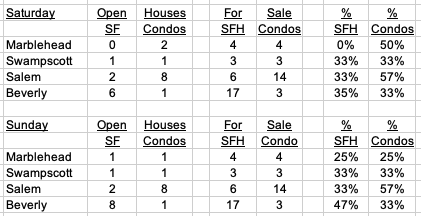

Open Houses weekend February 3/4

Here are this weekend’s Open Houses (an updated list for Sunday will be posted tomorrow at 8 a.m.*):

Click on these links for details:

Marblehead Open Houses

Swampscott Open Houses

Salem Open Houses

Beverly Open House

*becuase of the timing of the MLS feed, many of Sunday’s OHs do not show up in today’s links until later today and will be in tomorrow’s post

And these recent articles:

MARBLEHEAD 2023 MARKET REPORT and 5-YEAR REVIEW

SWAMPSCOTT 2023 MARKET REPORT and 5-YEAR REVIEW

SALEM 2023 MARKET REPORT and 5-YEAR REVIEW

ESSEX COUNTY 2023 MARKET REPORT and 5-YEAR REVIEW

How was MY assessment calculated? Q&A with Marblehead Assessor Karen Bertolino

My Marblehead Current article on Property Taxes

Marblehead FY 2024 Property Tax Explained

Why Mortgage Rates will fall in 2024

How a tax break of up to $3,200 can help heat your home more efficiently this winter

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

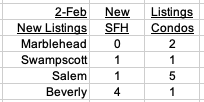

New Listings and Inventory week ending February 2

Just a few new listings this week:

Click on these links for details:

Marblehead New Listings

Swampscott New Listings

Salem New Listings

Beverly New Listings

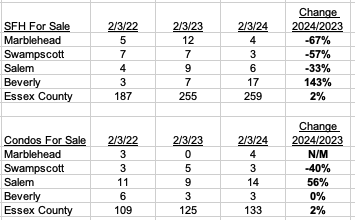

While latest inventory numbers generally in Essex County are similar to last year’s levels, the declines in 4 towns on the North Shore are dramatic:

And these recent articles:

MARBLEHEAD 2023 MARKET REPORT and 5-YEAR REVIEW

SWAMPSCOTT 2023 MARKET REPORT and 5-YEAR REVIEW

SALEM 2023 MARKET REPORT and 5-YEAR REVIEW

ESSEX COUNTY 2023 MARKET REPORT and 5-YEAR REVIEW

How was MY assessment calculated? Q&A with Marblehead Assessor Karen Bertolino

My Marblehead Current article on Property Taxes

Marblehead FY 2024 Property Tax Explained

Why Mortgage Rates will fall in 2024

How a tax break of up to $3,200 can help heat your home more efficiently this winter

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

How was MY assessment calculated? Q&A with Marblehead Assessor Karen Bertolino

This is the thrid part in my series about the property tax assessment process. Links to the first two parts are included at the end of this 9 question Q&A.

Q. How is my property assessed each year?

A. All property is valued every year and is based on calendar year market sales in Marblehead. Fiscal Year 2024 began July 1, 2023, and is based on what existed January 1, 2023, so the preceding calendar year 2022 primarily is used for the basis of valuations.

Assessed values are based on fair market value using arm’s length sales in 2022. Our analysis does not use any foreclosures, short sales, family, estate, or private sales.

Components of an arm’s length transaction are a willing buyer and seller, who are unrelated, acting in their own best interest, neither under undue influence, the property is for sale in the open marketplace and the price represents the nominal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

Every sale is reviewed to ensure that it is an arm’s length transaction by reviewing deeds, speaking with realtors and brokers knowledgeable about the sale, reviewing Multiple Listing Service (MLS), sale questionnaires and site inspections. Every year the Town Assessor is out in the field to observe changes in neighborhood conditions, trends and property characteristics.

The DOR criteria states that valuations must be between 90%-110% of fair market value. The Board of Assessors values close to 100% of fair market value depending on what is happening in the marketplace.

Additionally, appraising and assessing are based on the same principles and procedures of valuation with 2 distinct differences: number of homes viewed and market timeframe.

For example, if you hired an appraiser to value your home on July 1, 2023, they will compare your home to 3 to 6 properties that ideally sold on your street, if not in your neighborhood, if not in a similar neighborhood in town using current market sales. The comparable homes will be adjusted (grade, square footage, etc.) to arrive at an opinion of value for your home.

In Assessment, we are looking at all the single-family homes (condo’s, etc.) that sold in a past market, which in FY2024 is calendar year 2022. A statistical analysis of this data is performed by breaking it into sub-groups (gross living area, neighborhood, sales price, etc.) and then applied to market sales using the DOR criteria mentioned above.

Q. Are there different districts in town and do they have different values attributed to them?

A. Location is one of the biggest factors that impacts market value. Neighborhood codes are based on where your property is in town and take into consideration attributes such as style, age, etc. According to the Dictionary of Real Estate Appraisal, a neighborhood is, “A group of complementary land uses; a congruous grouping of inhabitants, buildings, or business enterprises.” Adjustments are made to the neighborhoods and properties as the marketplace dictates.

Q. Why has my assessment gone up so much while others have seen smaller increases? (more…)

Recent Comments