Have Mortgage Rates peaked?

With all the noise about the determination of the Federal Reserve (Fed) to continue to increase interest rates it might be tempting to asume that mortgage rates will continue to rise.

But I believe there are good reasons for thinking that mortgage rates may have peaked. Read on to find out why I think this.

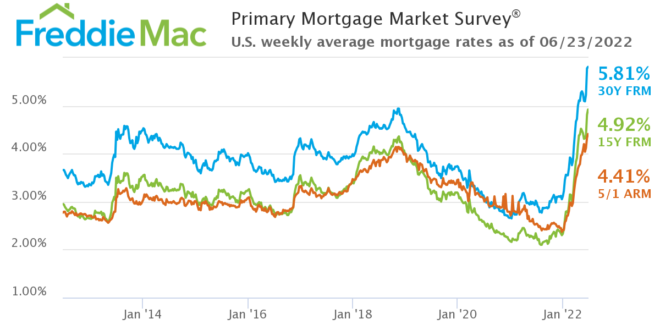

Current rates

The 30-year Fixed rate Mortgage (FRM) reached its highest level since 2008 this week:

The link between FRM and the Treasury 10-year Note (10T) yield:

Conventional mortgages are bundled and sold to investors, who require a risk premium – higher yield – over that offered by the 10-year Treasury note (10T), which is seen as a proxy for mortgage rates. The difference between the rate on the 30-year Fixed rate Mortgage (FRM) and the yield on 10T is called the spread.

This spread has been remarkable constant overall in recent years, but it can and does does fluctuate sharply from time to time, normally in times of financial or economic stress.

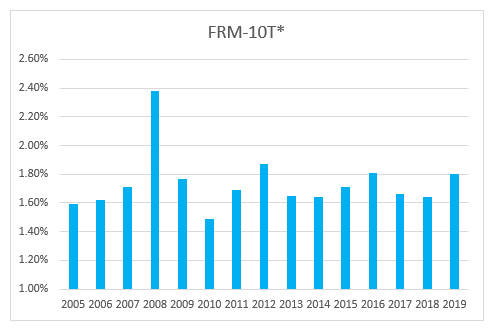

2005-2019

The first chart shows the spread on an annual basis from 2005-2019. With the exception of the Great Recession, the spread has mostly been in the 1.6-1.8% range. Note that the ranges have been wider during some of the years but the spread always reverts to the mean.

*weekly averages

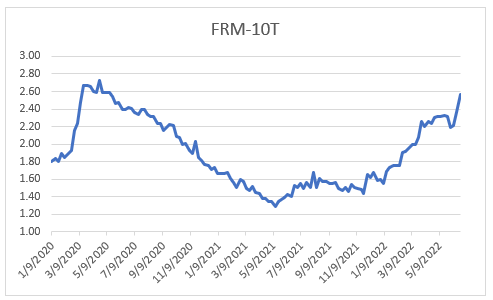

Since 2020

Now let’s look at the period since the start of 2020:

The Fed pumped huge amounts of money into Treasuries in the early days of the pandemic, helping to drive down the yield on 10T. As conditions became more stable the yield on 10T started to cliimb again, and the spread narrowed. As the Fed continued to buy both Treasuries and Mortage-Backed Securities (MBS – Conventional mortgages are packaged and sold to investors as MBS) so the spread narrowed further. Late in 2021 the Fed finally admitted that inflation was not “transient” and slowed its purchases and started talking of interest rates rises.

You can read my views on the Fed’s actions – or rather lack of them – in the articles linked to below.

2022 Comment

The spread was back into its historic 1.6-1.8% range this year until mid-February, since when it has been on a seemingly never-ending vertical climb. But history tells us that it should revert to the mean – a mathematical concept that says that when a system of numbers departs from a long-standing pattern, eventually the system will return to this ordinary range. This is paired with the concept of an aggressive reversion to the mean, which says that a system which departs from historic patterns will change back to its ordinary range dramatically and quickly.

I don’t know whether we will have a normal reversion or an aggressive reversion, but a realistic expectation would be that the spread will drop from its current 2.5% to at least 1.8% at some point. If the yield on 10T stays in the low 3% range that would suggest that the FRM will drop below 5% again. And some rates are already that low – I work with a bank that is cuurently offering 3-year mortgages at 5% with 0 points and 15-year at 4% with no points. Call me for an introduction.

Read these recent articles:

Ecomonic commentary

Are we already in a Recession?

Federal Reserve in Fantasyland: Implications for Housing Market

How far Behind the Curve is the Federal Reserve?

Will the Federal Reserve show chutzpah today?

Why are Mortgage Rates so high?

Other

How quickly are houses selling?

Have Home Sales slowed?

Time to Consider an Adjustable Rate Mortgage

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

[email protected]

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205