Are we already in a Recession?

In January this year I published an article asking Can the Federal Reserve prevent a Recession?

My question now is: Are we already in a Recession?

I think the answer is yes. Here is the evidence, in three charts:

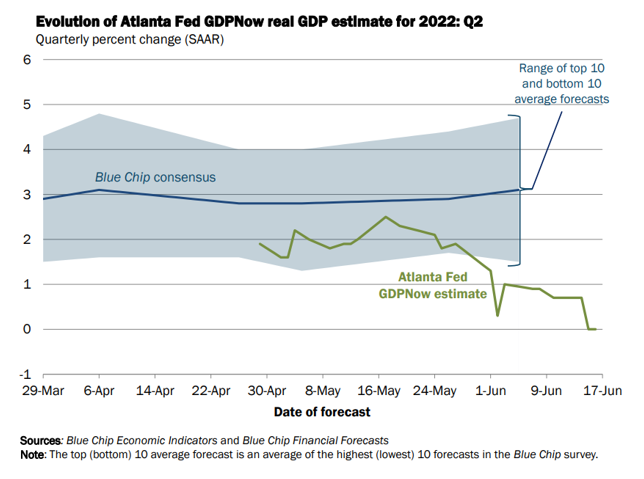

GDP growth

Atlanta Fed’s Q2 GDP estimate showing the progress of their forecast – a month ago the forecast was for 2% growth, as of this week it is 0% (and bear in mind GDP declined 1.5% in Q1)

Consumer Confidence (from The Conference Board, published May 31, before the latest CPI number and Fed Funds rate increase):

The report included these comments: “Meanwhile, purchasing intentions for cars, homes, major appliances, and more all cooled—likely a reflection of rising interest rates and consumers pivoting from big-ticket items to spending on services. Vacation plans have also softened due to rising prices. Indeed, inflation remains top of mind for consumers, with their inflation expectations in May virtually unchanged from April’s elevated levels. Looking ahead, expect surging prices and additional interest rate hikes to pose continued downside risks to consumer spending this year.” And this was before the CPI announcement on June 10th.

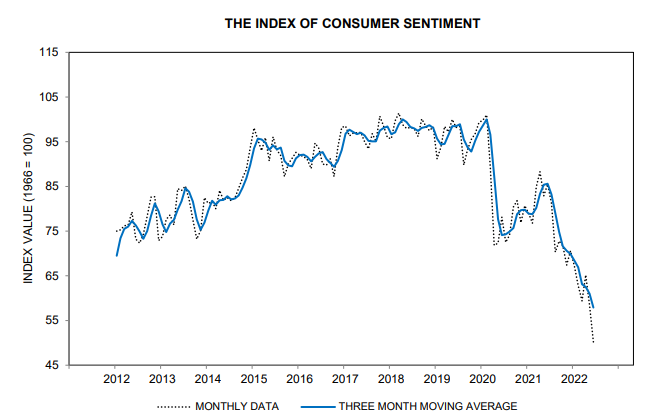

Consumer Sentiment (University of Michigan, preliminary report published June 10):

The statement accompanying this report read: “Consumer sentiment declined by 14% from May, continuing a downward trend over the last year and reaching its lowest recorded value, comparable to the trough reached in the middle of the 1980 recession. All components of the sentiment index fell this month, with the steepest decline in the year-ahead outlook in business conditions, down 24% from May. Consumers’ assessments of their personal financial situation worsened about 20%. Forty-six percent of consumers attributed their negative views to inflation, up from 38% in May; this share has only been exceeded once since 1981, during the Great Recession.”

Comment

It will be several weeks before we get preliminary and then final GDP numbers for Q2. But to me it does not matter whether we end up being technically in or technically just missing a recession in early 2022, because it certainly has the feel of a recession. Just as in recent years the headlines have been about the stock market and housing market hitting new highs, so today’s headlines are about gas prices and grocery prices doing the same. And increasingly, about corporate lay-offs (see Wave of layoffs sweeping the US ).

The big unknown is whether – or by how much – consumers will pull back in response to both higher prices and the talk of recession. Fear of a recession can actually cause a recession if consumers adjust their behaviour. The best outcome might be a sharp pullback in activity, which means that the correction will be short-lived. The worst outcome would be a gradual slowdown coupled with a continued gradual approach by the Fed to raising rates.

And read these recent articles:

Federal Reserve in Fantasyland: Implications for Housing Market

How far Behind the Curve is the Federal Reserve?

How quickly are houses selling?

Have Home Sales slowed?

June Housing Inventory: still way below 2020 levels.

Time to Consider an Adjustable Rate Mortgage

The Federal Reserve and Mortgage Rates

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205