What drives Mortgage Rates – and no it’s not the Federal Reserve

I am always astonished by the number of reports I read, before and after the Federal Reserve (Fed) makes a change in its interest rate, about the effect such a change will have on mortgage rates.

No doubt it came as a surprise to those writers when there was virtually no change in the Freddie Mac weekly survey of mortgage rates this week.

Myth

“Mortgage rates react to the Fed.”

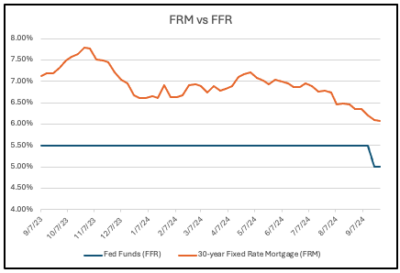

Look at this chart for the last year:

The FFR rate was unchanged at 5.5% for over a year until last week, but during that time frame the FRM varied between a high of almost 7.8% last October and a low of just over 6% last week before the Fed cut its inetrest rate by 0.5%.(The Freddie Mac survey takes place from Monday-Wednesday each week, so the 6.09% reported on September 19 reflected rates before the Fed cut its interest rate).

What happened after the Fed cut rates?

Precious little. The rate before the Fed cut rates was 6.09% and afterwards…. 6.08%.

In simple terms, there is no correlation or link between the Fed’s interest rates and the rate on 30-year Fixed Rate Mortgages.

What does determine Mortgage Rates? (more…)

Federal Reserve increase rates; Mortgage Rates drop

Too often I see a headline like this one: “Mortgage Rates Continue to Slide Despite Fed Hike.” The 30-year Fixed Rate Mortgage (FRM) does NOT follow the Federal Reserve’s rate increases!

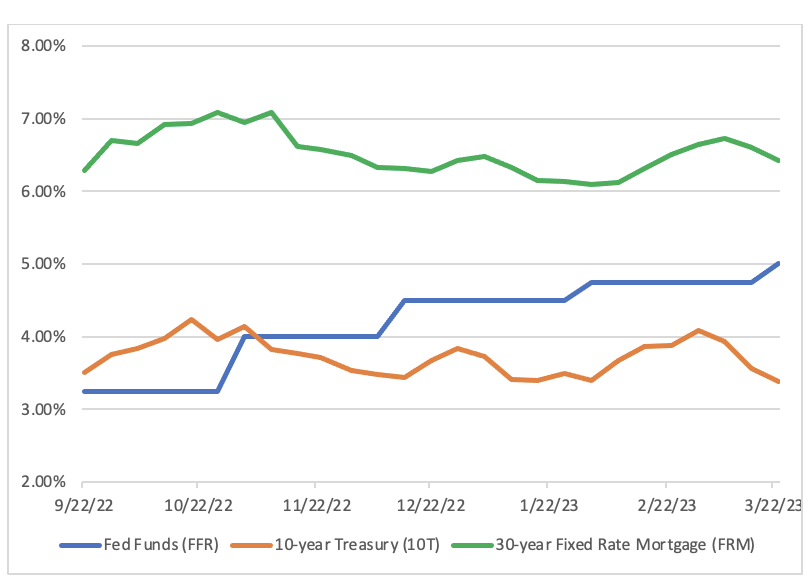

Look at this chart for the last few months:

Note the correlation between the 10T (red line) and FRM (green) – and the lack of correlation between FFR (blue) and FRM.

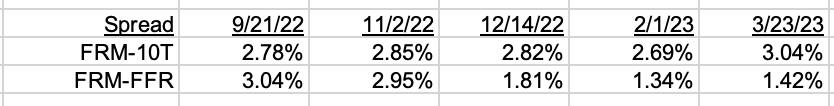

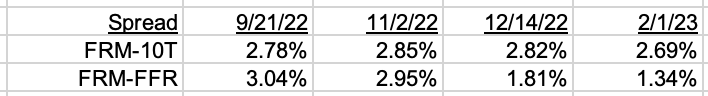

Let’s look at this another way, the spread (difference) between the FRM and 10T, and between FRM and FFR:

Over the last 6 months, the spread between FRM and 10T has been in a tight band between 2.69% and 3.04%, while that between FRM and FFR has dropped from 3.04% to 1.42%.

For a more detailed explanation of what drives mortgage rates – and why the FRM will fall at some point – read Why Mortgage Rates Will Fall

And these recent articles: (more…)

What drives Mortgage Rates in one chart

I can explain as often as I do that the 30-year Fixed rate Mortgage (FRM) is based upon the yield on the US 10-year Treasury (10T), not the Federal Reserve’s Fed Funds rate (FFR), but still I read regularly comments such as “mortgage rates will move up after the Fed increased its interest rate.”

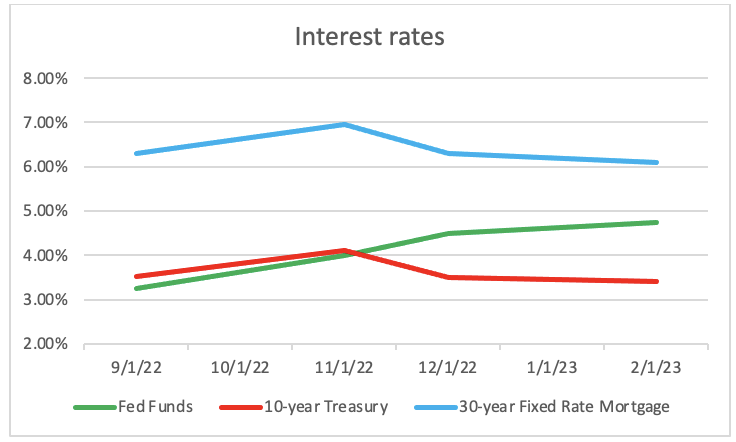

Look at this chart for the last few months, the dates being those when the Federal Reserve increased its interest rate:

Note the correlation between the 10T (red line) and FRM (blue) – and the lack of correlation between FFR and FRM.

Let’s look at this another way, the spread (difference) between the FRM and 10T and between FRM and FFR:

Over the last 5 months, the spread between FRM and 10T has been in a tight band between 2.69% and 2.85%, while that between FRM and FFR has dropped by a huge 1.7%.

For a more detailed explanation of what drives mortgage rates – and why the FRM will fall at some point – read Why Mortgage Rates Will Fall

And these recent articles: (more…)

Essex County 2022 Housing Market Review

Single Family Homes (SFH)

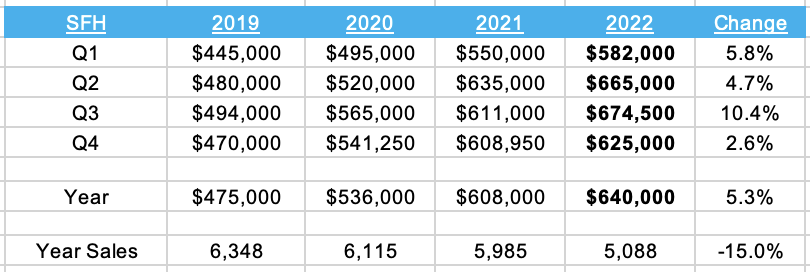

After sharp increases Year-over-Year (YOY) in Q2 and Q3, the median SFH price in Essex County showed a more modest increase (YOY) in Q4, and also showed the usual seasonal decline from Q3 into Q4. Overall, the median price increased 5% for the year to $640,000, taking the increase in the last 3 years to 35%. Reflecting the low levels of inventory recently, SFH sales declined 11% in H1 and 18% in H2.

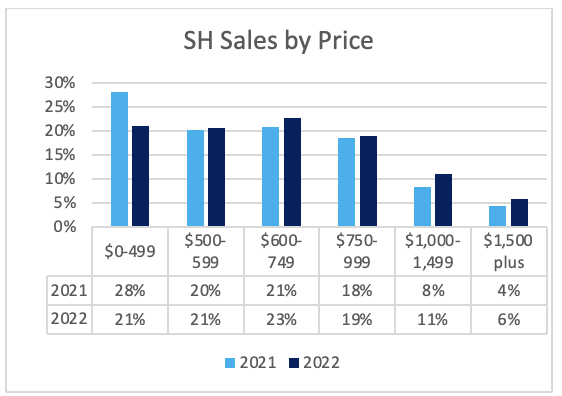

The share of sales over $600,000 increased from 52% in 2021 to 58% in 2022, driving the median price for the year well over $600,000.

Condos

The median condo sale price moved more steadily upwards in 2022, increasing by 11% in both H1 and H2, and by 34% since 2019. Sales fell 11% in H1 but by a startling 27% in H2. It seems likely that the increase in mortgage rates had a bigger impact on Condo sales – often bought as a first home with a significant mortgage – than on SFH sales, where mortgages – especially at the higher-end – tend to be less important with many buyers using cash or a large down-payment. (more…)

Why Mortgage Rates Will Fall

I have read and heard several comments suggesting that the increase in the 30-year Fixed Rate Mortgage (FRM) this year has been a direct result of the increase in the Federal Reserve’s Fed Funds rate (FF).

This is not correct.

As I will demonstrate, the FRM is determined by market forces, and in particular by the extra yield – the “spread” – which investors require when buying pools of mortgages (Mortgage Backed Securities or MBS), as compared with the risk-free yield available with the 10-year Treasury Note (10T) which has the nearest duration to the expected life of a pool of mortgages.

In contrast, the FF is the rate that banks use when setting their Prime Rates. When the FF increases, banks increase their Prime Rates and therefore the interest rate on those loans whose rates are based upon Prime Rates – e.g. credit cards and auto loans.

And we will see that the FRM increased this year long before the Fed started to increase the FF rate.

Mortgage-Backed Securities (MBS)

A conventional mortgage or conventional loan is any type of home buyer’s loan that is not offered or secured by a government entity. Instead, conventional mortgages are available through private lenders, such as banks, credit unions, and mortgage companies.

Most conventional mortgages are packaged into mortgage-backed securities and sold to investors. This allows the bank or originator to use its capital to finance more mortgages.

The relationship between 10T and FRM

This chart shows how the two have moved in lockstep over the last 30-plus years:

Source: National Association of Realtors

Mortgage Rates peaked? I spoke too soon

In June I published Have Mortgage Rates peaked? when the 30-year national average Fixed-Rate Mortgage (FRM) reached 5.81% and commented:”..a realistic expectation would be that the spread (the difference beyween the FRM and the yield on the 10-year Treasury) will drop from its current 2.5% to at least 1.8% at some point. If the yield on 10T stays in the low 3% range that would suggest that the FRM will drop below 5% again.”

Well it did…for a while, dropping to 4.99% on August 4th.

But then this happened:

Why have mortgage rates jumped again? (more…)

No, the Federal Reserve does not control mortgage rates

There is widespread misunderstanding about what drives mortgage rates. Indeed, I read an article recenlty on the National Association of Realtors website which stated that mortgage rates had risen sharply following the increase in the Federal Reserve’s interest rate.

Not so. (more…)

Have Mortgage Rates peaked?

With all the noise about the determination of the Federal Reserve (Fed) to continue to increase interest rates it might be tempting to asume that mortgage rates will continue to rise.

But I believe there are good reasons for thinking that mortgage rates may have peaked. Read on to find out why I think this.

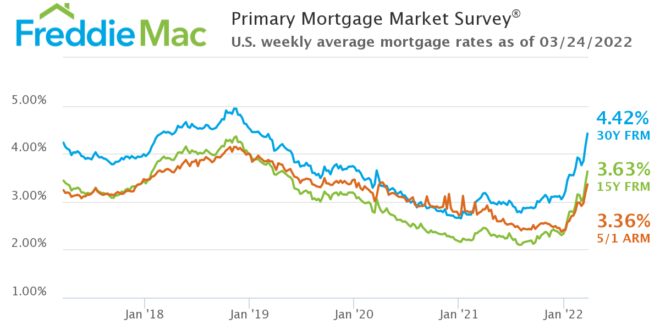

Current rates

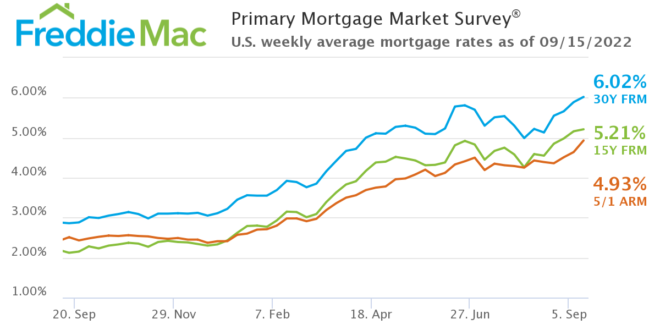

The 30-year Fixed rate Mortgage (FRM) reached its highest level since 2008 this week: (more…)

What Higher Mortgage Rates Mean for the Housing Market

The recent uptick in mortgage interest rates is having a chilling effect on home buyers at the moment, but Wharton real estate professor Benjamin Keys doesn’t expect that to last.

Mortgage interest rates have increased across all categories in the last several weeks, following the Federal Reserve’s first rate hike since 2018 to fight inflation. The interest rate on a 30-year fixed-rate mortgage topped 5% last week, compared with less than 3% a year ago. The jump corresponded with a 40% drop in mortgage applications from a year ago.

“Aside from a few days in 2018, we haven’t seen rates this high persistently since around 2011,” Keys said. “Mortgage rates are the real focus among a lot of people right now, and trying to understand what impact [that is] going to have on housing markets.”

Sky-high rents have been spiraling faster than home prices in the last decade, which will continue to push many Americans toward home ownership. With a fixed-rate mortgage, they can budget a stable monthly housing expense for the next 15 or 30 years. (more…)

Why are Mortgage Rates so high?

Yes, interest rates are rising and with that so are mortgage rates, but the 30-year Fixed Rate Mortgage (FRM) seems to be about 0.5% higher than I would expect.

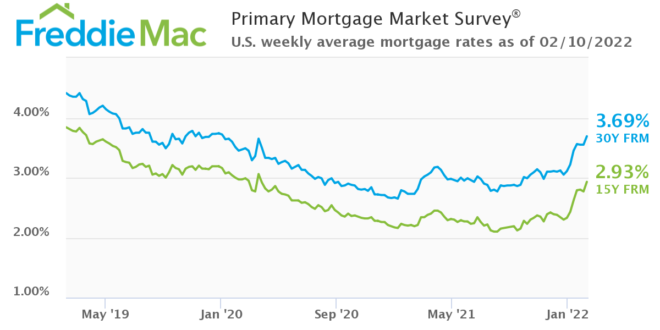

First, current rates:

In my recent article The Federal Reserve and Mortgage Rates I explained the link between the FRM and the 10-year Treasury yield (10T). The difference – the spread – has average around 1.7% over time, but with significant fluctuations during periods pf stress.

Here is the chart highlighting the spread at the time of Federal Funds rate changes – and as of this week: (more…)

Time to consider an Adjustable Rate Mortgage

As 30-year mortgage rates (FRM) continue their recent vertical ascent, it is worth considering an Adjustable Rate Mortgage (ARM).

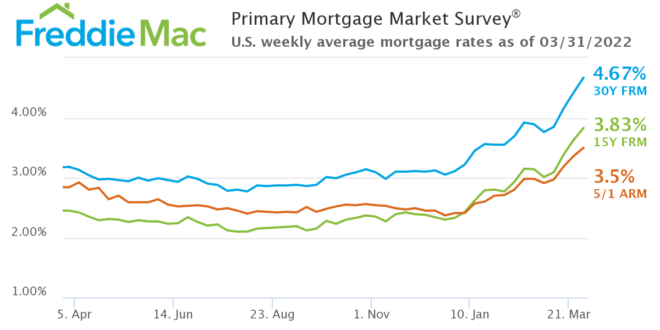

Here are the latest rates:

ARMs got a bad name in the boom that contributed to the Great Recession, but as in so many different situations, that was the result of lax – or no – underwriting standards – think liar loans – and loans with adverse features such as negative amortisation – payments so low, initially, that the loan balance increased over time.

All that changed with the passage of the Dodd-Frank Act in 2010. (more…)

The Federal Reserve and Mortgage Rates

As expected, the Federal Reserve (Fed) increased its Fed Funds Rate (FF) this week by 0.25% to 0.5%, the first increase since 2018.

What does this mean for mortgage rates and why are they rising? The FF rate affects the lending rate for credit cards, auto loans, adjustable rate mortgages, all of which are impacted by banks’ Prime Rate, which moves with the FF rate. Fixed Rate Mortgages – the typical 30-year mortgage – have a longer life and their benchmark is the closest Treasury security, which is the 10-year (10T).

Five charts explain the factors driving mortgage rates. In all cases the numbers are at the dates that the Fed has changed its FF since 2015: 9 increases followed by 5 decreases before this week’s rise. Because the purpose of this article is to show the link between FF, FRM and 10T the dates shown are only those on which the FF rate changed. Bear that in mind when looking at the charts below – they do not attempt to show all the price movements in between the dates shown. (more…)

Federal Reserve: “Make me responsible…. but not yet”

With apologies to St. Augustine the gist from the release this week of the minutes of the last meeting of the Federal Reserve Open Market Committee (FOMC) was that, yes, inflation is worse than we expected, and yes, we need to raise interest rates and, yes, we need to sell some of our huge portfolio of Treasuries and Mortgage-Backed Securities, and we will …soon…I promise.

“Participants observed that, in light of the current high level of the Federal Reserve’s securities holdings, a significant reduction in the size of the balance sheet would likely be appropriate,” the meeting summary stated.

The minutes show concern about inflation and financial stability though members urged “a measured approach” to tightening monetary policy. FOMC members noted that “inflation was beginning to spread beyond pandemic-affected sectors and into the broader economy.”

No kidding. (more…)

Earth to Federal Reserve: What are you waiting for?

As the debate amongst economists continues as to whether the Federal Reserve will raise interest rates 3 times, 5 times or 7 times this year, the Federal Reserve continues to do….nothing.

Giving the market advance warning about changes in monetary policy is an excellent idea, but the lack of flexibility from the Fed is alarming. The Fed has consistently said that its decisions as to the timing of the end of its bond buying program – which has glutted stock and real estate markets with cash – and the start of the “lift-off” in interest rates would be “data dependent.”

Well, my question is this: what data are you seeing Mr. Powell that the rest of us are missing? And by the rest of us I mean professional and award-winning economists – and me..

In March 2021, 11 months ago, Chairman Powell said: “We’re not going to act pre-emptively based on forecasts for the most part, and we’re going to wait to see actual data. And I think it will take people time to adjust to that, and the only way we can really build the credibility of that is by doing it.”

Also in March 2021, I published “Party on, dude” says the Federal Reserve which included:

Former Federal Reserve Chair William McChesney Martin, Jr famously said: “The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

This week, current Fed Chair Jerome Powell in effect said “party on, dude.” As the New York Times commented: “The official view of the central bank’s leaders now is that it has been an overly stingy host, taking away the punch bowl so quickly that parties were dreary, disappointing affairs.

The job now is to persuade the world that it really will leave the punch bowl out long enough, and spiked adequately — that it will be a party worth attending. They insist punch bowl removal will be based on actual realized inebriation of the guests, not on forecasts of potential future problematic levels of drunkenness.”

I just hope that those attending Mr. Powell’s prolonged party are not planning to drive home.

In that March article I also wrote: “The test for the Fed will come in future months as the economy recovers. The market may demand higher interest rates, even as the Fed will want to keep them low to finance continuing federal deficits.”

By June 2021 I was writing: “Should inflation prove to be more persistent than the Fed expects, then it is likely that the Fed will have to start to increase interest rates sooner and move them up more quickly than it currently expects. And mortgage rates would follow.

I have to admit that I struggle to understand how low interest rates, which boost asset classes such as stock prices and real estate, are helping to boost employment. Lower interest rates benefit those who own assets which appreciate.

I would like to see the Fed start to reduce (taper) its bond buying, while encouraging Congress to focus on removing barriers to employment – by providing increased child care allowances, for example. In other words, deal directly with the problem rather than hoping that benefits will trickle down somehow.”

And my most recent post on this subject was Can the Federal Reserve prevent a Recession? in which I wrote: “Since World War II there has been a consistent pattern of the Federal Reserve hiking interest rates to control inflation and thereby triggering a recession. With the Fed finally acknowledging in late November that inflation was not transitory and committing to end its bond buying spree and also raise interest rates, will it be able to avoid a recession? Can this time be different?”

I also wrote: “It is important to understand that the Fed controls short-term rates and that mortgage rates are based upon the yield of the 10-year Treasury, where the yield is set by market demand. I have been forecasting – guessing – that mortgage rates will reach 4% this year as I expect that interest rates will need to be raised aggressively to ward off stubbornly persistent inflation. But if the result is indeed a recession later this year then interest rates may ease back later.

The chart below shows that the 30-year mortgage rate id now back to its pre-COVID level and is set to move higher next week – unless Mr. Putin decides to invade Ukraine, an action which would likely drive investors to buy Treasuries and force rates down in the immediate term.

Summary

The danger of being slow to end the bond buying program and slow to increase short-term interest rates is that the Fed will also be slow to lower rates if economic growth and inflation slow – and thus cause a recession. Right now the US economy is expanding rapidly and is fairly close to the current level of full employment. I hope that the Fed manages successfully to manage interest rates to slow down the economy without driving it into recession. An early 50 basis point rise in the Fed Funds rate would make me more confident that it will succeed.

Read these recent reports:

February Inventory – Marco? Marco? Where are you?

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Essex County 2022 Commercial Property Tax Rates: Town by Town guide

Guide to Buying and Selling in Southwest Florida

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

Can the Federal Reserve prevent a Recession?

The housing market is driven by the balance between supply and demand. Supply cannot be increased significantly quickly, so the only way for the booming housing market to slow is if demand drops. And the most likely causes for a drop in demand are either a major geopolitical development – such as Russia invading Ukraine and the US and its NATO partners deciding to respond militarily – or a recession.

Since World War II there has been a consistent pattern of the Federal Reserve hiking interest rates to control inflation and thereby triggering a recession. With the Fed finally acknowledging in late November that inflation was not transitory and committing to end its bond buying spree and also raise interest rates, will it be able to avoid a recession? Can this time be different?

The Boston Globe recently carried an excellent article on this subject by Jim Puzzanghera: ‘A hellishly difficult task.’ Can the Federal Reserve lower inflation without causing a recession?

“The virus is unpredictable. People’s responses to the virus are unpredictable. It’s not a garden variety business cycle by any means,” said Donald Kohn, a senior fellow at the Brookings Institution think tank who served as Fed vice chair from 2006-10. “It’s much harder to peer into the future and know how to calibrate your monetary policy.”

Bernard Baumohl, chief global economist at the Economic Outlook Group, a forecasting firm, was more blunt. “The Fed has a hellishly difficult task right now,” he said. “There is absolutely no history for the Fed to lean on to deal with this kind of inflation.”

Most economists predicted last spring that high inflation would be temporary, pointing to the supply chain problems caused by restarting the US and world economies. But some economists warned the $1.9 trillion COVID aid bill enacted last March risked fueling longer-lasting inflation by pumping too much money into the already recovering US economy.

By last June even I was writing: “Should inflation prove to be more persistent than the Fed expects, then it is likely that the Fed will have to start to increase interest rates sooner and move them up more quickly than it currently expects. And mortgage rates would follow.

The Fed’s two goals of price stability and maximum sustainable employment are known collectively as the “dual mandate.” In explaining its policy of keeping interest rates low – in part by buying large quantities of Treasuries and Mortgage-Backed Securities, the latter helping to keep mortgage rates low – the Fed refers to the still high level of unemployment.

I have to admit that I struggle to understand how low interest rates, which boost asset classes such as stock prices and real estate, are helping to boost employment. Lower interest rates benefit those who own assets which appreciate.

I would like to see the Fed start to reduce (taper) its bond buying, while encouraging Congress to focus on removing barriers to employment – by providing increased child care allowances, for example. In other words, deal directly with the problem rather than hoping that benefits will trickle down somehow.”

Some quotes (more…)

Recent Comments