ESSEX COUNTY 2023 MARKET REPORT and 5-YEAR REVIEW

Go HERE to download a pdf of this report

Median Price and Sales

The median price of the Single Family homes (SFH) sold in Essex County increased 44% from $475,000 in 2019 to $684,000 in 2023. Sales declined slightly from 2019 to 2021, but dropped sharply in 2022, and again in 2023, when they were almost 40% lower than in 2019.

The median price of the Condos sold increased by 40% from $320,000 in 2019 to $446,500 in 2023. Sales followed a similar pattern to that for SFHs, declining 30% from 2019 to 2023.

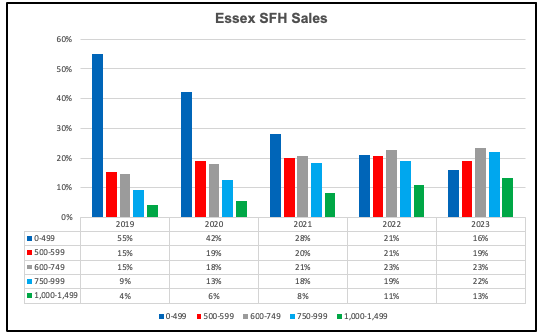

Single Family Sales by Price

Another way to look at sales is the distribution by price. In 2019, 55% of SFH sales were under $500,000, and by 2022 that had dropped to just 16%. Conversely, the share of sales over $750,000 went from 13% to 35% in the same period.

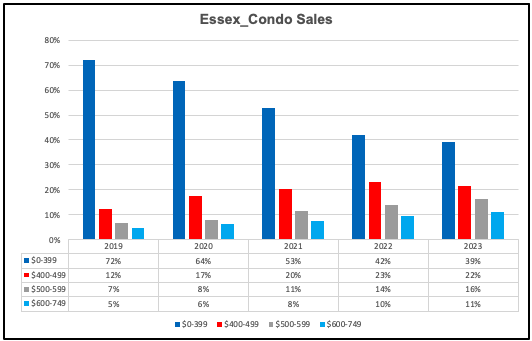

Condo Sales by Price

The share of sales under $400,000 dropped from 72% in 2019 to 39% in 2023, while the share over $500,000 more than doubled, from 12% to 27%, in the same period.

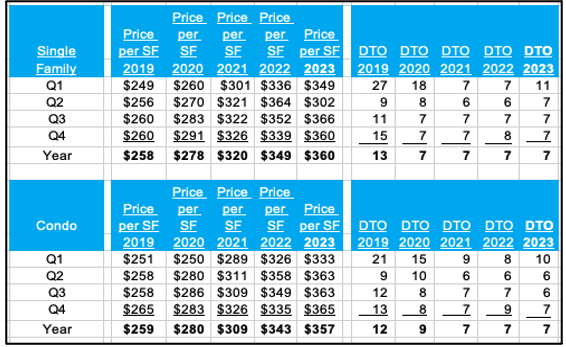

Price per Sq Ft (PSF) and Speed of Sales (Days to Offer Accepted – DTO)

PSF is another way to look at sales. For SFHs the increase was 40% (in line with the median price increase) from $256 in 2019 to $360 in 2023; for Condos 38% from $248 to $357. Note the similarity in PSF for both SFHs and Condos.

Since the start of the pandemic, sales have been very quick, with 7 days until an offer was accepted (Days To Offer) the norm for both SFHs and Condos. There was no slowdown in 2023, despite the sharp jump in mortgage rates.

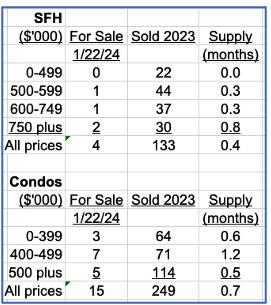

CURRENT INVENTORY

A market is traditionally deemed to be in equilibrium between buyers and sellers when there is 6 months of supply. Throughput 2023 inventory was at extremely low levels in Essex County, explaining the rapid pace of sales in 2023 despite the huge jump in mortgage rates – which in turn kept inventory low, as homeowners were reluctant to give up their low-cost mortgages.

The beginning of the year always sees very low inventory levels – see the next chart – but there are towns in Essex County with single digit inventory numbers at the start of 2024.

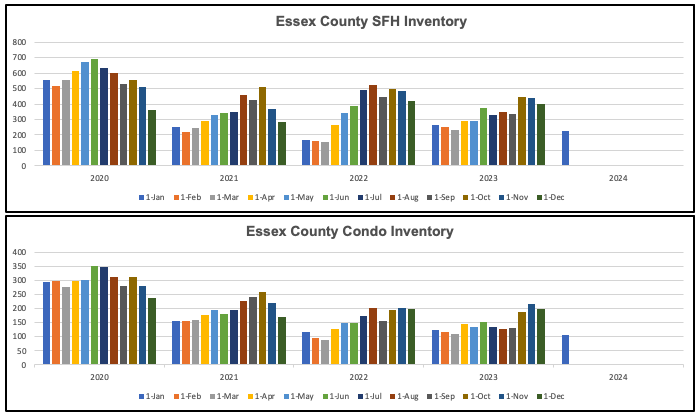

RECENT INVENTORY

While inventory levels have fluctuated, the overall trend since late 2020 has been downwards.

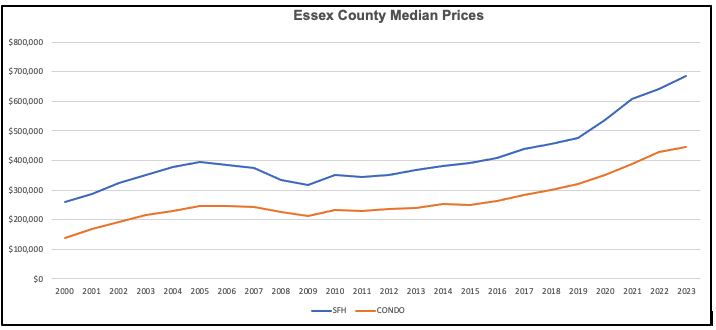

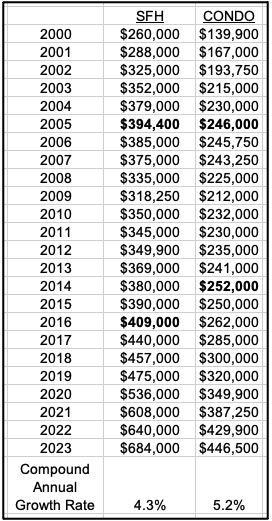

LONGER TERM VIEW.

Massachusetts did not experience the boom of the early 2000s to the extent that some other parts of the country did; did not suffer the same severe drops in the Great Recession; and also saw more modest – but still substantial – increases in the post-COVID, easy money period.

Over the whole of this century, the compound annual growth rate has been just over 4% for SFHs and just over 5% for Condos.

Andrew Oliver. m. 617.834.8205

Andrew@TeamHarborside.com

www.OliverReportsMA.com

www.OliverReportsFL.com