Why are mortgage rates rising?

As expected, the Federal Reserve (Fed) lowered its Fed Funds Rate (FF) this week by 0.25% to 2.0%.

What does this mean for mortgage rates and why are they rising?

Five charts explain the factors driving mortgage rates. In all cases the numbers are at the dates that the Fed has changed its FF over the last 4 years: 10 increases and more recently two decreases.

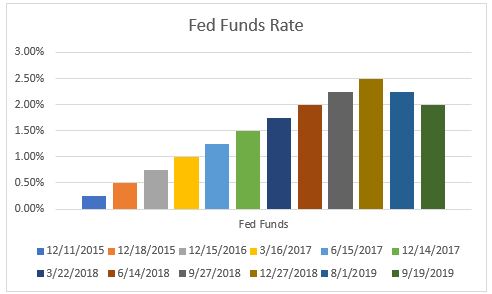

Fed Funds rate (FF)

The Fed Fund rate is the rate at which banks lend to each other overnight.

After increasing from 0% to 2.5% since late 2015, two recent cuts have lowered the rate to 2%.

30-year Fixed Rate Mortgage (FRM)

The FRM reached nearly 5% in late 2018 and declined to a low of 3.49% in early September, since when it has increased to 3.73%.

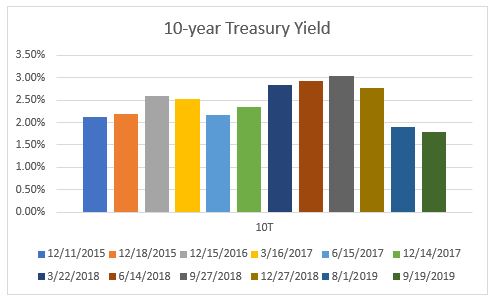

10-year Treasury yield (10T)

The yield on the 10T is influenced by two major factors: the outlook for the economy (expanding businesses invest creating demand for money) and geopolitical events – the US dollar and US Treasuries are seen as a safe haven during times of uncertainty.

After reaching 3.2% last November (which was the time of the peak in the FRM), the yield dropped under 1.5% in early September before recovering to 1.79%.

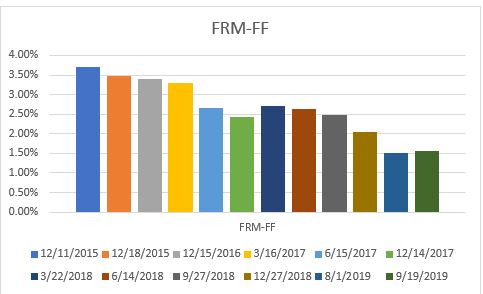

The spread, or difference, between FRM and FF

If there were a link between FF and FRM it would show up in this chart. In fact, the spread has dropped from 3.5% to 1.5%, demonstrating that there is no direct link between FF and FRM

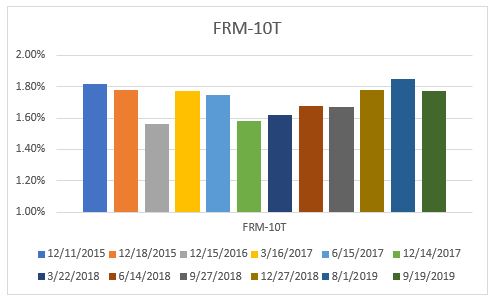

The spread, or difference, between FRM and 10T

We see more consistency between FRM and 10T, where the spread has been in a much tighter range of 1.5% to 1.8%. Indeed, over the last several years the spread has been very stable averaging around 1.7%

Comment

The FF rate affects the lending rate for credit cards, auto loans, adjustable rate mortgages, all of which are impacted by banks’ Prime Rate, which moves with the FF rate. Fixed Rate Mortgages – the typical 30-year mortgage, have a longer life and their benchmark is the closest Treasury security, which is the 10T. Conventional mortgages are bundled and sold to investors, who require a risk premium – higher yield – over that offered by 10T.

As can be seen, that premium – spread – has been remarkable constant over recent years. It does fluctuate from time to time – the yield on 10T tends to move quickly at times – but in recent years has always comes back to that 1.7% level.

The reason that mortgage rates have been rising of late, therefore, is that the yield on 10T has been rising.

A simple guide to the FRM rate, therefore, is to follow the yield on 10T and add 1.7%.

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReports.com

www.TeamHarborside.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated