No, the Federal Reserve does not control mortgage rates

There is widespread misunderstanding about what drives mortgage rates. Indeed, I read an article recenlty on the National Association of Realtors website which stated that mortgage rates had risen sharply following the increase in the Federal Reserve’s interest rate.

Not so.

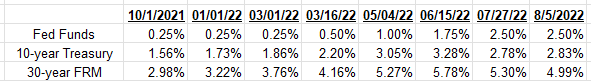

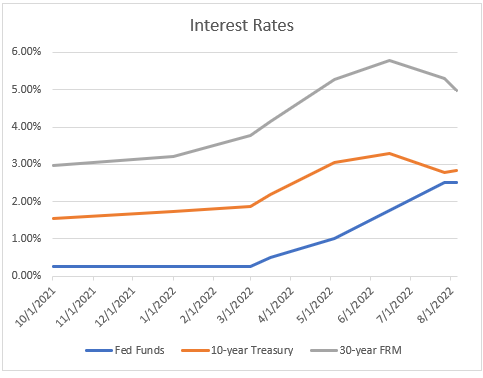

As the table and chart demonstrate, the cost of a FRM increased by 3/4% before the Fed made its first move in March, and moved a further 1.5% while the Fed Funds rate increased by 0.5%. And the FRM has decreased by 0.8% during the latest increase in the FFR.

What does influence the FRM?

Mortgages are packaged and sold to investors who demand an extra yield over that which they can receive in the US Treasury security with the closest maturity to the expected life of the mortgage pool – and that is the 10-year Treasury Note (10T).

Over time the extra yield demanded by investors – the spread – has averaged in the 1.6-1.8% range. It tends to be higher in times of uncertainty or stress – such as the Great Recession or the early days of COVID before the Fed started helicoptering in cash by the trillion.

In the chart the correlation between FRM and 10T is clear. The spread may fluctuate but the two move in the same direction.

And these recent articles:

Economic and mortgage commentary

Recession? What recession?

Recession? Yes, no, maybe….

Federal Reserve tries to rewrite history

Has Inflation Peaked?

Have Mortgage Rates peaked?

Are we already in a Recession?

Federal Reserve in Fantasyland: Implications for Housing Market

Time to Consider an Adjustable Rate Mortgage

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Market Reports

Essex County Mid-Year Market Summary in 5 slides

Massachusetts Mid-Year Market Summary in 5 slides

How quickly are houses selling?

Have Home Sales slowed?

June Housing Inventory: still way below 2020 levels.

Other

Free Property and Mortgage Fraud alert notification for homeowners

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205