Why have mortgage rates dropped below 4%?

The average 30 year Fixed Rate Mortgage (FRM) fell below 4% this week for the first time in 5 months. Why has this happened?

In December 2015, when the Federal Reserve (Fed) raised interest rates for the first time, I published What the Fed’s rate increase means for mortgage rates.

In that article I explained that while the increase in the Fed Funds rate influenced items such as credit cards, auto loans and home equity lines of credit (HELOC), it did not directly affect 30 year mortgage rates.

The FRM is priced off the US Treasury 10 year yield which in large part reflects the outlook for economic growth and inflation.

These charts show what has happened

The Fed Funds chart just shows the rate increases – unlike FRM and 10T, the Fed Funds rate does not fluctuate from day to day – it is not traded in the market.

The charts for FRM and 10T show: rates just before, at, and just after the 3 Fed Fund rate increases in December 2015, December 2016 and March 2017, together with rates on Thursday, April 20.

Fed Funds rate

Three increases since December 2015 have taken the rate from 0.25% to 1% – an increase of 0.75%.

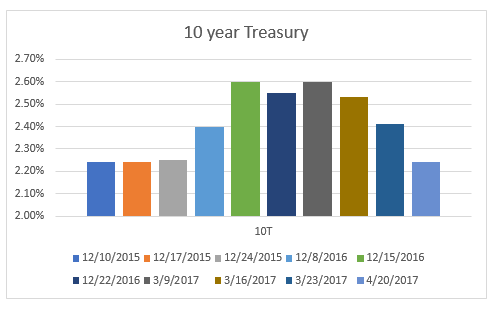

10 year Treasury

But the yield at 2.24% is exactly where it was when the Fed first increased rates in 2015.

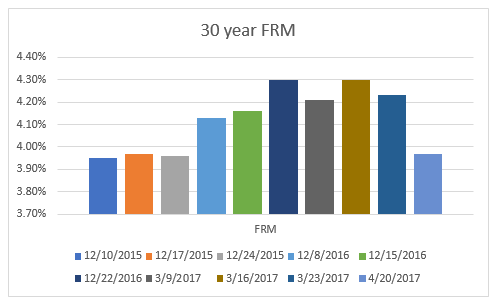

30 year FRM

The rate is also back to where it was in late 2015 before the first Fed Funds rate increase.

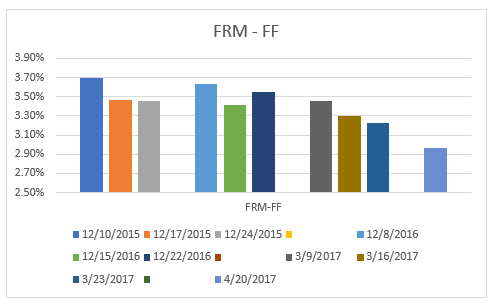

Is there a correlation between FRM and FF?

No!! The spread (difference between the two rates) has dropped from 3.70% to 2.97%.

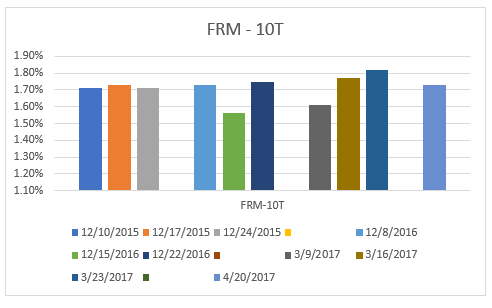

Is there a correlation between FRM and 10T?

Yes!! This spread has averaged right around 1.7% for the last 4 years.

So why has the yield on 10T dropped recently?

When the Republicans swept both Congress and the White House, markets believed that lower taxes and reduced regulation would combine to produce faster economic growth and higher inflation.

For years the only economic stimulus has come from monetary policy – keeping interest rates extremely low – because Congress was unable to agree on fiscal policy – such as tax cuts, infrastructure spending.

With the expectation of fiscal stimulus there was reduced need for the Federal Reserve to keep interest rates low and thus we have seen two rate increases since the Election.

But, almost 100 days into the new Administration, no fiscal measures have been introduced, let alone passed by a still divided Congress. Markets, which were willing to believe that economic growth could jump to 3-4% annually are now saying, well maybe it won’t be better than 2-2.5%. In other words, much the same as we have seen for the last several years.

At the end of this week we have had promises of health care reform and tax reform coming “very soon.” At this stage, the markets are saying “Show me.” Because the markets are saying “it’s complicated”.

How do I know what will happen to mortgage rates?

The key number to follow is the yield on the 10 year Treasury. That will tell you what the market is expecting to happen to the economy. From time to time it will also be affected by geopolitical factors – from Brexit last year to the French elections this weekend, to worries in Syria or North Korea. Geopolitical factors may cause buying of Treasuries, driving down the yield, and mortgage rates may not follow so closely. At those time the spread will tend to increase, but as geopolitical factors fade, that spread has for the last 4 years gravitated back to 1.7%.

Should I try to time my house purchase based upon my expectation for mortgage rates?

No! Mortgage rates, around or just under 4%, are historically cheap. The biggest factors to consider when buying a house are: do I want to move (or make my first purchase) and can I find a house that meets my needs and budgets.

According to the National Association of Realtors, sales in March increased 6% from a year ago and the median price increased 7%. Meanwhile, the number of homes for sale is 7% less than a year ago. Year on year inventory has fallen for 22 months in a row.

The biggest challenge for buyers is finding a suitable house to buy, not trying to time mortgage rates.

If you are looking to buy, I will contact you immediately when a house that meets your needs is available. In this market you need to have somebody looking after your interests.

Andrew Oliver is a Realtor with Harborside Sotheby’s International Realty. Each Office Is Independently Owned and Operated

Are you thinking about selling? Read Which broker should I choose to sell my house?

Please contact me on 617.834.8205 or Andrew.Oliver@SothebysRealty.com for a free market analysis and explanation of the outstanding marketing program I offer

@OliverReports