Mortgage Rates peaked? I spoke too soon

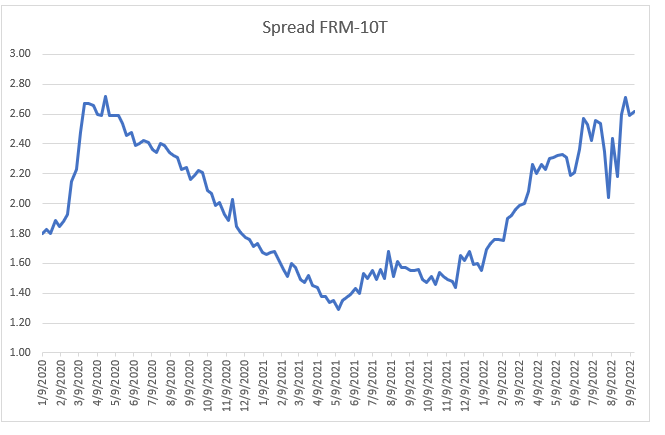

In June I published Have Mortgage Rates peaked? when the 30-year national average Fixed-Rate Mortgage (FRM) reached 5.81% and commented:”..a realistic expectation would be that the spread (the difference beyween the FRM and the yield on the 10-year Treasury) will drop from its current 2.5% to at least 1.8% at some point. If the yield on 10T stays in the low 3% range that would suggest that the FRM will drop below 5% again.”

Well it did…for a while, dropping to 4.99% on August 4th.

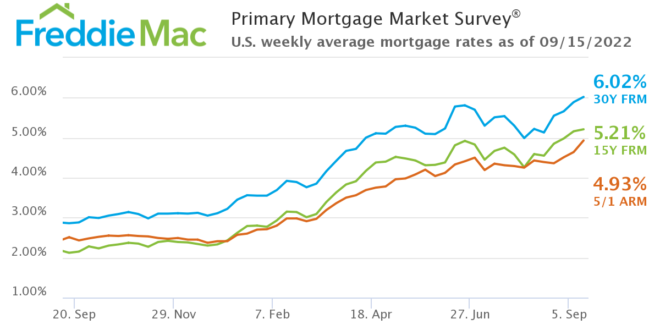

But then this happened:

Why have mortgage rates jumped again?

A lot of press and industry commentary relates the increase in the FRM to the increases in the Federal Reserve’s Fed Fund Rate (FFR). In fact, the FFR is used by banks to set their prime rates, used in calculating the interest rate on credit cards and auto loans, while the FRM is based upon the market appetite for mortgage-backed securities (MBS). Conventional mortgages – those backed by Freddie Mac and Freddie Mae – are packaged and sold to investors. And those investors consider the yield offered by the US Treasury with the closest life to that expected by mortgages – the 10-year (10T)- and then demand an extra yield – the spread referred to above – to compensate fore the additional risk in buying mortgages rather than securities with the full faith of the US Government.

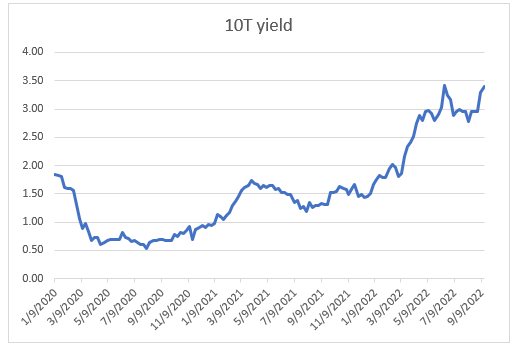

The yield on the 10-year Treasury dropped sharply for a while but has since rebounded again close to the June high:

While the spread, after falling to close to 2%, has also rebounded:

So what happened?

In Federal Reserve tries to rewrite history published on July 30th, I commented, after Fed Chairman Powell’s press conference: “So this week the stock market has decided that by the time the Fed meets again in September the economy will have slowed so much that the Fed will be able to ease off on its interest rate increases. Hence the big rally as “risk on” returns, betting that we will actually have a soft landing for the economy based upon the continuing strength of the labor market.

Or maybe it was just a strong, bear market rally from an oversold postion where “everybody” was negative.”

The stock market rally lasted for a while, but then the market got the very short message delivered by Powell at Jackson Hole on August 26. In essence, he told the market that those betting that the Fed would either pause interest rate increases or reverse them quickly needed to “read my lips.” The Fed was going to continue to increase rates and tighten monetary policy until inflation returned to its 2% target.

Since then, the stock market has fallen again, and yields have soared.

And mortgage rates have been hit with a double whammy: higher 10-T yields and wider spreads.

Where to now?

When my daughter was growing up I used to tell her that it was always important to understand the difference between relative and absolute. In relative terms, the spread between the FRM and 10T is unusually high and at some point this should return to the norm. In absolute terms, whether or not this means that the FRM will be lower depends upon the yield on the 10T.In the meanwhile, those buying a house now might want to discuss with their financial adviser whether an Adjustable Rate Mortgage – I like the 7-year fixed option – would be appropriate.

And read these recent articles:

Economic and mortgage commentary

Recession? Yes, no, maybe….

Federal Reserve tries to rewrite history

Has Inflation Peaked?

Have Mortgage Rates peaked?

Are we already in a Recession?

Federal Reserve in Fantasyland: Implications for Housing Market

Time to Consider an Adjustable Rate Mortgage

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Market Reports

Is the U.S. Housing Market at a Crossroads?

Summer 2022 Market Review

August Inventory recovers to 2020 levels

Essex County Mid-Year Market Summary in 5 slides

Massachusetts Mid-Year Market Summary in 5 slides

How quickly are houses selling?

Have Home Sales slowed?

June Housing Inventory: still way below 2020 levels.

Other

Free Property and Mortgage Fraud alert notification for homeowners

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or andrew@teamharborside.com

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108