Marblehead’s 2025 Property Tax Explained

Marblehead’s property tax rate for Fiscal Year 2025 (July 1, 2024- June 30, 2025) has been set at $9.05, slightly up from $8.96 in FY 2024.

The formula for calculating the property tax is: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt – to produce the total Tax Levy.

The tax rate is then calculated by dividing the Tax Levy by the Assessed Value of property – and, crucially, that calculation is based upon prices as of January 1, 2024, using date from sales in calendar year 2023. What that means is that 2024 sales are used for the calculation of the tax rate in FY2026 – not FY2025.

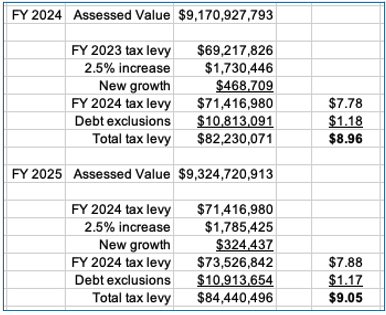

Here are the numbers for Fiscal Years 2024 and 2025, remembering that FY 2025 runs from July 2024 to June 2025:

The Tax Levy calculation

The dollar amount raised by the property tax will increase year by year. That is because of the formula: last year’s number plus 2.5% plus new growth. In the table above you can see how the FY 2024 tax levy of $71,416,980 becomes the base for FY 2025. Add $1,785,425 for Prop 2.5% and $324,437 for new growth and the new figure is $73,526,842. To this number is added the debt service of $10,913,654 – to give a total amount to be raised of $84,440,496.

The Tax Rate (more…)

Property Tax reports mentioned at Town Meeting

These are the reports Board of Assessors Chair John Kelley mentioned at Town Meeting this week:

marbleheads-property-tax-explained/

answers-to-frequently-asked-tax-rate-questions/

How was MY assessment calculated? Q&A with Marblehead Assessor Karen Bertolino

And read these recent articles:

Marblehead Q1 2024 Market Summary

Swampscott Q1 2024 Market Summary

Salem Q1 2024 Market Summary

Essex County Q1 2024 Market Summary

Why Mortgage Rates will fall in 2024

How a tax break of up to $3,200 can help heat your home more efficiently this winter

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those l</p

How was MY assessment calculated? Q&A with Marblehead Assessor Karen Bertolino

This is the thrid part in my series about the property tax assessment process. Links to the first two parts are included at the end of this 9 question Q&A.

Q. How is my property assessed each year?

A. All property is valued every year and is based on calendar year market sales in Marblehead. Fiscal Year 2024 began July 1, 2023, and is based on what existed January 1, 2023, so the preceding calendar year 2022 primarily is used for the basis of valuations.

Assessed values are based on fair market value using arm’s length sales in 2022. Our analysis does not use any foreclosures, short sales, family, estate, or private sales.

Components of an arm’s length transaction are a willing buyer and seller, who are unrelated, acting in their own best interest, neither under undue influence, the property is for sale in the open marketplace and the price represents the nominal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

Every sale is reviewed to ensure that it is an arm’s length transaction by reviewing deeds, speaking with realtors and brokers knowledgeable about the sale, reviewing Multiple Listing Service (MLS), sale questionnaires and site inspections. Every year the Town Assessor is out in the field to observe changes in neighborhood conditions, trends and property characteristics.

The DOR criteria states that valuations must be between 90%-110% of fair market value. The Board of Assessors values close to 100% of fair market value depending on what is happening in the marketplace.

Additionally, appraising and assessing are based on the same principles and procedures of valuation with 2 distinct differences: number of homes viewed and market timeframe.

For example, if you hired an appraiser to value your home on July 1, 2023, they will compare your home to 3 to 6 properties that ideally sold on your street, if not in your neighborhood, if not in a similar neighborhood in town using current market sales. The comparable homes will be adjusted (grade, square footage, etc.) to arrive at an opinion of value for your home.

In Assessment, we are looking at all the single-family homes (condo’s, etc.) that sold in a past market, which in FY2024 is calendar year 2022. A statistical analysis of this data is performed by breaking it into sub-groups (gross living area, neighborhood, sales price, etc.) and then applied to market sales using the DOR criteria mentioned above.

Q. Are there different districts in town and do they have different values attributed to them?

A. Location is one of the biggest factors that impacts market value. Neighborhood codes are based on where your property is in town and take into consideration attributes such as style, age, etc. According to the Dictionary of Real Estate Appraisal, a neighborhood is, “A group of complementary land uses; a congruous grouping of inhabitants, buildings, or business enterprises.” Adjustments are made to the neighborhoods and properties as the marketplace dictates.

Q. Why has my assessment gone up so much while others have seen smaller increases? (more…)

My Marblehead Current article on Property Taxes

Here are links to the two parts of my recent article explaining how property taxes are calcuated:

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205

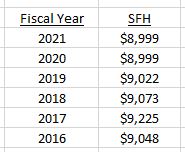

Marblehead FY 2024 Property Tax Explained

Marblehead’s property tax rate for FY 2024 (July 1, 2023- June 30, 2024) has been set at $8.96, down from $10.00 in FY 2023 following a dramatic 16% increase in Assessed Values.

The formula for calculating the property tax is: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt – to produce the total Tax Levy.

The tax rate is then calculated by dividing the Tax Levy by the Assessed Value of property – and, crucially, that calculation is based upon prices as of January 1, 2023, using date from sales in calendar year 2022. What that means is that 2023 sales are used for the calculation of the tax rate in FY2025 – not FY2024.

Here are the numbers for Fiscal Years 2023 and 2024, remembering that FY 2024 runs from July 2023 to June 2024.

The Tax Levy calculationThe dollar amount raised by the property tax will increase year by year. That is because of the formula: last year’s number plus 2.5% plus new growth. In the table above you can see how the FY 2023 tax levy of $69,217,826 becomes the base for FY 2024. Add $1,730,446 for Prop 2.5% and $468,709 for new growth and the new figure is $71,416,980 . To this number is added the debt service of $10,813,091 – to give a total amount to be raised of $82,230,071..

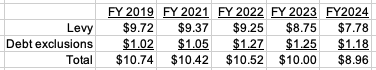

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, commercial and personal. The tax rate is calculated by dividing the total dollar amount to be raised by the total Assessed Value of all property. Thus, while the $ amount raised by the tax (and therefore the median tax bill) will increase each year, the headline tax rate will fluctuate depending upon the direction of Assessed Values.

In simplistic terms, the $ amount raised before debt service will increase by a little more than 2 1/2% each year, so if the median Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. One additional factor is the cost of debt service.

In FY 2023 the tax rate was $10.00, achieved by dividing the $79.1 million to be raised by the $7.9 billion of Assessed Value. And in FY 2024 the calculation is $82.2 million divided by $9.2 billion, which produces a rate of $8.96. The median tax bill, based on the higher Assessed Values, will increase by $244 or 3%, to $8,318.

Note that the calculation of the tax rate is made simpler by the fact that Marblehead’s Select Board votes each year to have a single tax rate for both residential and commercial property. In towns which elect to have a differential rate – i.e. by taxing commercial property at a higher rate than residential – there are generally two different tax rates, achieved by dividing the amount to be raised from residential and commercial taxpayers by their respective aggregate Assessed Values.

How does debt service affect the tax rate?

The announced property tax rate announced each year also includes the cost of debt service:

What is the outlook for FY 2025?

In 2023, the year that is the basis for the FY 2025 property tax calculation, the median MLS SFH sale price through December 16 was $987,000, an increase of 4% from 2023’s $938,000. This suggests that the actual tax rate should be flat or show perhaps a slight decline for FY2025, but we will get a clearer idea after the town publishes its budget next February .

Read these recent reports: Why Mortgage Rates will fall in 2024

How a tax break of up to $3,200 can help heat your home more efficiently this winter

Conventional Mortgage Loan Limits increased for 2024

INFLATION and RECESSION UPDATE

Most Sales Still Over List Price

Core Inflation Prices Barely Budged in August

MARBLEHEAD Q3 MARKET REPORT 2019-2023

SWAMPSCOTT Q3 MARKET REPORT 2019-2023 SALEM Q3 MARKET REPORT 2019-2023

ESSEX COUNTY Q3 2023 MARKET REPORT

(more…)

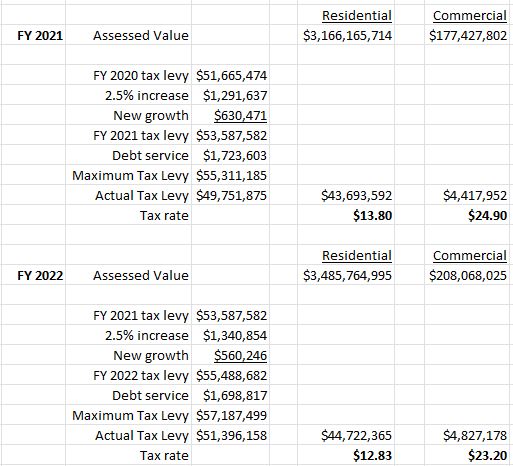

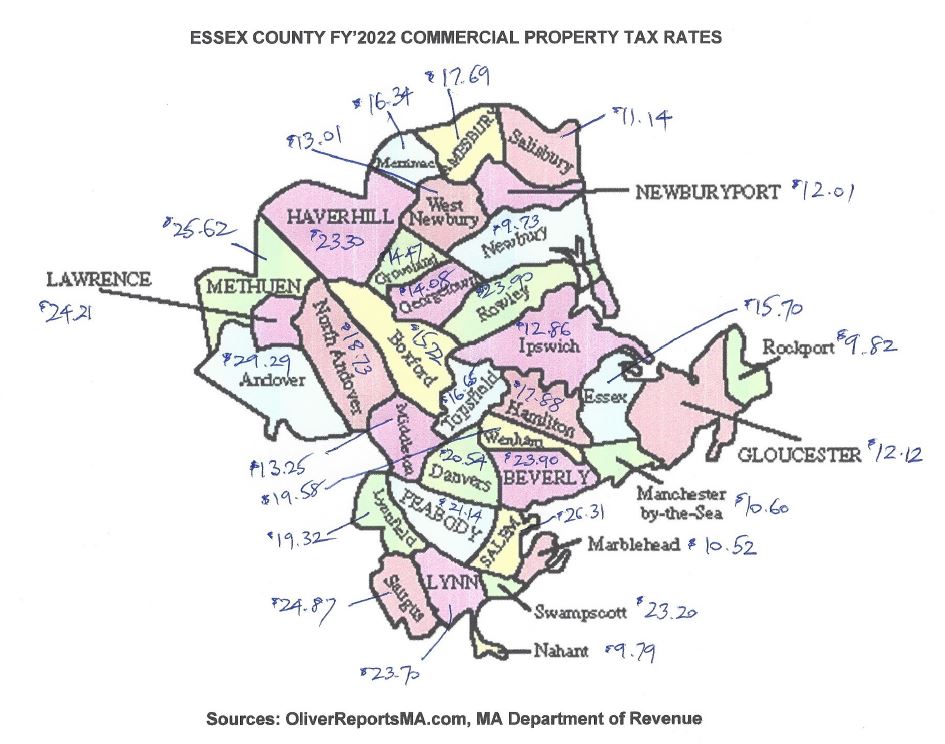

How Swampscott’s FY2022 Property Tax is Calculated

Swampscott’s residential tax rate will drop from $13.80 in Fiscal Year 2021 to $12.83 in FY 2022 (and down from a high of $18.84 in FY 2013). The FY 2022 rate will be the lowest since 2006.

Commercial and industrial property is surcharged at 170%, as in FY 2021, resulting in a tax rate of $23.20, down from $24.90 in FY 2021 (and a high of $35.02 in FY 2013).

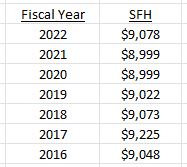

The average SFH tax bill has been flat in recent years:

“Every year since 2017, Swampscott’s average, single-family home tax bill has dropped or stayed level – and that’s unique, exceptional,” said Town Administrator Sean Fitzgerald. “You won’t be able to find another community in the commonwealth that has spent as much time really trying to find balance and stability. Many peer communities have increased their taxes every year over the past four years.”

How is the rate calculated?

The method of calculating the tax rate is quite simple: take the $ amount of the previous year’s tax levy, add 2.5% for Proposition 2 1/2, and also add any new growth (such as new construction or a condo conversion). This figure is the new maximum tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt.

Note that in recent years, Swampscott has not assessed the maximum allowed under this formula, a decision that has reduced the tax bill for residents.

Here are the numbers for FY 2021 and FY 2022, remembering that the FY 2022 runs from July 2021 to June 2022.

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, and commercial, industrial and personal (CIP). The tax rate is calculated by dividing the total dollar amount to be raised from each class by the Assessed Value of each class. Thus, the headline tax rate will also fluctuate depending upon the direction of Assessed Values.

In simplistic terms, if we assume that the $ amount to be raised increases by a little more than 2 1/2% each year, then if the average Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. In recent years Assessed Values have been increasing significantly more than 2 1/2% allowing for the tax rate to decline sharply.

Looking at the Swampscott residential tax rate, in FY 2021 it was $13.80, achieved by dividing $43.7 million raised from residential homeowners by the residential AV of $3.2 billion. In FY 2022 the amount to be raised from residential taxpayers is set to increase slightly to $44.7 million, but because the total residential AV increased by 10% to $3.5 billion, the headline tax rate has dropped to $13.20, the lowest figure since 2006.

Comment

The residential real estate market in Swampscott was stable in 2020 (and 2020 prices are the basis for the FY 2022 tax rate), with the median price of Single Family Homes sold rising by 2.1%. Sales in any year represent only a small percentage of the total stock so it does not follow that assessed values calculated by the town will mirror these movements.

As to the tax rate for FY 2023, 2022 ( the basis for FY 2021) is a different story with the median Single Family price increasing 16% in the first half of the year. The actual rate will depend on a number of factors: the amount of debt service, how much of the maximum tax levy is assessed, and the shift to the CIP class being three of them. But unless there is a dramatic change in the market in the second half of 2021 the likelihood is that the actual tax rate will decline significantly in FY2023.

From a residential real estate perspective, the substantial decline in the tax rate in recent years and the stability in tax bills are both very welcome news and are clearly encouraging more people to decide both to live and work in Swampscott.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver

REALTOR® | Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

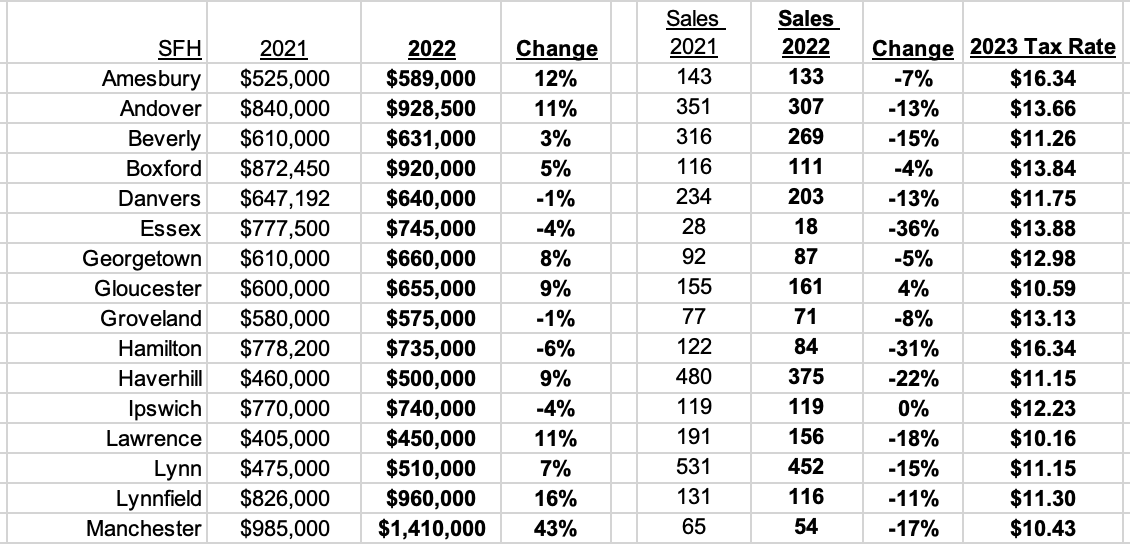

Essex County Town by Town Guide: 2022 Median Prices and Sales; 2023 Tax Rates

Here is a town-by-town guide to 2022 Median Prices and Sales, together with 2023 property tax rates.

Read February Inventory as low as this weekend’s temperature

And these recent articles:

Economic and mortgage commentary

How Marblehead’s 2023 Property Tax Rate is Calculated

Essex County 2023 Property Tax Rates: Town by Town guide

Lies, Damned Lies and Inflation “Statistics”* (more…)

Essex County 2023 Property Tax Rates: Town by Town guide

Property tax rates for FY 2022 for all 34 cities and towns in Essex County have been certified. The first table shows the tax rates in alphabetical order, while the second lists them from low to high.

Tax rates for each town

Alphabetically (download a copy of this table by clicking here) (more…)

How Marblehead’s 2023 Property Tax Rate is Calculated

The formula for calculating the property tax is: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt. – to produce the total Tax Levy.

The tax rate is then calculated by dividing the Tax Levy by the Assessed Value of property – and, crucially, that calculation is based upon prices as of January 1, 2022, using date from sales in calendar year 2021. What that means is that 2022 sales are used for the calculation of the tax rate in FY2024 – not FY2023.

Here are the numbers for Fiscal Years 2022 and 2023, remembering that FY 2023 runs from July 2022 to June 2023. (more…)

Marblehead 2023 Property Tax Rate

The 2023 Property Tax rate of $10.00, for both residential and commercial property, has been approved by the Massachusetts Department of Revenue.This compares with a rate of $10.52 for 2022 but, with assessments climbing, tax bills will -as usual – be going up.

I will publish my usual breakdown, showing how the tax rate is calculated, next week.

And these recent articles:

Economic and mortgage commentary

Why Mortgage Rates Will Fall (more…)

How Marblehead’s 2022 Property Tax Rate is calculated

The formula for calculating the property tax is actually very simple: take the $ amount of the previous year’s Tax Levy, add 2.5% for Proposition 2 1/2, and also add any New Growth (such as new construction or a condo conversion). This figure is the new tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt. – to produce the total Tax Levy.

Here are the numbers for Fiscal Years 2021 and 2022, remembering that FY 2022 runs from July 2021 to June 2022. (more…)

Essex County 2022 Property Tax Rates: Town by Town guide

Property tax rates for FY 2022 for all 34 cities and towns in Essex County have been certified. Below is a map, so that you can compare tax rates in neighboring towns, followed by the tax rates for each town the last 5 years. The first table shows the tax rates in alphabetical order, while the second lists them from low to high.

Tax rates for each town

Alphabetically (download a copy of this table by clicking here. (more…)

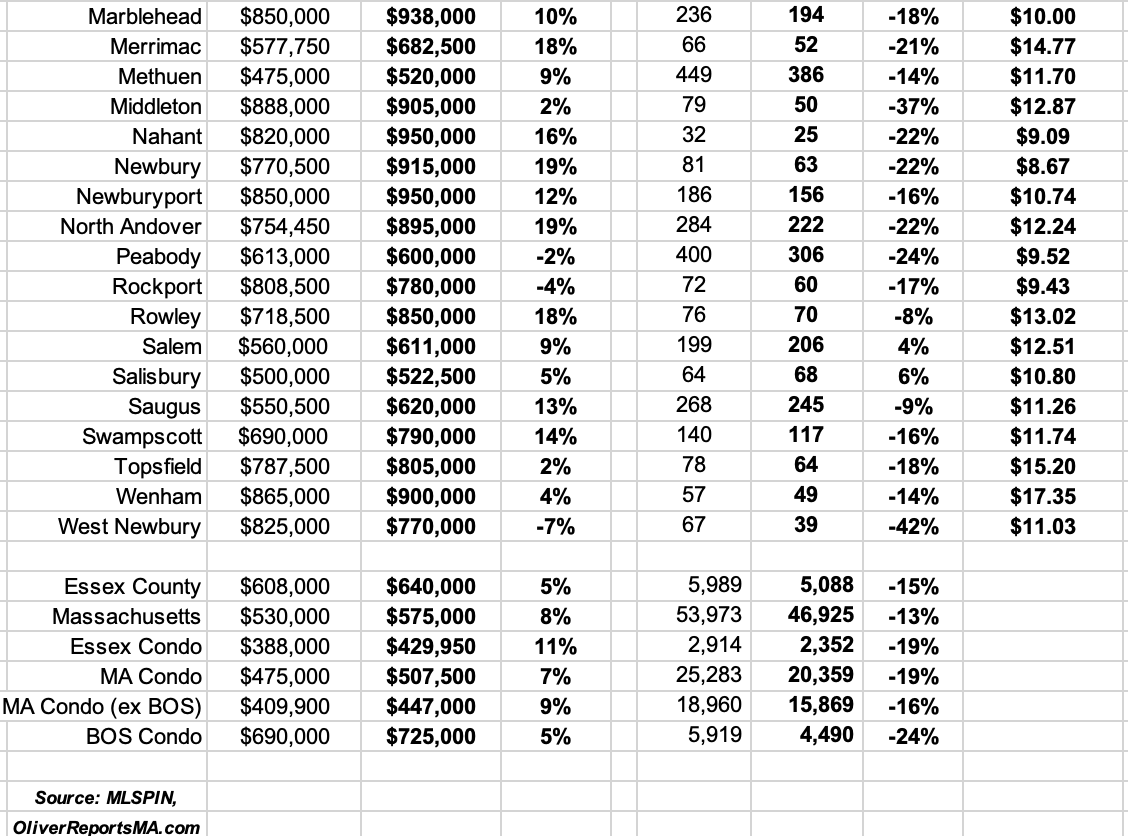

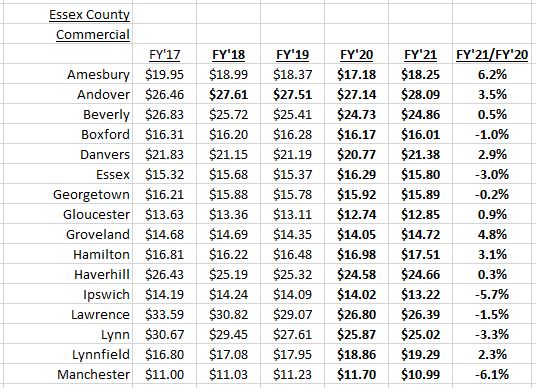

Essex County 2022 Commercial Property Tax Rates: Town by Town guide

While most of us look at residential tax rates (read Essex County 2022 Property Tax Rates: Town by Town guide ) fewer consider commercial tax rates. Yet a healthy commercial business environment can contribute significantly to the attractiveness of a town. The map below shows commercial rates in each of Essex County’s 34 cities and towns, followed by a table showing commercial rates for each town.

Commercial rates for each town: (more…)

Swampscott FY 2021 Property Tax Rate Calculation

Swampscott’s residential tax rate will drop from $14.30 in Fiscal Year 2020 to $13.80 in FY 2021 (and down from a high of $18.84 in FY 2013). The FY 2021 rate will be the lowest since 2008.

Commercial and industrial property is surcharged at 170%, as in FY 2020, resulting in a tax rate of $24.90, down from $25.85 in FY 2020 (and a high of $35.02 in FY 2013).

The average SFH tax bill has been flat in recent years:

“Every year since 2017, Swampscott’s average, single-family home tax bill has dropped or stayed level – and that’s unique, exceptional,” said Fitzgerald in the fiscal 2021 tax classification hearing on Dec. 9. “You won’t be able to find another community in the commonwealth that has spent as much time really trying to find balance and stability. Many peer communities have increased their taxes every year over the past four years.”

How is the rate calculated?

The method of calculating the tax rate is quite simple: take the $ amount of the previous year’s tax levy, add 2.5% for Proposition 2 1/2, and also add any new growth (such as new construction or a condo conversion). This figure is the new maximum tax levy. To this figure is added debt service – the Principal and Interest payable on the town’s debt.

Note that in recent years, Swampscott has not assessed the maximum allowed under this formula, a decision that has reduced the tax bill for residents.

Here are the numbers for FY 2020 and FY 2021, remembering that the FY 2021 runs from July 2020 to June 2021.

The Tax Rate

The actual tax rate depends upon the total Assessed Value of all property: residential, and commercial, industrial and personal (CIP). The tax rate is calculated by dividing the total dollar amount to be raised from each class by the Assessed Value of each class. Thus, the headline tax rate will also fluctuate depending upon the direction of Assessed Values.

In simplistic terms, if we assume that the $ amount to be raised increases by a little more than 2 1/2% each year, then if the average Assessed Value also increases by a little more than 2 1/2% the tax rate will be unchanged. If the increase in Assessed Values is less than 2 1/2%, then the tax rate will rise. And if the increase in Assessed Values is more than 2 1/2% then the tax rate will fall. In recent years Assessed Values have been increasing significantly more than 2 1/2% allowing for the tax rate to decline sharply.

Looking at the Swampscott residential tax rate, in FY 2020 it was $14.30, achieved by dividing $42.9 million raised from residential homeowners by the residential AV of $3.0 billion. In FY 2021 the amount to be raised from residential taxpayers is set to increase slightly to $43.7 million, but because the total residential AV increased by 5.4% to $3.17 billion, the headline tax rate has dropped sharply to just $13.80, the lowest figure since 2009.

Comment

The residential real estate market in Swampscott was stable in 2020 (and 2020 prices will be the basis for the FY 2022 tax rate), with the median price of Single Family Homes sold rising by 2.1%. Sales in any year represent only a small percentage of the total stock so it does not follow that assessed values calculated by the town will mirror these movements.

As to the tax rate for FY 2023, 2022 ( the basis for FY 2021) is a different story with the median Single Family price increasing 16% in the first half of the year. The actual rate will depend on a number of factors: the amount of debt service, how much of the maximum tax levy is assessed, and the shift to the CIP class being three of them. But unless there is a dramatic change in the market in the second half of 2021 the likelihood is that the actual tax rate will decline significantly in FY2023.

From a residential real estate perspective, the substantial decline in the tax rate in recent years and the stability in tax bills are both very welcome news and are clearly encouraging more people to decide both to live and work in Swampscott.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver

REALTOR® | Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

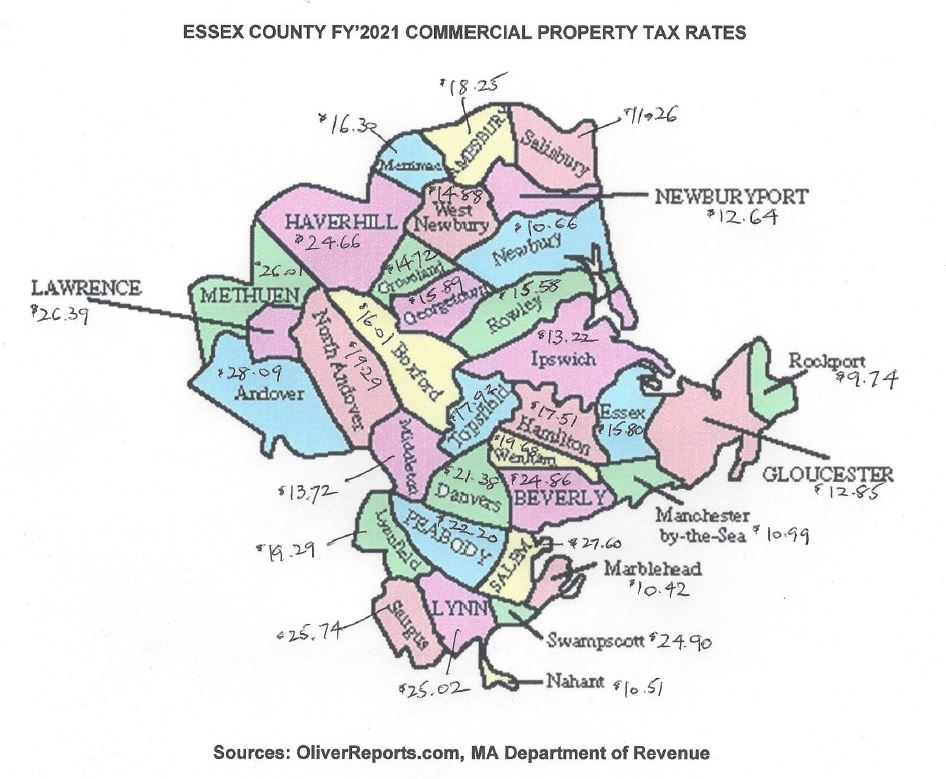

Essex County 2021 Commercial Property Tax Rates: Town by Town guide

While most of us look at residential tax rates, fewer are concerned with commercial tax rates. Yet a healthy commercial business environment can contribute significantly to the attractiveness of a town. The map below shows commercial rates in each of Essex County’s 34 cities and towns, followed by a table comparing residential and commercial rates.

(Click here to download a copy of this map and here to download the table)

There is a bigger variation in commercial rates than in residential rates

The lowest rate for both residential and commercial rates is Rockport’s $9.74, but while the highest residential rate is Wenham’s $19.68, there are 11 towns with commercial rates over $20, with the highest being $28.09 in Andover. 20 towns set the same rate for both residential and commercial, while in 4 towns the commercial rate is twice or more times the residential one.

Why do some towns have different residential and commercial tax rates?

Cities and towns have the ability to increase the percentage of the total tax bill paid by commercial (and industrial and personal) property owners. The percentage of the value of property classified as commercial varies enormously from town to town.

In Marblehead, for example, where residential property is 95% of the total, a 50% tax shift to commercial would increase the median commercial tax bill from $7,322 to $10,979, while reducing the median residential tax bill by only $190.

Towns with a higher percentage of commercial property are more likely to shift an increased share of the tax bill to commercial owners.

Essex County 2021 Residential Property Tax Rates: Town by Town guide

Andrew Oliver

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

m 617.834.8205

Licensed Sales Agent in Florida

www.OliverReports.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

Recent Comments