New Listings week ending May 20

There is a bounce in New Listings this week:

Click on these links for details: (more…)

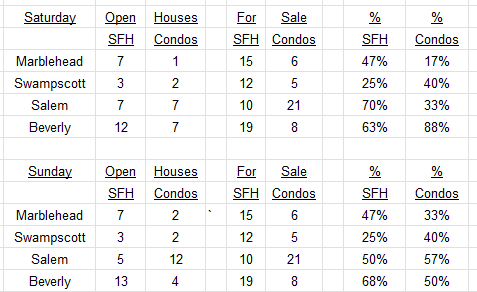

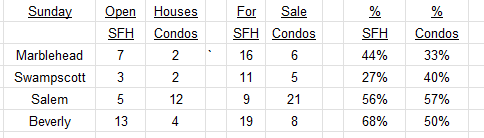

Open Houses weekend May 14/15

Here are this weekend’s Open Houses (an updated list will be published tomorrow at 8 a.m.):

Click on these links for details: (more…)

Marblehead Neck Oceanfront New Listing

It has been 9 months since the last oceanfront house on Ocean Avenue sold and now comes this Wonderful opportunity to enjoy Marblehead living at its finest.

This spacious and gracious home sits on a bluff with sweeping views directly out over the ocean. Built in 1920, the home retains much of its original charm, period details and architectural elegance, yet offers many recent updates providing for luxurious living for today’s discriminating buyer.

Experience the breathtaking vistas and sounds of the sea with spectacular views from almost every room. The tastefully landscaped grounds feature an acre+ of rolling lawns and beautiful gardens leading to your own private gate allowing direct access to the rocks, ocean and beach.

The home offers plenty of space including 4 bedrooms with en-suite baths including a stunning master with luxurious spa-like bath and amazing views. Located in Marblehead – a unique town that embraces community and sea-side living.

Click here for full details and photos.

Please call me on 617.834.8205 to arrange a private showing.

And read these recent articles:

Why This Housing Market Is Not a Bubble Ready To Pop

Why are Mortgage Rates so high?

The Federal Reserve and Mortgage Rates

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________________

Andrew Oliver, M.B.E.,M.B.A.

Real Estate Advisor| Market Analyst | The Feins Group | thefeinsgroup.com

m.617.834.8205

www.OliverReportsFL.com

Andrew.Oliver@Compass.com

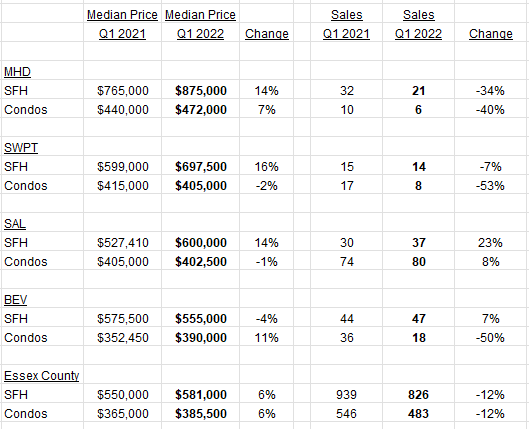

Flash First Quarter 2022 Numbers

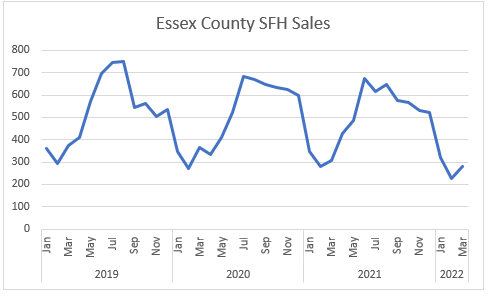

The shortage of inventory is reflected in these Q1 numbers:

As always, small numbers need to be treated with caution. This chart shows the cyclicality of sales in New England:

Marblehead’s disappearing Inventory

For some time I have been publishing charts showing inventory in recent years, but this one goes back to 2010 on this date.

There are some 6,300 SFHs in Marblehead and currently just 2 of them are available for sale. It is hard to imagine a better time if you need to sell.

And read these recent articles:

Is Real Estate seasonal?

Federal Reserve: “Make me responsible…. but not yet”

Earth to Federal Reserve: What are you waiting for?

February Inventory – Marco? Marco? Where are you?

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 .

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of Oliver Reports . He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Sale, Beverly, Lynn and Swampscott.”

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m. 617.834.8205

www.OliverReportsMA.com

————————–

Andrew Oliver

Sales Associate | Market Analyst | DomainRealty.com

REALTOR®

Naples, Bonita Springs and Fort Myers

m. 617.834.8205

www.MarbleheadSouth.com

www.OliverReportsFL.com

How Marblehead’s 2022 Property Tax Rate is calculated

The formula for calculating the property tax is actually very simple: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt. – to produce the total Tax Levy.

Here are the numbers for Fiscal Years 2021 and 2022, remembering that FY 2022 runs from July 2021 to June 2022. (more…)

Old North Festival Holiday Concerts THIS WEEKEND

While Covid-19 has again interrupted our traditional Festival Chorus Holiday Concert plans, we press on and adapt!

After last year’s forced absence, the Old North Festival Holiday Concerts return in modified form during this year’s Christmas Walk, on Saturday, December 4th at 8 p.m., and Sunday, December 5th at 7:30 p.m. Maria vanKalken, Minister of Music at Old North Church, celebrates her 33rd season as Director of the Festival Chorus – despite a recent fall and damage to her head and shoulder.

This year’s Concerts will feature the Festival Orchestra, and Soloists: Holly Cameron, soprano; Gabriela Fagen, mezzo-soprano; Kevin Hayden, tenor; Daniel Fridley, bass; and Michael Galvin, bass, in seasonal works for solo voices by J.S. Bach, Purcell, Handel and Mendelssohn, together with the Old North Bell Choir under the leadership of Liz Smith

While the Chorus will have to wait until next year to perform again, we will be able to enjoy the concerts as audience members, and will greatly enjoy singing the carols along with the audience!

The concerts will have a reduced capacity and last 75 minutes with no intermission. Proof of vaccination will be required for admission and properly-fitted masks must be worn at all times in the Church.

Tickets are available at Arnould Gallery and Crosby’s Marketplace; or online at onchurch.org/festivalchorus and, with seating limited, should be purchased in advance. Further information can be obtained by calling 781.608.2782.

The format may be different this year, but all involved – orchestra, soloists and audience – will rejoice in being able to make music together again!

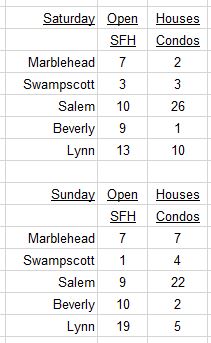

Open Houses weekend November 6/7

Here are the Open Houses this weekend. Because of the quirks of MLS properties with OH’s both days do not show up in both days’ lists but do if you click on the individual properties. I will publish the updated list for Sunday tomorrow at 8 a.m.

Click on these links for details: (more…)

How accurate are Zillow’s Zestimates?

During the pandemic-spurred housing boom, Zillow Offers emerged as a particularly aggressive iBuyer, or instant buyer, of homes in Sun Belt markets, offering homeowners more than the market value of their properties, with no catch. Zillow has now conceded that it has been paying too much for properties, even in a market characterized by soaring home values. Saying it had lost $1 billion on iBuying, Zillow has shut down its Zillow Offers unit.

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility,” Chief Executive Rich Barton said.

Zillow used an algorithm to make home price estimates, called the “Zestimate,” and determine what it would pay home sellers.

Are Zestimates accurate?

Zestimates are somewhat like the National Hurricane Center’s projection for a hurricane’s path: both provide a single price or point, but those prices and points are actually the median of a range.

Here’s an example for a house: (more…)

Support the Fort (Sewall)

Preserving Fort Sewall – A Centennial Campaign Established in 1644, Marblehead’s Fort Sewall is one of the oldest English coastal fortifications in the United States, and is the second most visited spot in town according to surveys, with over 50,000 annual visits by residents and visitors. Known for many years as the Marblehead Fort or the Fort on Gale’s Head, it was renamed in 1800 to honor Marblehead’s Samuel Sewall, Massachusetts Supreme Judicial Court’s Chief Justice.

The Fort’s greatest historical moment was probably Sunday April 3, 1814 when the U.S.S. Constitution, being chased by two British frigates, escaped into Marblehead Harbor under the protection of the fort’s guns. Two Marblehead crewmen piloted the Constitution between Marblehead Rock and Marblehead Neck – thus escaping the British warships that lacked charts for the harbor’s underwater rock outcroppings. (more…)

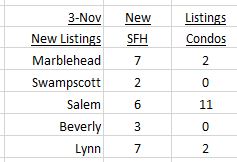

Mid-week New Listings and Inventory Update

Here are the latest New Listings (a link to my report on the current state of inventory is shown later in this article):

Click these links for details: (more…)

Latest Housing Inventory

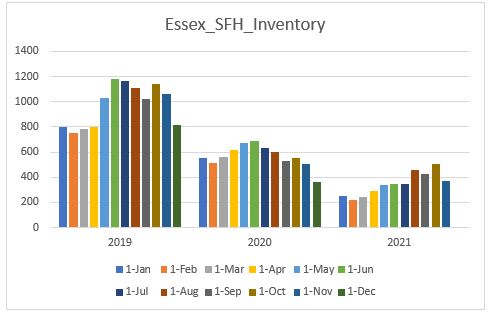

After increasing somewhat – albeit from a very low base – during 2021, the seasonal drop-off in late October has been just as sharp as in prior years – and again this is a reduction from a low level.

Single Family Homes

The November 1st SFH inventory number of 370 was a decline of 27% from 2020 and 65% compared with 2019:

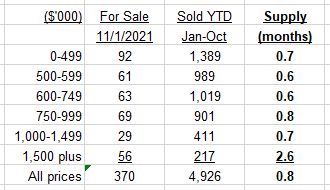

Inventory now has less than 1 months’ supply overall and is only over 1 month – but still far below the 6 months deemed to reflect a market in equilibrium – at prices over $1.5 million.

Condos (more…)

Marblehead architect’s ‘Walking Man’ survives nor’easter

Architect Tom Saltsman endured battering winds and rain during the recent Nor’easter to protect and secure his latest Halloween installation outside his home at 32 Pleasant Street. “The Walking Man” is an 18-foot-tall ghost of an elderly, skeletal man, captured in a moment of motion and representing a year of loss.

“The Walking Man” is notably different from Saltsman’s more whimsical creations over the years. “This is about self-reflection for our family, and the people we’ve lost over the past year,” he said.

Courtesy photo/Tom Saltsman

A town tradition (more…)

Marblehead’s Rapid Recovery Plan

Over the last several months, the Town of Marblehead has participated in the Massachusetts Local Rapid Recovery Plan (LRRP) Program to help support business owners and community members by developing recovery plans for local business districts. In Marblehead, Downtown Marblehead and the B1 District (Atlantic & Pleasant St) have been the focus of our work. This recovery plan has been developed in coordination with the local government, and informed through stakeholder interviews, a public forum, and surveys, and is customized to the individual economic challenges and COVID-19 related impacts in Marblehead. It includes a data analysis as well as an exploration of challenges, barriers, strategies, and actions.

The Town has scheduled a public forum to review the LRRP Final Report and its recommendations on Monday, October 25 at 11am. We hope you’ll join us to view the recommendations of the final report and ask questions or offer comments on the report.

You can view the LRRP report in advance of the forum here (more…)

Recent Comments