Why mortgage rates may be headed upwards – finally

At my son’s wedding recently, his father-in-law said “I used to be a banker, but I’m better now.” In similar vein, I confess that I have a degree in economics from Oxford, although in self-defense I should add that the degree also included philosophy and politics. Or maybe that is not a defense.

As this blog is dedicated to helping people understand as much as possible about factors affecting real estate markets I write from time to time about mortgage rates. The key to understanding where mortgage rates are headed is to know that the price of the 30-year Fixed Rate Mortgage (FRM) is based on the yield on the US Government’s 10-year Treasury Note (10T) – and that yield is set by the bond market, not by the Federal Reserve.

Rather than explain this in more detail here I will link to two articles I have written in the recent past: Are mortgage rates going to 5%? and Why have Mortgage Rates dropped below 4%? and show two charts.

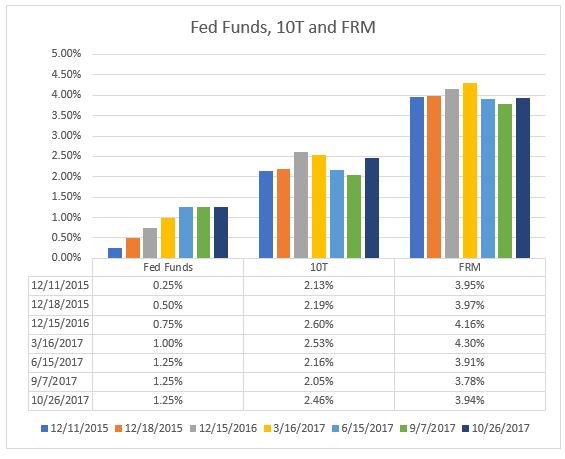

The first chart shows the course of rates over the last two years. The Fed Funds rate is the one announced by the Federal Reserve and affects short-term interest rates for items such as credit cards, auto loans and adjustable rate mortgages. Note that while the FF rate has moved up steadily, the yield on 10T spiked after the 2016 Election, trended down during the spring and summer months, and has recently moved up again. This chart clearly shows that there is no link between FF and FRM.

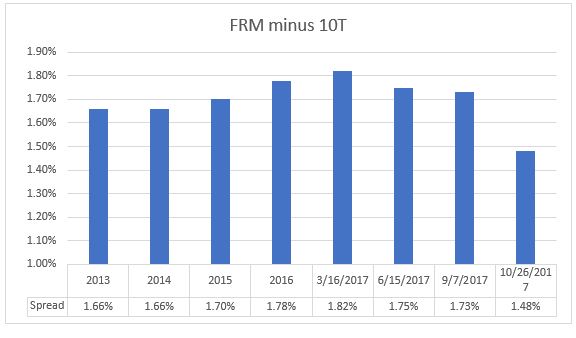

The second chart shows the difference between the 30-year Fixed Rate Mortgage and 10T. The numbers shown for 2013-2016 are averages for the entire years; the data for 2017 is the spread on those days. Note how consistent the spread has been at +/- 1.7%. And note that the current spread is below 1.5%, suggesting that the FRM is about to increase.

Why the FRM may rise in 2018

Behind all the political drama, the US economy does seem to have gathered strength in recent months, with back to back quarters showing 3% GDP growth. It seems likely that Congress will pass some measure of tax cuts and it appears that businesses have started to invest more. Inflation is below the Fed’s target but is also picking up, while unemployment, as officially measured, is extremely low. All these factors suggest that the yield on 10T may continue to increase and that in turn will lead to an increase in the FRM.

Why the FRM may not rise in 2018

In one word, Amazon. OK, I am exaggerating, but I remember some 20 years or so the famed economist, Brian Reading, explained to me why he believed inflation was no longer a threat in the US. He called it the Marshall’s effect – Never, Never, Never pay Full Price. Consumers learned to shop around and find the cheapest source – and, of course, the internet helped that process.

Back to Amazon. Recently, it bought Whole Foods and seemingly has plans to shake up the grocery market.What if Amazon decides to get into the health care market? Of is somebody else does. Disruption has occurred in many industries over the last decade – but not in health care, which represents nearly 20% of GDP.

All the focus in healthcare has been on extending coverage but much less focus has been on controlling costs. Maybe that will change.

But probably not in 2018, so at the moment it does seem likely that mortgage rates will follow the 10T and see an increase in 2018.

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact Andrew Oliver on 617.834.8205 or Kathleen Murphy on 603.498.6817.

If you are looking to buy, we will contact you immediately when a house that meets your needs is available. In this market you need to have somebody looking after your interests.

Are you thinking about selling? Read Which broker should I choose to sell my house?

Andrew Oliver and Kathleen Murphy are Realtors with Harborside Sotheby’s International Realty. Each Office Is Independently Owned and Operated

@OliverReports