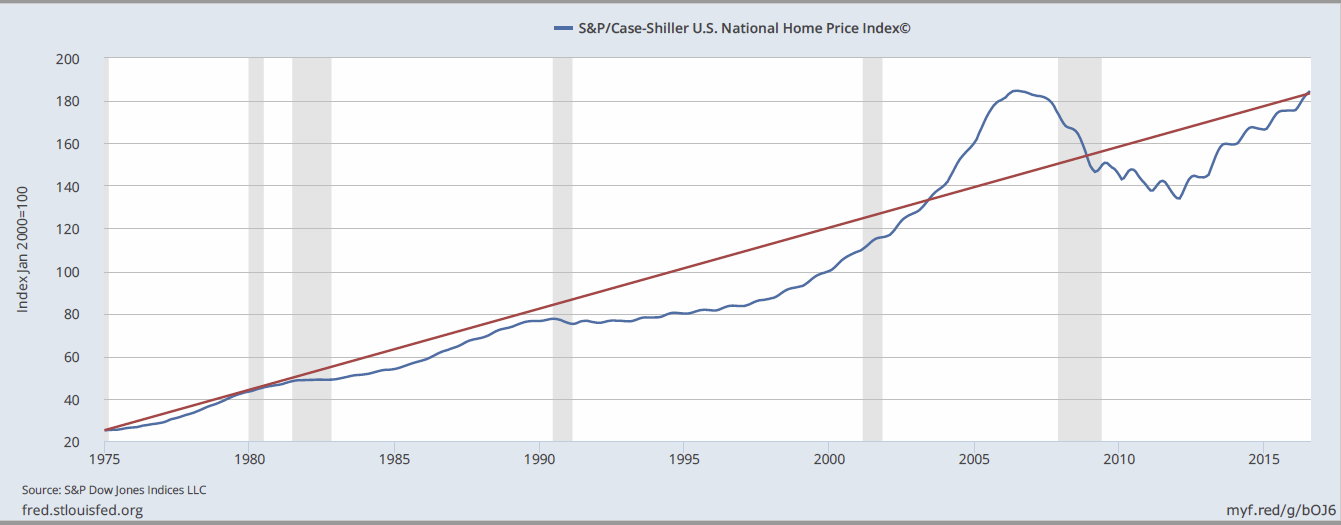

Will home prices continue to rise?

The chart below shows the growth in national home prices over the last 40 years. My reading of this is that we have now recovered from the sub-prime boom and bust cycle and that prices are likely to continue to grow modestly over time.

If you are considering selling your home please contact me on 617.834.8205 or Andrew.Oliver@SothebysRealty.com for a free market analysis and explanation of the outstanding marketing program I offer.

Not sure which broker to use to sell your home? Read Which broker should I choose to sell my house?

If you are looking to buy, I will contact you immediately when a house that meets your needs is available. In this market you need to have somebody looking after your interests.

Andrew Oliver is a Realtor with Harborside Sotheby’s International Realty. Each Office Is Independently Owned and Operated

@OliverReports