July Inventory shows Sharp Drop

Single Family Homes (SFH)

SFH inventory dropped sharply in July from the previous month

Condos

Condo inventory also dropped from June.

(more…)

Is the U.S. Housing Market at a Crossroads?

Homes reached record prices in early 2022 – so is the current market a housing recession or just a market correction?

Here are some extracts from an article Market at the Crossroads on the Florida Realtors website, with my comments and links to recent articles at the end.

Is there a housing slowdown?

There is widespread consensus that the housing market has experienced a drastic drop-off in activity since its pandemic-prompted heights.

The housing market is “not like the volatile stock market, always going up and down; the housing market moves at a different, slower pace. “The market simply could not, and was never expected to, grow at that pace indefinitely,” Neda Navab, president of brokerage operations at real estate company Compass said. “Whether this trend will continue long enough for the market to enter a true ‘recession,’ or if this is simply the start of an expected ‘correction’ to historic norms, still remains to be seen.”

The case for a housing correction (more…)

Pre-Labor Day Inventory drops

The drop in Single Family inventory before Labor Day, as sellers delay listing, was sharper than usual this year. We will get a better read on Inventory in the next couple of weeks.

Single Family Homes

Condos

Condo inventory continues to lag both 2020 and 2021 levels.

August Inventory recovers to 2020 levels

There has been a sharp increase in the number of properties for sale in the last few months, taking SFH inventory back to 2020 levels:

Single Family Homes

Condos

The number of Condos available has also jumped, but in this case still remains a little below last year’s levels:

Millennials now make up 43% of Homebuyers

The share of millennial homebuyers increased significantly over the past year, according to the 2022 Home Buyer and Seller Generational Trends report from the National Association of Realtors® (NAR).

The combined share of younger millennial (23 to 31 years old) and older millennial buyers (32 to 41 years old) rose to 43% in 2021, up from 37% the year prior. Almost two out of three younger millennials (65%) found the home they ultimately purchased on the internet, a number that gradually decreases with older generations. (more…)

Will the Federal Reserve show chutzpah today?

In my How far Behind the Curve is the Federal Reserve? report last weekend I suggested that the Fed needed to increase its Fed Funds rate by a full 1.0% today to regain control of the inflation narrative and asked if it has the chutzpah to do this.

The following table shows clearly that it has been the market fighting inflation by driving up interest rate – while the fed has continued with its easy money policy.

We’ll find out in a few hours how serious this Fed is about getting inflation under control.

And read these recent articles:

How far Behind the Curve is the Federal Reserve?

How quickly are houses selling?

Have Home Sales slowed?

June Housing Inventory: still way below 2020 levels.

Swampscott House on over 1 acre with HUGE potential

Marblehead Neck Oceanfront New Listing

Why are Mortgage Rates so high?

Time to Consider an Adjustable Rate Mortgage

The Federal Reserve and Mortgage Rates

Federal Reserve: “Make me responsible…. but not yet”

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or ajoliver47@gmail.com.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205

How far Behind the Curve is the Federal Reserve?

In March 2020, as the impact of COVID-19 was being felt, the Federal Reserve cut the Fed Funds rate by 50 basis points ( 0.5%) on March 3 and followed that with a 100 basis points (1%) cut on March 15th – a total of 1.5% in under two weeks. This emergency action was decisive and instrumental in preventing a financial disaster. But the economy quickly bounced back with a huge rebound in Q3 2020. The emergency was over.

The Fed, however, kept pumping huge amounts of cash into the economy. Eventually, the market decided that the Fed was behind the curve and market rates took off. Yet the Fed has been slow – make that very slow – to respond. This chart shows interest rates on January 31st 2020, the trading day before COVID-19 was declared to be a public health emergency in the US, and this Friday after the announcement that the Consumer Price Index rose 8.6% in May from a year earlier.

Does anything strike you about this chart? Such as the fact that all the market interest rates are up anywhere from 50% to 130% – and the Fed Funds rate is still way down from its pre-COVID level. (more…)

Have Home Sales slowed?

Last week I published How quickly are houses selling? which showed that 88% of sales which closed in May received offers in 15 days or fewer.

But home sales are a lagging indicator, with May reported sales reflecting contracts agreed to for the most part in March. At the onset of COVID I started tracking the number of offers accepted on a weekly basis. This showed a sharp drop from mid-March 2020 which lasted only until early May, after which the number of accepted offers took off.

With all the publicity about the sharp jump in mortgage rates, the high level of inflation, concerns about a possible recession, etc. etc. one might have accepted to see a slow down in the number of accepted offers. This chart shows the weekly numbers YTD for 2021 and 2022: (more…)

June Housing Inventory: still way below 2020 levels

There has been a sharp increase in the number of properties for sale in the last three months, but while this takes inventory of SFHs above the year ago level, it remains well below that of 2020:

Single Family Homes

Condos

The number of Condos available has also jumped, but in this case still remains below year ago levels:

Free Property and Mortgage Fraud alert notification for homeowners

It has been reported by the FBI that one of the quickest growing white collar crimes in America is property and mortgage fraud. This happens when a person knowingly records a fraudulent document making it appear that they own another person’s property or that the owner owes them money.

Southern Essex’s state-of-the-art Property Watch Service allows you to view the document the same day it was recorded and print it at no cost.

How it works: (more…)

Swampscott House on over 1 acre with HUGE potential

This property has HUGE potential. It offers a large (3,376 sq. ft.), home on over 1 acre of land located on top of a hill situated in the middle of tranquility and privacy. The home offers plenty of space and is ready for your updating and great ideas. Very convenient to the Swampscott train station, restaurants, shopping, the high school and less than a mile to the beach. Great opportunity to create your own dream home in a wonderful seaside community.

Click 41 Spinale Road for more details and call me on 617.834.8205 to arrange a private showing.

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

m.617.834.8205

www.OliverReportsMA.com

ajoliver47@gmail.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

Licensed in Florida

www.OliverReportsFL.com

Why This Housing Market Is Not a Bubble Ready To Pop

According to this report from Keeping Current Matters the major reason for the housing crash 15 years ago was a tsunami of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity, the fear of massive foreclosures impacting today’s market is not realistic.

Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream.

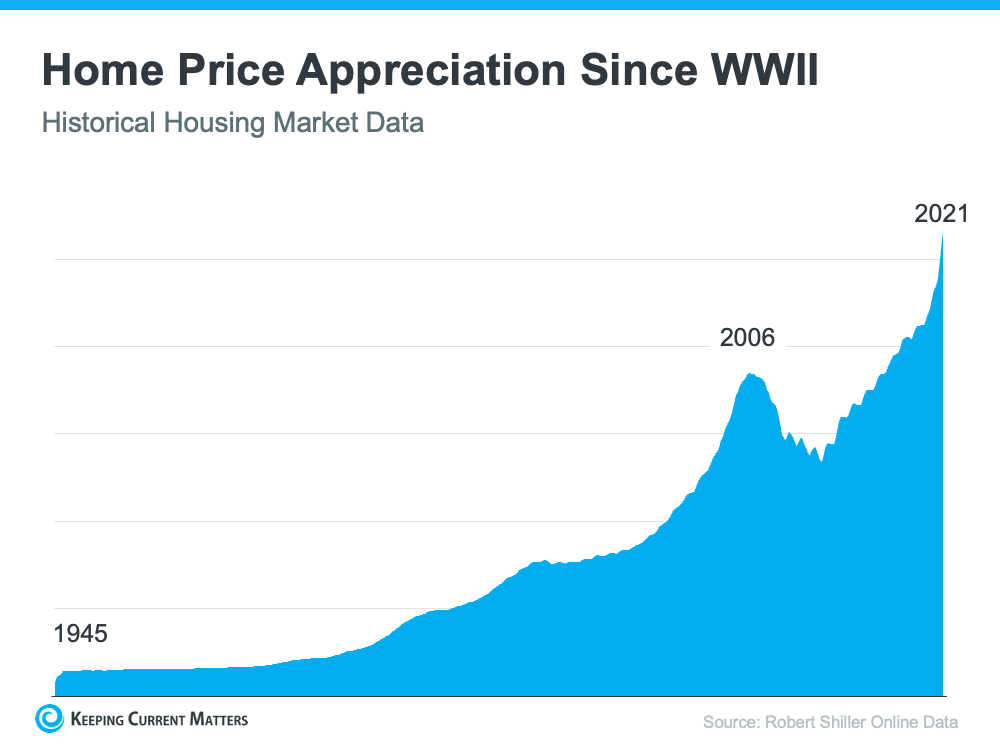

Prior to the 1950s, less than half of the country owned their own home. However, after World War II, many returning veterans used the benefits afforded by the GI Bill to purchase a home. Since then, the percentage of homeowners throughout the country has increased to the current rate of 65.5%. That strong desire for homeownership has kept home values appreciating ever since. The graph below tracks home price appreciation since the end of World War II:

Myths about today’s Housing Market

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

www.OliverReportsMA.com

m.617.834.8205

Licensed in Florida

www.OliverReportsFL.com

5 tips on how not to disappear in the hybrid workplace

When remote work was mandatory and all or most of your co-workers, your boss, and many of your external stakeholders were remote, the playing field was level. There was a real sense that we were all “in this together.” People were remarkably understanding and accepting of quirky situations, whether IT related or the result of the blurred line between home and work (think dogs barking and children crying during meetings). That kind of tolerance is now rare. And it’s just one of many pitfalls for remote workers.

Whether you are fully remote or in a hybrid work environment, avoid the “Zoom ceiling” by understanding and working around the potential pitfalls that come from lowered visibility in the office.

Knowledge at Wharton, a business journal from the Wharton School of the University of Pennsylvania, has suggested five steps to position yourself better for greater visibility to ensure that you are getting recognition for your accomplishments and staying in line for promotions and desirable assignments. Make sure your employer knows you aren’t stepping off the ladder. (more…)

Recent Comments